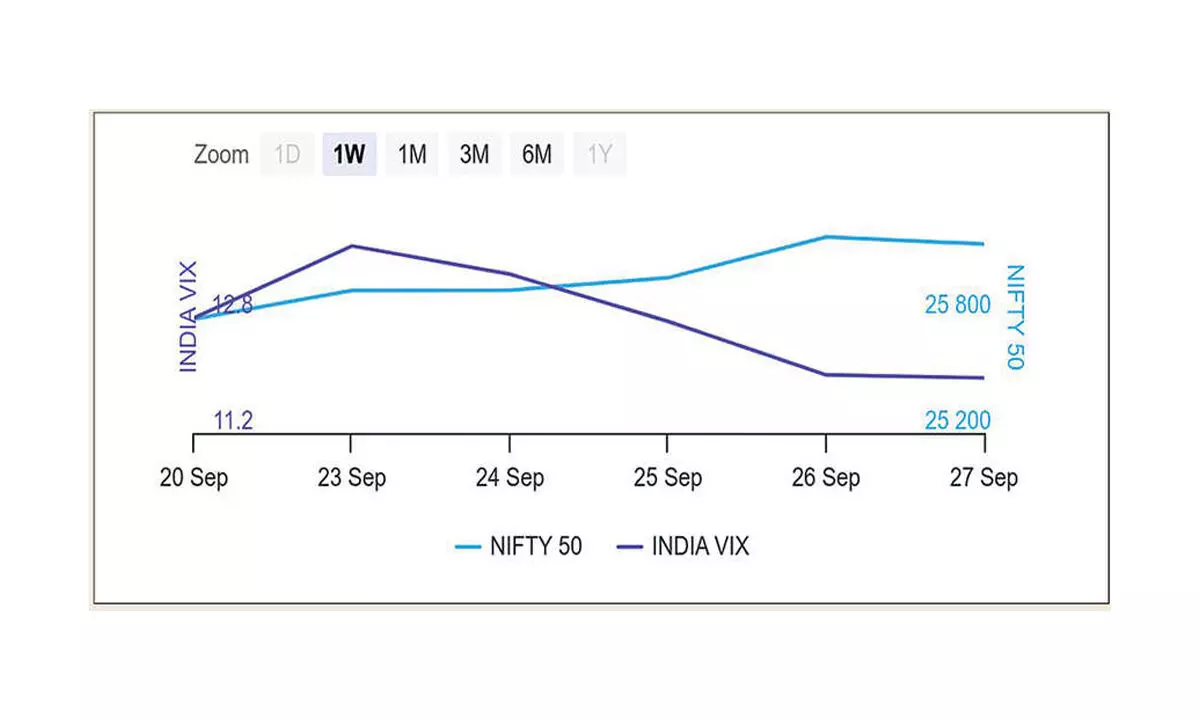

Derivatives Outlook: Options data points to range-bound trading

Nifty premium of 75 points turned into a discount of almost 20 points due to FTSE rebalancing

The latest options data on NSE after Friday’s session pointing to the same support level remains at 25,000PE for a third consecutive week, while the resistance level at 27,000CE for the two weeks in a row.

The 27,000CE has highest Call OI followed by 27,500/ 26,500/ 26,200/ 26,250/ 26,600/ 26,800/ 26,000/27,700 strikes, while 27,700/ 27,950/ 27,900/27,000/27,500/ 26,500/26,200 strikes recorded significant build-up of Cal OI. Modest OI fall is visible at Call ITM strikes from 26,100 inwards.

Coming to the Put side, maximum Put Oi is seen at 25,000PE followed by 23,050/ 23,100/ 23,300/ 24,000/ 24,500/25,500/ 25,800/26,000/ 26,200 strikes. Further, 26,250/26,200/ 26,000/ 25,800/ 25,500/ 25,000/23,050 strikes witnessed reasonable addition of Put OI. Moderate decline in Put OI is seen at select OTM Put strikes.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “

“NSE Nifty closed near its record high, finishing the week with a gain of 1.5 per cent. Looking at Nifty’s derivatives data, the highest Call Open Interest was observed at the 26,200 and 26,500 strikes, while Put writers were at the 26,000 strike,” added Bisht.

BSE Sensex closed the week ended September 27, 2024, at 85,571.85 points, a further recovery of 1,027.54 points or 1.21 per cent, from the previous week’s (September 20) closing of 84,544.31 points. For the week, NSE Nifty also rose by 388 points or 1.50 per cent to 26,178.95 from 25,790.95 points a week ago.

Bisht forecasts: “For the upcoming sessions, sentiment remains positive as long as the Nifty stays above the psychological level of 26,000. The strong rollover in Nifty suggests good momentum in the near term, provided there are no fresh market triggers. Traders are advised to avoid taking new short positions above this level and to monitor how the market reacts to any new positions established throughout the month.”