Live

- PM Modi highlights govt's efforts to make Odisha prosperous and one of the fastest-growing states

- Hezbollah fires 200 rockets at northern, central Israel, injuring eight

- Allu Arjun's Family Appearance on Unstoppable with NBK Breaks Viewership Records

- Unity of hearts & minds essential for peace & progress, says J&K Lt Governor

- IPL 2025 Auction: I deserve Rs 18 cr price, says Chahal on being acquired by Punjab Kings

- EAM Jaishankar inaugurates new premises of Indian embassy in Rome

- Sailing vessel INSV Tarini embarks on second leg of expedition to New Zealand

- Over 15,000 people affected by rain-related disasters in Sri Lanka

- IPL 2025 Auction: RCB acquire Hazlewood for Rs 12.50 cr; Gujarat Titans bag Prasidh Krishna at Rs 9.5 crore

- Maharashtra result reflects the outcome of Congress' destructive politics: BJP's Shazia Ilmi

Just In

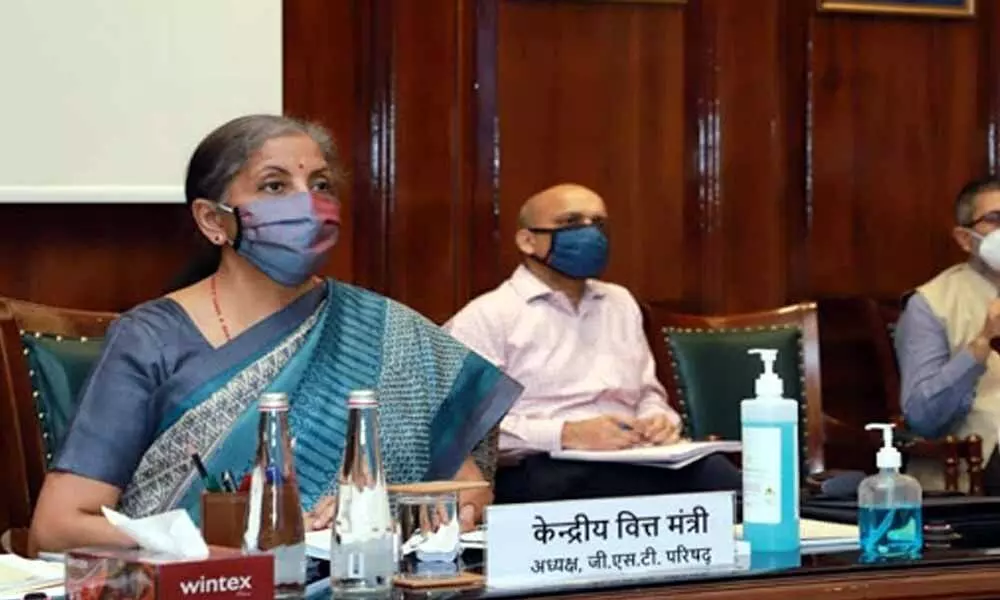

Finance Minister Nirmala Sitharaman

The Centre will disburse nearly Rs 20,000 crore among the states tonight from the amount collected as compensation cess this year.

The Centre will disburse nearly Rs 20,000 crore among the states tonight from the amount collected as compensation cess this year. Finance Minister Nirmala Sitharaman made the announcement today after the 42nd GST Council meeting.

Briefing the media in New Delhi, Finance Minister informed that by next week the Centre will also disburse Rs 25,000 crore towards Integrated GST for 2017-18 to those states that received less amount due to the anomalies.

The GST Council also recommended the extension of Levy of Compensation Cess beyond the transition period of five years which is beyond June 2022, for such period as may be required to meet the revenue gap.

Recommendations of the GST Council:

* Levy of Compensation Cess to be extended beyond the transition period of five years i.e. beyond June 2022, for such period as may be required to meet the revenue gap.

* Centre will release compensation of Rs 20,000 crore to States today towards loss of revenue during 2020-21 and an amount of about Rs 25,000 crore towards IGST of 2017-18 by next week.

