Options data holds widening range

As per the latest options data on NSE after the last Friday session, the resistance level remained at 26,000CE for a second consecutive week, while the support level fell by 1,000 points to 24,000PE.

As per the latest options data on NSE after the last Friday session, the resistance level remained at 26,000CE for a second consecutive week, while the support level fell by 1,000 points to 24,000PE.

The 26,000CE has highest Call OI followed by 25,200/ 25,300/ 25,500/ 25,600/ 25,000/ 25,100/ 24,900/ 25,250/ 25,900 strikes, while 25,000/25,100/ 25,300/25,500/ 25,700/ 25,800/ 26,000/ 24,850 strikes recorded heavy addition of Call OI.

Coming to the Put side, maximum Put OI is seen at 24,000PE followed by 23,000/ 22,500/ 23,350/ 24,000/24,800/ 25,000 strikes. Further, 22,350/ 22,400/ 23,500/ 24,000/ 24,850 strikes witnessed reasonable build-up of Call OI. Put ITM strikes recorded moderate OI fall.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “In the derivatives market, Nifty highest Call Open Interest is at 25,200 and 25,000 strikes, while for Put side highest Open Interest was observed at the 24,600 and 24,500 strikes. The key level to watch this week is 25,000 zone as it previously served as support based on option data.”

Major Put writing was visible across the board with the highest Put base placed at ATM 24,000PE strike. Any decline can trigger further weakness in the Nifty in the near term. Among Call strikes, high OI is seen at 26,000CE strike which is likely to act as an immediate hurdle.

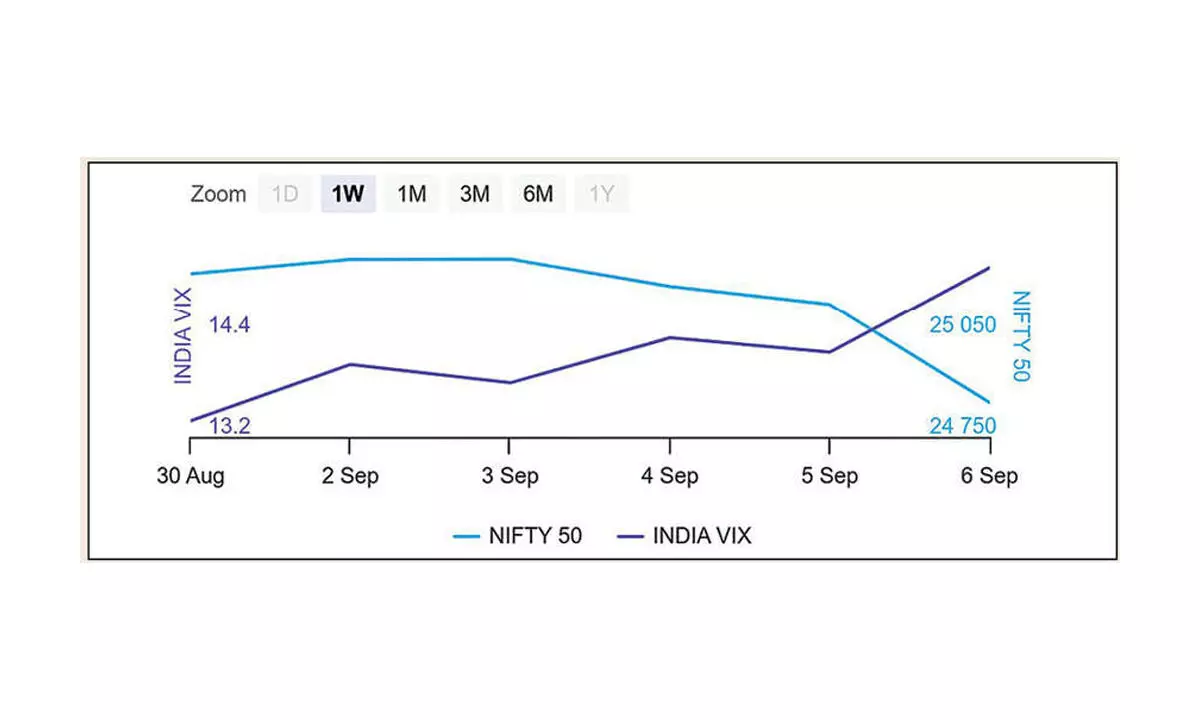

“Both the NSE Nifty and Bank Nifty indices corrected by over 1.5 per cent on a weekly basis weighed down by weak global cues. The Nifty erased all gains from the previous week, while the Bank Nifty formed a bearish engulfing pattern on its weekly charts. Major losers included PSU banks, energy, along with oil & gas stocks, whereas the financial services and FMCG sectors outperformed the market,” added Bisht.

BSE Sensex closed the week ended September 6, 2024, at 81,183.93 points, a net loss of 1,181.84 points or 1.43 per cent, from the previous week’s (August 30) closing of 82,365.77 points. For the week, NSE Nifty also fell by 383.4 points or 1.51 per cent to 24,852.5 from 25,235.90 points a week ago.

Bisht forecasts: “Traders are advised to remain on cautious note as selling pressure is likely to continue in upcoming sessions as well with Nifty seen breaching its crucial support level of 25k mark.”