Live

- Ashutosh Gowariker to lead International Jury at IFFI 2024

- The global challenges of greener aviation

- Shreyas Media secures exclusive advertising rights for ‘MahaKumbh Mela 2025’

- Experience the journey of art

- Seven iconic ghats undergo makeover for Mahakumbh

- Smog engulfs capital with ‘severe’ air quality

- Slur against HDK wrong, Zameer will be corrected: K’taka Cong

- Himalayan Echoes Literature Festival returns to Nainital with a focus on art, environment, and culture

- Taking Off: Solo travelling as a minor

- MVA will win over 160 seats, form govt in Maha: Shivakumar

Just In

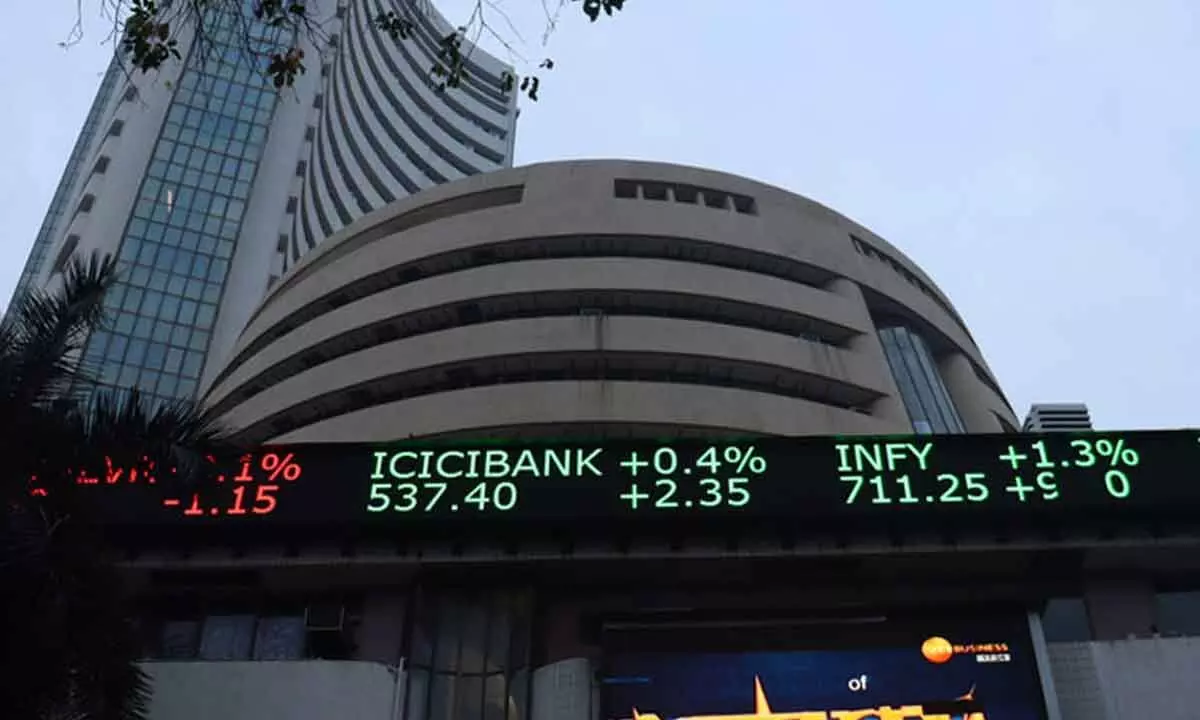

Markets in consolidation mode amid premium valuations

Traders ready to book profits at earliest sign of trouble as some nervousness gripped the bourses and any election-led jitters

After marching to new highs for the better part of the week, the market took a sharp turn lower amid selling pressure in key index heavyweights on Friday to close on a flat note during the week ended. BSE Sensex gained 147 points to end at 73,878 points, while NSE Nifty finished at 22,475 points, closing 56 points higher. In the two days of trading in May, FPIs have invested Rs1,156 crore in equity and sold Rs1,726 crore in debt. Rumours of impending changes in capital gains both short-term and long-term have been scotched by FM. The market is at record highs in uncharted territory. Factors like the ongoing Lok Sabha elections, uncertain economic and rate outlook in the US, FII selling, and anxiety around corporate earnings are bound to stoke turbulence in the market say old timers. At historic highs, there is always some nervousness and people watching over their shoulders to see who is rushing through the door. They want to book profits at the earliest sign of trouble.

Expect a degree of consolidation in the market due to expensive valuations and any election-led jitters. When the market opens on Monday, it will react to the Q4 earnings of Kotak Mahindra Bank, DMart and IDBI Bank. Major companies that would announce their numbers in the coming week are DRL, Cipla, Tata Motors, Asian Paints, BPCL, SBI, Hero Moto and L&T. Renewed hopes for a second rate cut in 2024 emerged following a weaker US labour report, giving markets some reason to celebrate during the week ended. Oil prices may remain under pressure as Hamas reportedly studies a proposal for a temporary cease-fire with Israel and plans to send a delegation to Egypt to continue negotiations. Moving forward, the ongoing results season will be detrimental for investors to align their portfolios. The market will also remain vigilant about the election related news and global cues.

Street Talk: Rumours of promoters inflating profits (through profit entry) and in nexus with Gujarati-Marwari brokers driving their stock prices to unrealistic levels are gaining ground. With the domestic equity market is flush with funds from retail as well as other domestic investors, the combined market capitalisation (mcap) of all listed stocks on the BSE has zoomed above a record high level of Rs400 lakh crore.

STOCK PICKS FOR 2024

Biocon Ltd is biopharmaceutical company, which focuses on treating diabetes, cancer and autoimmune diseases. Biocon operates four distinct business segments: a. Generics b. Novel Biologics c. Biosimilars (Under Biocon Biologics Limited) d. Research Services (Under Syngene International Limited). Generics Business comprises of a growing portfolio of Active Pharmaceutical Ingredients (APIs) as well as finished dosages.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com