Options data denotes range-bound trading

The resistance level remained unchanged for a second week at 25,000CE, while the support level rose 1,300 points to 23,000PE, as per the latest options data on NSE

The resistance level remained unchanged for a second week at 25,000CE, while the support level rose 1,300 points to 23,000PE, as per the latest options data on NSE. The 25,000CE has highest Call OI followed by 25,500/ 26,000/ 25,200/ 24,900/ 26,200/ 26,250 strikes, while 25,000/ 24,900/ 24,500/25,100/ 25,200/25,300 strikes witnessed heavy addition of Call OI. Only three OTM Call strikes-26,000/25,950/ 25,750- recorded heavy to modest offloading of OI. And the marginal OI fall was seen at Call ITM strikes.

Coming to the Put side, maximum Put base seen at 23,000PE followed by 23,500/ 23,300/ 23,600/ 23,800/21,600/ 21,700/ 22,000/22,400 strikes. Further, 21,600/ 22,300/ 22,500/22,800/22,900/ 23,000/ 23,350/ 23,100/ 24,000 strikes clocked heavy build-up of Put OI.

Few Put ITM strikes recorded miniscule decline in OI.

The F&O trading had recorded a fall in Nifty OI on Friday. Major short covering was seen in several bluechips. Even FIIs net short positions fell sharply to 50,000 contracts in a single session. Sustainability of 23,800 level itself may take markets higher towards 24,500 in the coming sessions and any fresh weakness below that level may be observed. Responding to sharp surge on last Friday, Call writers preferred to close positions along with noteworthy Put writing. On the downside, major Put base was at 23,500 strike. While Call OI is still visible at ATM and OTM strikes, but sustainability of current levels may trigger closure of these positions during the monthly settlement, observes ICICIdirect.com.

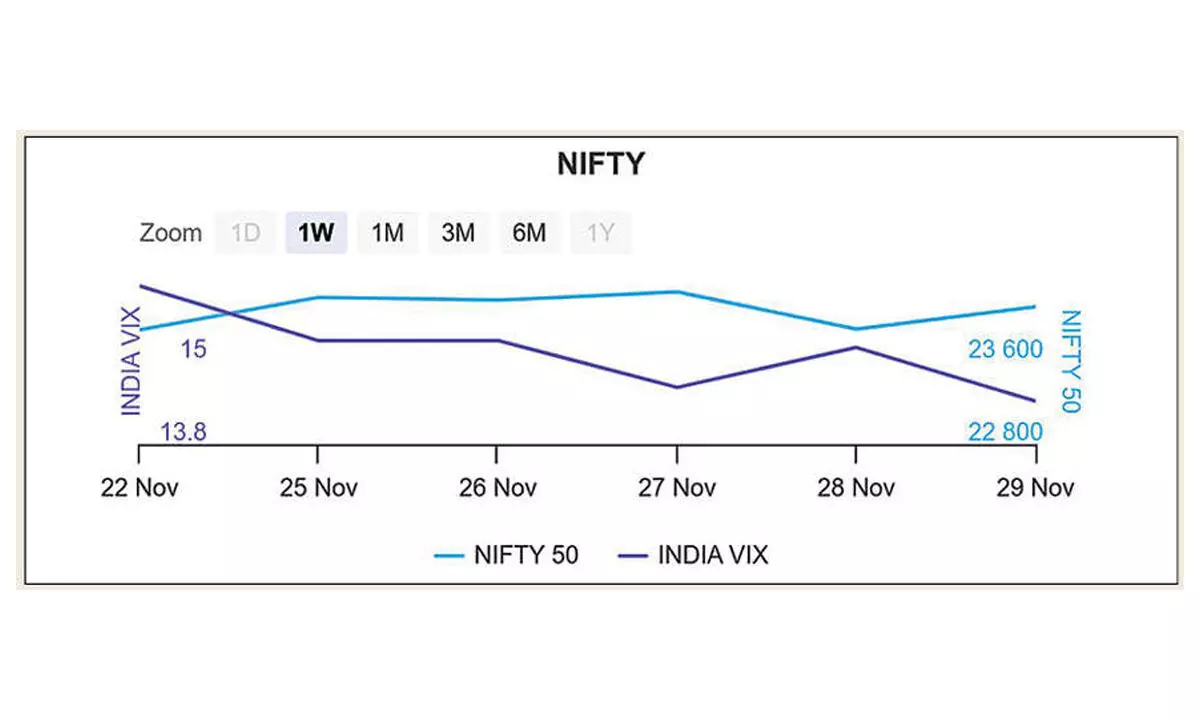

BSE Sensex closed the week ended November 29, 2024, at 79,802.79 points, a further recovery of 685.68 points or 0.86 per cent, from the previous week’s (Nov 22) closing of 79,117.11 points. For the week, NSE Nifty also rebounded by 223.85 points or 0.93 per cent to 24,131.10 points from 23,907.25 points a week ago.

India VIX fell 5.13 per cent to 14.42 level. India VIX fell below 15 level and it’s expected to fall in a volatile market.