MTaI seeks separate budget for medical devices industry

MTaI seeks separate budget for medical devices industry

It has also demanded the govt to exempt the free medical device samples from the TDS, along with its other long pending requests including reduction in duties and removal of health cess

The medical devices industry, which was left high and dry in the Union Budget for the financial year 2022-23, now wanted several policy initiatives from Union Finance Minister Nirmala Sitharaman in the upcoming Union Budget 2023-24 that can support the sector. The Medical Technology Association of India (MTaI), an association of the research-based medical technology industry in the country, has urged the Finance Minister to consider a separate budget of $5 million in the upcoming Union Budget 2023 for the growth of the medical devices industry. It has also demanded to the government to exempt the free medical device samples from the Tax Deducted at Source (TDS), along with its other long pending requests including reduction in duties and removal of health cess. The association argues that a separate budget of up to $5 million needs to be allocated for the promotion, advertising and marketing of the Indian medical device industry globally. This will help strengthen 'brand India' and get greater acceptability of India-made medical devices in overseas markets which will further the government's vision of 'Make in India for the world'. It will also help in the promotion of India as a destination of manufacturing and R&D in MedTech.

In its pre-budget representation, the association pointing to the guidelines issued in June 2022 regarding section 194R of IT Act that free samples of medical devices would come under the TDS regime. It said that the product samples provided by medical device companies to clinicians enable them to get hands-on training to learn the optimum usage, application and handling of the product and sometimes to even demonstrate to the patients on how the procedure will be carried through.

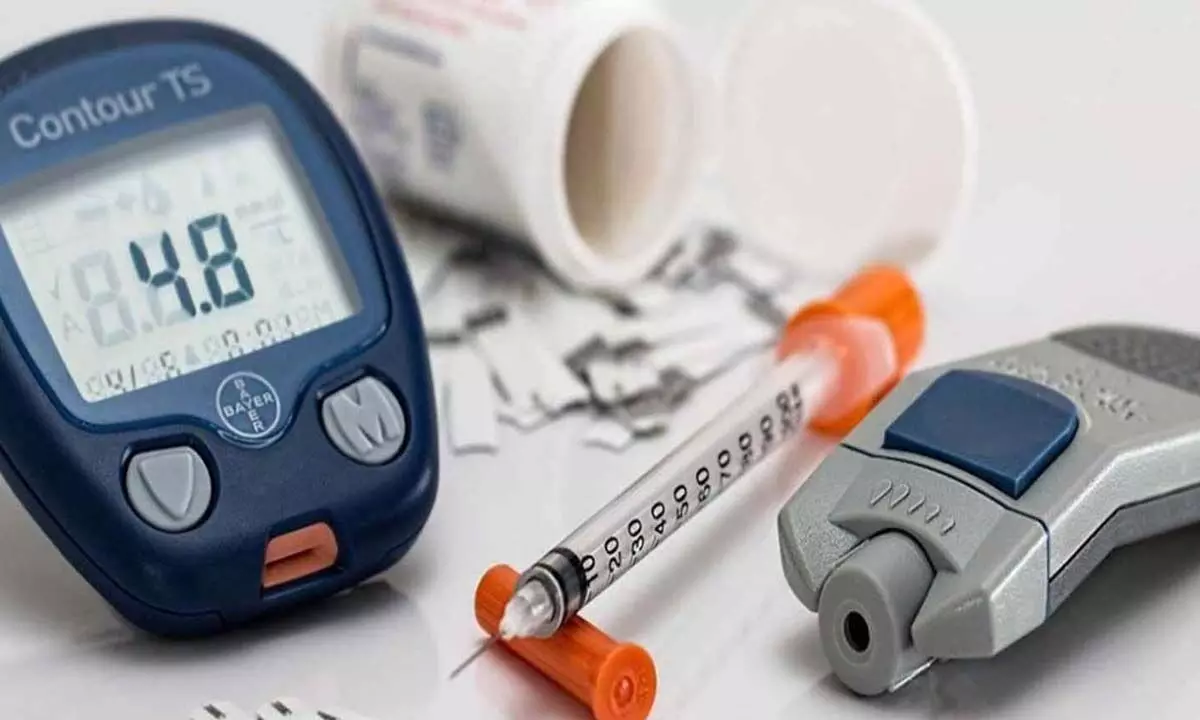

These samples are always marked "Physicians Sample not for sale" as per the Drugs & Cosmetics Act and Medical Devices Rules 2017 and are not to be used to generate any income. Therefore, the association argues that any taxation on samples will prohibit these activities and hinder the doctor's ability to deliver optimal patient outcomes. The Association sought the government to increase tax exemption and benefits for patients. As the prevalence of non communicable diseases like heart diseases, stroke, diabetes and respiratory diseases is continually rising and is estimated to comprise 75 per cent of the India's disease burden by 2050, therefore to enable timely treatment, preventive health checkups should be encouraged by increasing tax exemption limit from Rs 5000 to Rs 15000. Additionally, the deduction limit towards payment of medical insurance premium under section 80D should be increased from Rs. 25,000 to Rs. 50,000. Other demands of the sector include reduction of customs duties to 2.5 per cent on medical devices and removal of the 5 per cent health cess on import of medical devices.

Last year, the US $15 billion medical devices industry in the country was upset over the fact that the sector has been given a cold shoulder by the Union Finance Minister Nirmala Sitharaman in the Union Budget for the financial year 2022-23 presented in Parliament on February 1.

The medical devices industry felt that though there were several measures that could have brought in to support the sector, the Union Budget 2022 did not address any of the major concerns of the industry, both the research-based medical technology industry and the domestic manufacturers. The industry's major expectations from the Budget included a predictable tariff policy, graded increase of custom duty to 10-15 per cent from the current zero to 7.5 per cent, and reduced GST on medical devices, etc. From the current estimated market size of nearly US $15 billion, the medical device sector was projected to register a CAGR of almost 15 per cent and is poised for significant growth in the next five years with the market size expected to reach $50 billion by 2025.

There can be no two opinions about the fact that the Indian medical device manufacturing industry is at the cusp of a great opportunity. Manufacturing growth in China has been challenged by many countries resistance to buy Chinese medical devices. Another opportunity is the current Indian Public Procurement Policy. Due to geopolitical reasons global investors have begun to show renewed interest in India.

So, the medical devices industry has been looking towards various policy initiatives from the government to support the growth in future. It was expecting the government to move forward on promised reforms and anticipated conducive measures to boost domestic manufacturing of the medical devices. But, when the Finance Minister announced the budget proposals for 2022-23, the medical devices industry was left high and dry as there was no booster dose in the budget for this emerging sector in India. Now, over to the Finance Minister to consider the demands of the sector seriously to take the Indian medical devices sector to the next level.

(The author is a freelance journalist with varied experience in different fields)