Market on edge ahead of Union Budget

Market on edge ahead of Union Budget

Trade with low position size, stringent risk management; Stay cautious for next week

The Indian stock markets traded amid high volatility and registered a net loss during the last week. After hitting a new lifetime high, the Nifty tumbled almost 400 points. On a net basis, it ended with 61.80 points or 0.42 per cent at 14371.9. The BSE Sensex also lost 0.3 per cent. The broader market indices Nifty Midcap-100 and Smallcap-100 lost 1.3 per cent and 0.7 per cent, respectively. On the sectoral front, Nifty Auto was the top gainer with 3.3 per cent. IT index was up by 0.5 per cent. The Nifty Metal index was down by 6.3 per cent. Nifty Bank, pharma and realty indices closed with 3-3.5 per cent losses. The overall market breadth was negative for the week.

The market is finally feeling nervous as the Union Budget is nearing. For the last two consecutive weeks, the benchmark index, Nifty, is forming bearish candles. These back-to-back bearish doji candles just before the Budget week are not at all a good sign for the market. The Nifty formed a shooting star and finally closed with a weekly loss. It also breached the previous week's low at the beginning of the week, but the closing below the prior week is important for the bearish confirmation. Since March lows, several bearish formations failed to get the confirmation. Let us watch whether the bears will be to get the strength to pull down the market this time. Let us also watch for, will the history repeats, this time, as most of the market tops formed in the January-March quarter. After gaining over 96 per cent or 7242 points from the March low, the market has shown the first signs of fatigue.

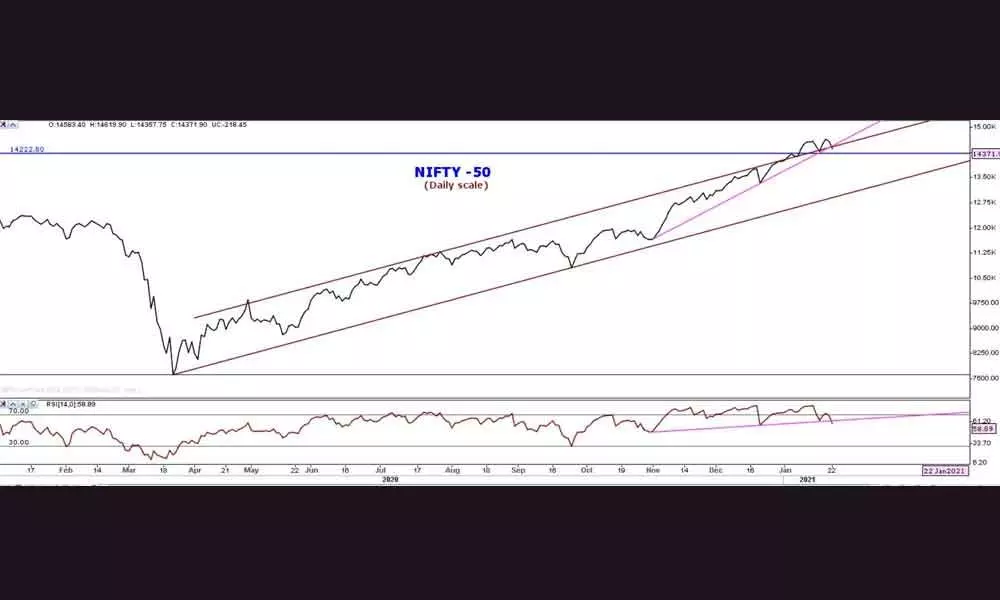

Technically, the Nifty has broken the important upward trend line support on the daily line chart. Interestingly, this line chart based on the closing prices gives many other clues. After breaking out of the upward channel on January 8, it came back into the channel. This is nothing but a failed breakout. It is also forming a double top kind of pattern. In any case, if it closes below 14,280 next week, it will be a very big negative sign. The Nifty broke down the medium-term trend line support on last Friday on the same line chart. This trend line is drawn by connecting recent three swing lows. This breakdown came with RSI negative divergence. The RSI closed below the prior swing low. Watch RSI 55-56 zone, which is major support. In any case, it breaks below this level along with Nifty closing below 14,280 is a bearish signal confirmation. On a weekly chart, it failed to close above the weekly high after October last week. The negative divergence in RSI as well as in MACD is also giving warning signals to the bulls.

For the next week, immediate support is placed at 14,281. A daily close below this level will lead to falling towards 14,133 and 13,942 levels. Before the Budget, breaking below 13,942 may not be possible. On the Bullish side, a sustained bounce above the Friday high of 14,620 will negate the all-bearish signals. In any case, the Nifty failed to move above 14,450 by the market closing on Monday, will also be a negative sign.

As there are only four trading sessions before the Budget, try to trade with the low position size and stringent risk management. There is a very limited possibility of going further new highs. Regardless of any underlying buoyancy or liquidity-driven up moves, the markets have sharply deviated from the mean levels. Stay cautious for next week.

(The author is a financial journalist and technical analyst. He can be reached at [email protected])