India has an export target of $2 trillion by 2030, banks will have to play a pivotal part in achieving it: FM Nirmala Sitharaman

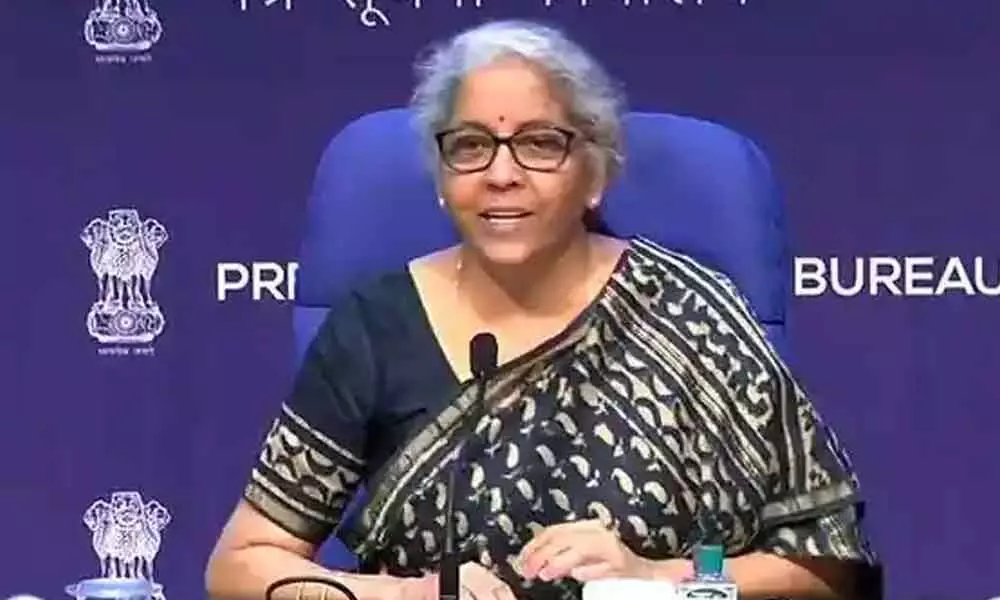

Union Finance Minister Nirmala Sitharaman

Union Finance and Corporate Affairs Minister Nirmala Sitharaman has said India has an export target of two trillion dollar by 2030 and said the banks will have to play a pivotal part in achieving the same

Union Finance and Corporate Affairs Minister Nirmala Sitharaman has said India has an export target of two trillion dollar by 2030 and said the banks will have to play a pivotal part in achieving the same. Speaking at the 74th Annual General Meeting of the Indian Banking Association in Mumbai on Sunday, Ms Sitharaman said, India aims to achieve a target export of two trillion dollar by 2030 of which one trillion dollar in merchandise export and one trillion dollar is services export. She added that the target cannot be achieved unless banks are going to be nimble with a sound understanding of various businesses and sectors.

Emphasizing the need of adopting new technology in banking, the finance minister said the long term future of Indian banking is going to be largely driven by digitized processes. She said post covid there has been extremely successful adoption of digitization. Ms Sitharaman emphasized the importance of a rationalized approach and optimal utilization of digital technologies to improve access to banking in every district. She said almost two-third of 7.5 lakh panchayats have optical fibre connection, IBA should consider this and conduct exercises to decide where they should have a physical presence and where customers can be served even without physical presence. She said, UPI is the flesh and blood of financial technology and there is a need to strengthen it. She said Indian UPI has made a very big impression in the world where Indian Rupay is now accepted in so many countries, which is symbolic of India's futuristic digital payment intentions.

While elaborating on the point of strengthening the banking network as the key of development, Ms Sitharaman said the way in which the economy is shifting to a different plane altogether and the way industry is adapting, many new challenges have risen, India needs bigger banks like SBI to scale up banking to meet changing requirements in light of shifting recent realities of economy and industry. She said, India needs to have 4-5 banks like SBI. The Minister also emphasized the need of developing Corporate Communications of the bank to keep people about their activities. She said Bank's Corporate Communication team should be able to tell customers about various portfolios and offerings and they have to lot more imaginative and creative.

Speaking specially about the deposits and lending scenario in the Eastern Region of the Country, the finance minister said, there is more than adequate Current and Savings Account in that region but there are no takers for credit and asked the banks to address the issue and see how they can lend in those regions in states like Bihar.

Talking about commercial banks and their core role, Sitaraman said the government will come out with a Developmental Financial Institution (DFI), which will provide a huge amount of funds for government big projects. DFI is to be at private sector also, so that money is available at competitive prices

Ms. Sitharaman praised IBA for the coming together of eight banks to form the Account Aggregator Framework. She said, this will give tailor-made portfolios for people to choose from and people will be encouraged to voluntarily share their data. She said this will also improve credit outreach going forward. The finance minister said, if the Account Aggregator Framework is put to use well, more specialized credit outreach would be needed. She informed that the Government along with RBI has taken initiatives with protocols and frameworks helping banks attain more through the digital systems which are being employed in the industry.

Minister of State for Finance Dr. Bhagwat Karad who also attended the function, stressed on the need for banks to play an important role in taking various govt schemes to the public. He said various packages announced by the central govt like Atma Nirbhar Bharat in the wake of the covid pandemic should be taken to the public. He said there is a need to take forward social security schemes which will help in financial inclusion. He also emphasized on modernisation of banks and said all banks should make special efforts to implement Ease 3.0 and 4.0 Reforms to modernize banks.