Live

- Free coaching to be provided at BC Study Circles in 26 dists

- Previous TTD board looted pilgrims’ money, slams Bhanu

- Will order a detailed probe into TIDCO irregularities: Narayana

- Naidu all praise for Modi

- Indian students' concerns about employment, safety, and visas discourage them from applying to UK universities

- Candlelight Concerts Makes a Dazzling Debut in Hyderabad with Sold-Out 'Tribute to Coldplay' Show

- Shubman Gill Sustains Thumb Injury Ahead of Perth Test; Devdutt Padikkal Joins Test Squad

- Unlock Loot Boxes, Diamonds, Skins, and More Exciting Rewards with Garena Free Fire Max Redeem Codes for November 16

- Regarding the DOGE Plan, Vivek Ramaswamy stated, "Elon Musk and I Will Take a Chainsaw to Bureaucracy"

- Sudanese army says repulsed paramilitary forces attack in western Sudan, killing over 80

Just In

Inflation, US Fed data to set the tone for markets

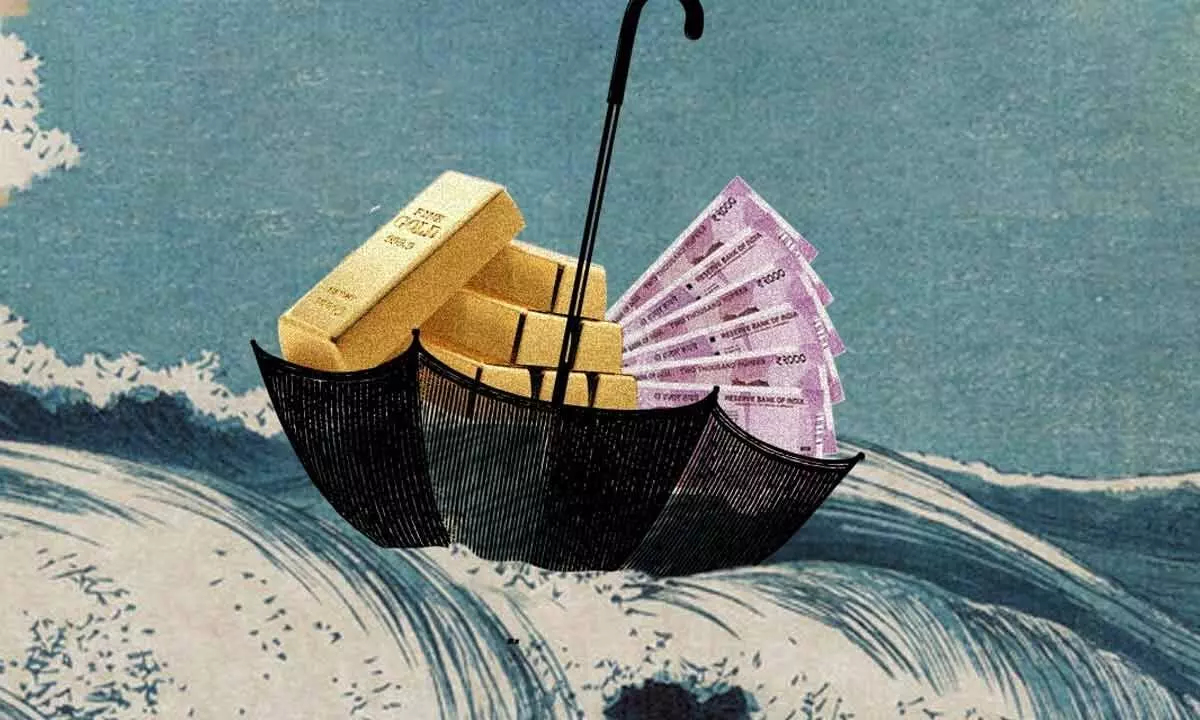

Inflation, US Fed data to set the tone for markets

Broader markets slightly better than frontline indices; BSE Mid-cap and Small-cap indices shedding only 1.2% and 2% respectively

Spooked by inflation risk, rise in international crude oil prices, mounting concerns over global monetary policy tightening and renewed FII selling, the domestic stock markets snapped a three-week winning streak and fell more than two percent during the week ended. The BSE Sensex corrected 1,466 points or 2.63 percent to 54,303, and NSE Nifty plunged 382.5 points or 2.3 percent to 16,202 points.

