Live

- Gurugram civic polls: Congress announces mayor, councillor candidates

- CM Revanth Reddy Urges Civil Servants to Adopt a Proactive Approach in Solving Public Issues

- New Delhi station tragedy: Railways denies platform change or special train cancellation

- Dharmendra Pradhan takes holy dip at Triveni Sangam in Prayagraj

- Nominations for Prime Minister’s ‘Yoga Awards 2025’ now open

- J&K: Brief exchange of fire along LoC in Poonch sector

- TPCC Defends Revanth Reddy’s Remarks on PM Modi’s Caste, Hits Back at BJP

- KTR Accuses Congress Government of Neglecting Gurukuls, Claims Institutional Collapse

- Progress of country, tribals are inter-linked: President Murmu

- FIH Women’s Pro League: England thwart India fightback, win bonus point in shootout

Just In

Options data holds moderate bullish bias

The 18,000CE has highest Call OI followed by 18,200/ 18,300/ 18,100/ 18,500/17,800/ 18,250 strikes, while 18,200/ 18,100/ 19,000/ 18,300 strikes recorded reasonable addition of Call OI.

The 18,000CE has highest Call OI followed by 18,200/ 18,300/ 18,100/ 18,500/17,800/ 18,250 strikes, while 18,200/ 18,100/ 19,000/ 18,300 strikes recorded reasonable addition of Call OI.

Coming to the Put side, maximum Put OI is seen at 18,000PE followed by 17,800/ 17,900/17,700/ 17,500 strikes. Further, the 18,000/17,900/ 17,950/ 18,050/ 18,100 strikes witnessed significant build-up of Put OI.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “From the derivatives front, Put writers added hefty Open Interest at 18,000 strike, while Call writers were seen shifting to higher bands with marginal Open Interest addition.”

Nifty began the May F&O series with low Open Interest of 8.3 million shares, which is the lowest since September 2020. Further, no major longs were formed after sharp short covering in the first half of the April series. Accumulation of fresh positions is likely to provide some directional bias in coming sessions.

“Indian markets began the May series with a bang, as bulls made a strong comeback, with Nifty gaining 2.50 per cent over the week. Almost all the sectors contributed to the up move wherein energy, IT and auto were among the top performers along with PSU banks. Banking index gained over 2.50 per cent as well over the week,” added Bisht.

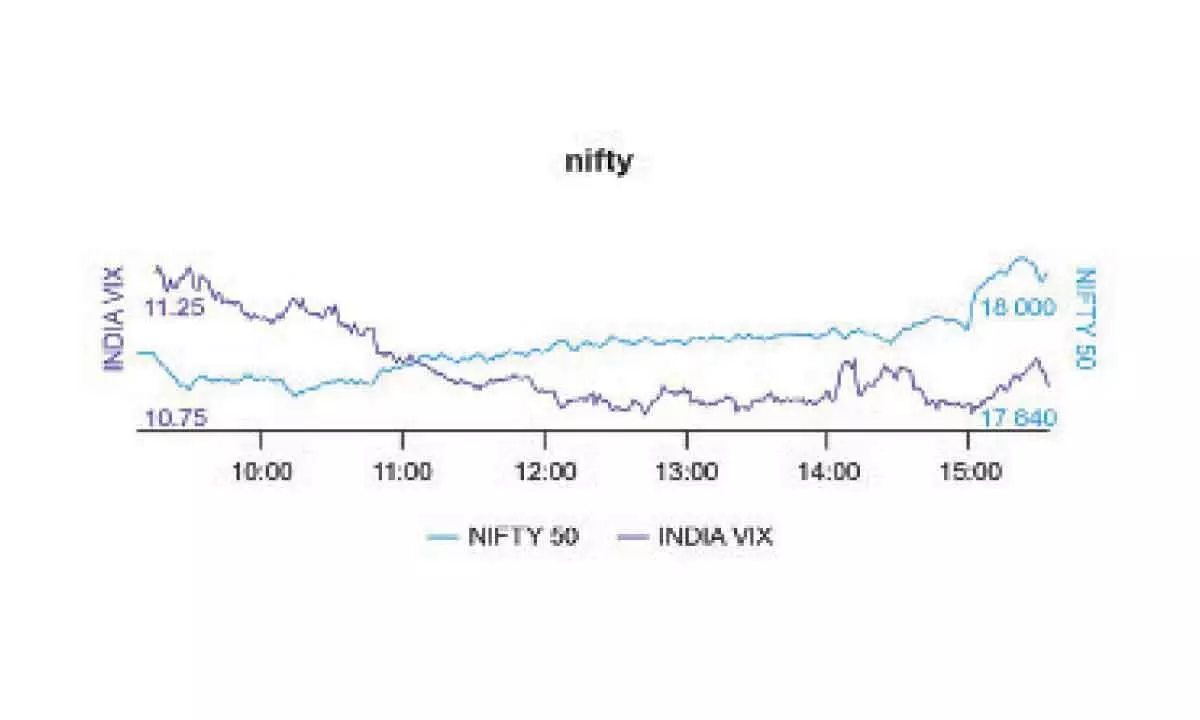

BSE Sensex closed the week ended April 28, 2023, at 61,112.44 points, an encouraging rebound of 1,457.38 points or 2.44 per cent, from the previous week’s (April 21) closing of 59,655.06 points. NSE Nifty ended the week at 18,065 points, a net gain of 440.95 points or 2.50 per cent, from 17,624.05 points a week ago.

Bisht forecasts: “Technically, both the indices can be seen moving with formation of higher bottom patterns on daily and weekly charts and are expected to keep their bullish momentum intact in upcoming sessions as well. On the downside now, the 18,000-17,800 zone would act as a strong support area for Nifty, while on the higher side, we expect Nifty to move towards 18,300 levels in upcoming sessions.”

India VIX fell 4.18 per cent to 10.95 level. The volatility index India VIX moved further down to below 11 level. Historically, it has not spent much time below this level. Probability seems higher for a spike in volatility, which may trigger intermediate profit booking.

“Implied Volatility (IV) of Calls closed at 9.97 per cent, while that for Put options, it closed at 10.65 per cent. The Nifty VIX for the week closed at 11.43 per cent. PCR of OI for the week closed at 1.41,” remarked Bisht.

Volume-weighted average price (VWAP) of the April series was 17,700 and it may act as an important support level. Traders can utilize the declines towards this level for creating fresh longs. Moreover, the Put base at 17,800 and 17,900 strike is above one crore shares. These positions are expected to close ahead of the upcoming FOMC meet and very low IVs. Investors are advised to wait for further drop to create fresh longs.

FIIs remained largely muted despite the monthly expiry. While the short covering in index futures continued as FIIs bought index futures worth Rs1,500 crore, which helped in a further reduction in net shorts positions. However, the focus shifted to stocks where it has bought over Rs4,800 crore during the week. Also, despite a gradual up move in the index, FIIs remained net sellers in index options and sold options worth nearly Rs11,000 crore during the week.

Bank Nifty

NSE’s banking index closed the week at 43,233.90 points, a miniscule loss of 14.55 points or 0.03 per cent from the previous week’s closing of 42,118 points. The Bank Nifty OI declined significantly during the May F&O series with nearly 2.2 million shares and the current OI is lowest in the last three month.

© 2025 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com