* Enhancement in features of return filing: In its 39th Meeting held in March 2020, the Council had recommended an incremental approach to incorporate features of the new return system in the present familiar GSTR-1/3B scheme. Various enhancements have since been made available on the GST Common Portal. With a view to further enhance Ease of Doing Business and improve the compliance experience, the Council has approved the future roadmap for return filing under GST. The approved framework aims to simplify return filing and further reduce the taxpayer's compliance burden in this regard significantly, such that the timely furnishing of details of outward supplies (GSTR-1) by a taxpayer and his suppliers would –(i) allow him to view the ITC available in his electronic credit ledger from all sources i.e. domestic supplies, imports and payments on reverse charge etc. prior to the due date for payment of tax, and (ii) enable the system to auto-populate return (GSTR-3B)through the data filed by the taxpayer and all his suppliers. In other words, the timely filing of GSTR-1 statement alone would be sufficient as the return in FORM GSTR-3B would get auto prepared on the common portal. To this end the Council recommended/ decided the following:

1. Due date of furnishing quarterly GSTR-1 by quarterly taxpayers to be revised to 13th of the month succeeding the quarter, w.e.f. January 1, 2021.

2. Roadmap for auto-generation of GSTR-3B from GSTR-1s by:

3. Auto-population of liability from own GSTR-1, w.e.f. January 1, 2021.

4. Auto-population of the input tax credit from suppliers' GSTR-1s through the newly developed facility in FORM GSTR-2B for monthly filers, w.e.f. January 1, 2021, and for quarterly filers w.e.f. April 1, 2021.

5. In order to ensure auto-population of ITC and liability in GSTR 3B as detailed above, FORM GSTR 1would be mandatorily required to be filed before FORM GSTR3B, w.e.f. April 1, 2021.

6. The present GSTR-1/3B return filing system to be extended till March 31, 2021, and the GST laws to be amended to make the GSTR-1/3B return filing system as the default return filing system.

* As a further step towards reducing the compliance burden particularly on the small taxpayers having aggregate annual turnover < Rs. 5 cr., the Council's earlier recommendation of allowing filing of returns on a quarterly basis with monthly payments by such taxpayers to be implemented w.e.f. 01.01.2021. Such quarterly taxpayers would, for the first two months of the quarter, have an option to pay 35% of the net cash tax liability of the last quarter using an auto-generated challan.

* Revised Requirement of declaring HSN for goods and SAC for services in invoices and in FORM GSTR-1w.e.f. 01.04.2021 as under:

1. HSN/SAC at 6 digits for supplies of both goods and services for taxpayers with aggregate annual turnover above Rs. 5 crores;

2. HSN/SAC at 4 digits for B2B supplies of both goods and services for taxpayers with aggregate annual turnover up to Rs. 5 crores;

3. Government to have the power to notify 8 digit HSN on the notified class of supplies by all taxpayers.

* Amendment to the CGST Rules: Variousamendments in the CGST Rules and FORMS have been recommended which includes provision for furnishing of Nil FORM CMP-08 through SMS.

* Refund to be paid/disbursed in a validated bank account linked with the PAN & Aadhaar of the registrant, w.e.f. January 1. 2021.

* To encourage domestic launching of satellites particularly by young start-ups, the satellite launch services supplied by ISRO, Antrix Corporation Ltd. and NSIL would be exempted.

Ms. Sitharaman informed that the GST Council has deferred the decision on the mode of payment of pending GST compensation share of the states to October 12, 2020, meeting of the Council. She said that about 20 to 21 states chose the option given by the Centre which allowed the states to borrow to cover the compensation shortfall. However, other states, she said, did not choose any option and wanted the Centre to borrow and pay the shortfall.

Revenue Secretary Ajay Bhushan Pandey who was also present during the media briefing informed that starting from January 1, 2021, taxpayers with less than Rs 5 crore annual turnover will not be required to file monthly GSTR-1 and GSTR-3B returns. He said they will now have to file it on a quarterly basis. The GST Council meeting today was attended by Finance Ministers of all States and Union Territories.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com