Broader markets were slightly better than the frontline indices, with the BSE Mid-cap and Small-cap indexes shedding only 1.2 per cent and two per cent, respectively. Selling for eighth consecutive month, FIIs have net sold Rs12,662 crore worth shares till date in current month. It is pertinent to know that FIIs sold more than Rs3.45 lakh crore since October 2021.

Partially offsetting FII sales, the DIIs have purchased Rs2.63 lakh crore worth stocks during the period. Selling by FIIs in emerging markets, including India is attributed to rising inflation concerns amid geo-political tensions and faster policy tightening by central banks. Continuous fall in stock price of LIC has also dampened sentiment. Time for DIIs to support the stock, say observers.

However, after the higher-than-expected inflation of 8.6 percent at 40-year high in May, the highest since December 1981; the fresh inflation shock hammered stock and bond prices anew, heightening investors' fears that the US FOMC may fast track its interest rate hike at its two-day meeting next week on June 14-15. Near term direction of domestic markets will be dictated by international crude oil prices, US Fed meeting, rupee-dollar fluctuations, spread of Monsoon and macroeconomic data. If the US market settles down, that is if it stops reacting to any bad news only then other markets across the globe will turn bullish. Markets may take five-six months to stabilize say old timers.

Listening Post: Stagflation—a toxic cocktail of stagnating growth and rising prices—is generally viewed as a relic of the 1970s. But economists are warning it could make a comeback. The term is broadly defined as sluggish growth tied with rising inflation.

Rising inflation erodes consumer purchasing power, and weaker demand hurts companies' profits and causes layoffs. Stagflation also puts the Central Banks across the globe in a bind because the central bank's job is to keep both inflation and unemployment low. They can raise interest rates to curb inflation—a path they have started on and intend to continue this year—but if they move too aggressively they risk strangling spending and tipping the global economy

into a recession. Inflation is close to a 40-year high in USA.

Stagflation would be a sustained period of both higher inflation and slower growth, not just one quarter. Stagflation remains a risk to the global economy, and there are similarities between the situation in the 1970s and today.

Stagflation occurred from the early 1970s to the early 1980s, when surging commodity prices and double-digit inflation collided with high unemployment. British Parliamentarian Iain Macleod is credited with first using the word stagflation in 1965.

F&O/ Sector watch

On the back of weak macro and micro factors, markets remained under pressure and volumes were on lower side in the derivatives segment during the week ended. NSE Nifty fell more than two per cent, while Bank Nifty also closed below 35,000 level with loss of more than two per cent week on week basis. PCR of OI for the week closed at 1.36. NSE Nifty could trade in a broader range of 15,600-16,600 levels in near term. Techies indicate that 16000 - 15800 zone would act as strong support for the Nifty, while 16500-16600 zone is likely to cap any sharp upside in the Nifty.

Expect sharp sector specific and stock specific moves in coming week. Crude oil prices have hardened again of late following the European Union's decision to ban a major chunk of oil imports from Russia as well as Saudi Arabia's recent decision to raise prices for Asian buyers by a greater-than-expected quantum. Stay invested and add on declines RIL, IOC, BPCL and HPCL. Fuelling the rise in RIL stock price has been the news that the GoI has lost its appeal in the English High Court against a $111 million arbitration award in favour of RIL and Shell in a cost recovery dispute in the western offshore Panna-Mukta and Tapti oil and gas fields.

Stock futures looking good are BEL, HPCL, Dr Reddy, Reliance Ind, ONGC, SBI Life and NTPC. Stock futures looking weak are Apollo Tyres, AU Bank, Berger Paints, Deepak Nitrate, United Phosphorus and Vedanta.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com