Live

- Nizamabad MP Dharmapuri Arvind and Jagtial MLA Dr. Sanjay Kumar Meet CM Revanth Reddy

- Hyderabad CP CV Anand Issues Stern Warning to Bouncers

- MP Laxman Criticizes Police Conduct, Calls for Support for Victims' Families

- Fire Breaks Out in Kachiguda-Chennai Egmore Express, Passengers Evacuated Safely

- CM Revanth Reddy Condemns Attacks on Film Personalities' Homes, Calls for Strict Action

- Victory Venkatesh and Nandamuri Balakrishna to Set Screens on Fire with Unstoppable Season 4

- Over 71.81 crore Ayushman Bharat Health Account numbers generated: Centre

- In special gesture, Kuwait's Prime Minister sees-off PM Modi at airport after conclusion of historic visit

- Veer crowned PGTI Ranking champion, Shaurya wins emerging player honour

- Sr National Badminton: Unseeded Rounak Chauhan, Adarshini Shri reach singles semis

Just In

East West Pipeline Ltd (EWPL), which was previously known as Reliance Gas Transportation Infrastructure Ltd (RGTIL), denied that any money was laundered at any stage during implementation of the project

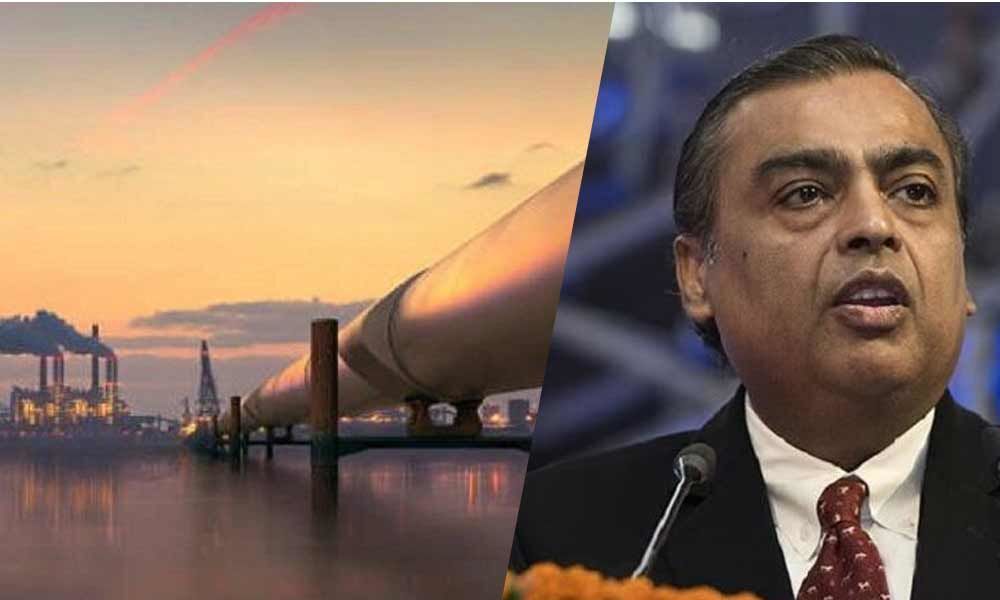

New Delhi: Dutch investigators have arrested three former employees of a local firm suspected of laundering $1.2 billion through over-invoicing services and works rendered for a gas pipeline built by a unit controlled by billionaire Mukesh Ambani, a charge vehemently denied by Reliance Industries.

East West Pipeline Ltd (EWPL), which was previously known as Reliance Gas Transportation Infrastructure Ltd (RGTIL), denied that any money was laundered at any stage during implementation of the project and that higher capital cost of a pipeline would result in higher tariff for users for receiving natural gas through the line.

Ambani's listed firm Reliance Industries too denied any link to the pipeline company saying he neither set up any gas pipeline in 2006 nor did it have contracts with any Netherlands company for any gas line.

