Short covering likely as Call writers hold outstanding positions

The NSE broad-based index Nifty is in the process of forming a base at 12,000 strike, while Call positions moved higher to 12,500, which will be the next target for the index.

The NSE broad-based index Nifty is in the process of forming a base at 12,000 strike, while Call positions moved higher to 12,500, which will be the next target for the index.

Analysts observe long rollovers in banks and metal stocks, while short covering is clearly visible in technology and certain pharma stocks.

Build-up of ITM Puts holds upthrust in the momentum. The Open Interest (OI) in the Nifty fell 20 per cent from 16 million to 12 million shares.

Highest Call OI of 16.48 lakh contracts was seen at 12,300 strike followed by 10.80 lakh contracts at 12,400 strike. Highest Call addition of 3.91 lakh contracts was at 12,300 strike followed by 3.22 lakh contracts with 12,350 strike.

Coming to Put side, 12,200 strike recorded highest OI of 27.07 lakh contracts followed by 12,100 strike with 15.06 lakh contracts and 12,000 strike with 11.95 lakh contracts.

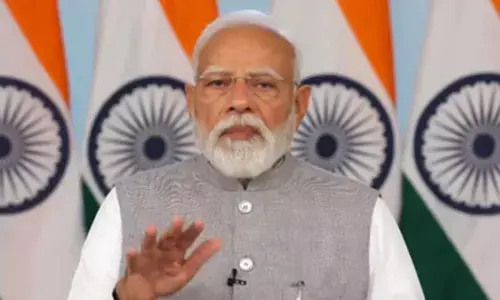

Highest addition of Put OI addition of 18.94 lakh contracts was seen at 12,200 strike. Dhirender Singh Bisht, senior research analyst (derivatives) at SMC Global Securities Ltd, observes that "We believe that still lot of outstanding short position is held with Call writers and we might witness another round of short covering once Nifty surpasses 12,300 levels."

Rollover for Nifty into January derivatives series was 70.4 per cent as against 79.6 per cent in December series and 84.1 per cent in November, and less than the three-month average of 78.94 per cent.

Bank Nifty rollover was higher than the previous average. Going by this, derivatives analysts forecast that financial and banking stocks to influence the market in the week ahead.

The January rollover commenced with 1.22 crore shares as against 1.47 crore shares in December series. In 2019, Nifty derivatives series closed on positive note during March, April, May, September, October and November.

Total market-wide rollover was 91 per cent as against 93 per cent and 89 per cent in previous series respectively.

Bisht said: "Snapping the three-day losing streak, Indian markets started the January series on a positive note with Nifty once again reclaiming 12,200 levels and Bank Nifty 32,400 levels supported by gains in financial counters.

From derivatives front, the 12,200 Put strike added hefty Open Interest, while marginal Call writing was observed at 12,300 strike."

For the week ended December 27, 2019, BSE Sensex closed at 41,575.14 points, a net loss of 106.4 points or 0.25 per cent, from the previous close of 41,681.54 points.

NSE Nifty inched down by 25 points or 0.20 per cent and closed the week at 12,245.80 points as against last week's 12,271.80 points.

"The technical setup at current juncture suggests that whatever fall Nifty has witnessed from its record peaks was profit booking at higher levels and the bounce from key support levels once again can add further momentum into the prices towards record peak.

On the higher side, 12,300-12,350 zone would act as immediate resistance for the Nifty while Bank Nifty has hurdle at 32,500 levels.

Though the broader trend is bullish for the markets, thus any dip into the prices towards support levels should be used to create fresh long positions. The immediate support for the Nifty is placed at 12,200 and 12,150 levels, forecasts Bisht.

The Implied Volatility (IV) declined from 15 per cent to 11 per cent in the January F&O series. The lower volatility suggests investors to buy on dips.

"The Implied Volatility of Calls closed at 11.13 per cent, while that for Put options closed at 12.10 per cent.

The Nifty VIX for the week closed at 11.12 per cent and is expected to remain volatile. Put-Call ratio of OI for the week closed at 1.15," added Bisht.

Bank Nifty

Bank Nifty rollover was 78.4 per cent higher than the 70 per cent of thee-month average. January series for Bank Nifty began with an Open Interest of 0.12 crore shares against 0.19 crore shares due to profit booking.

Registering a marginal gain of 27.4 points or 0.08 per cent for the week, Bank Nifty closed at 32,412.35 points as against 32,384.95 points. The Bank Nifty recorded 14 per cent closure of Open Interest.