The Fiscal Intelligence and Investigation Service & Economic Investigation Service (FIOD-ECD) arrested three former employees of Dutch pipeline firm A Hak, NL, alleging that an estimated $1.2 billion in profits earned by the company through over-invoicing services and works rendered to RGTIL were "creamed off" to Singapore-based Biometrix Marketing Ltd, a company they claim is allegedly linked to Reliance.

An AFP report quoting a statement issued by public prosecutor's office said that the company acted as "invoice duplicator" to enable the Indian firm to claim costs twice from gas customers. "It is suspected that the Dutch company used to increase the amounts on the invoices for the materials and services supplied," it said.

"The 'profits' earned in this way were subsequently creamed off via the Dutch company," it said. The gains were then transferred via a complex web of businesses based among others in Dubai, Switzerland and the Caribbean, before eventually ending up at a business owned by the Indian company in Singapore, AFP said adding the suspects allegedly received payments of up to $10 million for their involvement.

"In this case Dutch companies are suspected of assisting an Indian client to launder suspected illegal earnings," AFP quoted the statement as saying. The real losers "were probably individual citizens in India" as the cost of production of gas is passed onto the consumer, it added.

Reached for comments, EWPL said the pipeline project was built by a privately-owned entity, in which promoters' private funds were invested. "No public funds were invested and all borrowings from banks, financial institutions and others have been fully repaid by the promoters.

We strongly deny any suggestion of any money having been laundered at any stage during the implementation of the project. Suggestion of such impropriety lacks logic and economic rationale and is emphatically denied," EWPL said in a statement.

The pipeline project, it said, was implemented by a consortium of independent contractors from India, China, Russia and the Middle East. "A Hak, Middle East was one of the contractors.

The Project was completed expeditiously at globally competitive costs which have been benchmarked by reputed independent agencies."

EWPL said that the suggestion that a higher capital cost would result in higher tariff is "wrong" and "not in line with the applicable tariff regulations in India".

"According to the tariff regulations, the cost of fixed assets to be reckoned for the purpose of transportation tariff is lower of actual cost or the cost normatively assessed by the statutory authority, Petroleum and Natural Gas Regulatory Board (PNGRB).

Tariff has been approved for the East West pipeline on the basis of normative cost determined by PNGRB by employing professional consultants which is evident from the tariff order dated 19th April 2010.

Hence, the actual cost of setting up the East West Pipeline is not relevant for fixing the transportation tariff," EWPL's statement said.

It, however, did not reply to a query on PNGRB's March 12, 2019 ruling fixing tariff of the pipeline based on claims of cost made by the company. "As a matter of policy and good governance, at all times we have cooperated with the statutory authorities and will continue to do so.

It is clear from the media reports that the investigation has proceeded on assumptions and presumptions without factual basis. We once again strongly deny suggestions of any impropriety," EWPL said.

In a statement, RIL said neither it nor any of its subsidiaries set up any gas pipeline in 2006. Also, it never had any contracts with any Netherland company for setting up of any gas pipeline and hence the report cannot relate to RIL.

"RIL has always complied with all rules, regulations and applicable laws and any suggestion of impropriety by RIL is emphatically denied." Last month, Canadian investor Brookfield-led India Infrastructure Trust (InVIT) agreed to pay Rs 13,000 crore to buy the loss-making East-West gas pipeline that transports RIL's eastern offshore KG-D6 gas from east coast to customers in the west.

PNGRB had on March 12 approved a 37 per cent rise in tariff from April 1 for the pipeline to Rs 71.66 per million British thermal unit on a gross calorific value basis.

This was against Rs 151.84 that the operator wanted to charge from 2018-19 to 2035-36 claiming that the pipeline had a total capex of Rs 18,307.37 crore under two heads - actual capex of Rs 16,347.96 crore and future capex of Rs 1,959.41 crore.

The arrests in The Netherlands were made in connection with alleged over-invoicing of materials and services supplied by A Hak International Contractors Asia FZE (a firm set up by A Hak, NL, in the UAE) for building a gas pipeline with RGTIL in India between 2006 and 2008.

It is alleged that false insurance contracts were used to "cream off" about USD 1.2 billion of profit. This was done using 'bearer documents'.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com