Options data signals lack of direction

The key support level fell by 2,000 points to 23,000PE and resistance level rose by 2,000 points to 25,000CE

The key support level fell by 2,000 points to 23,000PE and resistance level rose by 2,000 points to 25,000CE. The 25,000CE has highest Call OI followed by 25,500/ 26,000/ 25,300/ 25,200/ 24,850/ 24,950/ 25,100 strikes, while 25,500/ 26,000/ 25,300/ 25,200/ 25,000/24,900/ 24,850 strikes recorded heavy build-up of Call OI. Drop in Call OI is visible at ITM strikes from 24,400CE onwards.

Coming to the Put side, maximum Put OI is seen at 23,000PE followed by 23,500/ 24,000/ 23,900/ 23,800/ 23,700/ 23,600/ 23,400/ 23,300/ 23,200/ 23,100/ 22,900 strikes. Further, 24,000/ 23,900/ 23,800/ 23,600/ 23,500/ 23,400/ 23,300 strikes witnessed reasonable to heavy addition of Put OI. Select deep Put OTM strikes recorded marginal OI fall.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “In the derivatives market, Nifty options indicated the significant Call Open Interest at the 25,000 and 24,900 strikes, while the substantial Put Open Interest observed at the 24,500 and 24,400 strikes.”

“Reflecting the broader market bounce, the IT sector was the top performer last week, with consumer durables and realty sectors also performing well. NSE Nifty closed above the 24,500 level, driven by a sharp rebound on Friday, although it saw only small gain for the week. Conversely, profit booking was seen in PSU banks, media, and financial services stocks,” added Bisht.

BSE Sensex closed the week ended August 16, 2024, at 80,436.84 points, a net recovery of 730.93 points or 0.91 per cent, from the previous week’s (August 9) closing of 79,705.91 points. For the week, NSE Nifty also rose by 173.65 points or 0.71 per cent to 24,541.15 points from 24,367.50 points a week ago.

Bisht forecasts: “The Nifty’s strong support zone is between 24,200 and 24,100, while resistance is expected around 24,800 to 24,900 levels. Traders are advised to adopt a buy on dip strategy, provided the support level holds.”

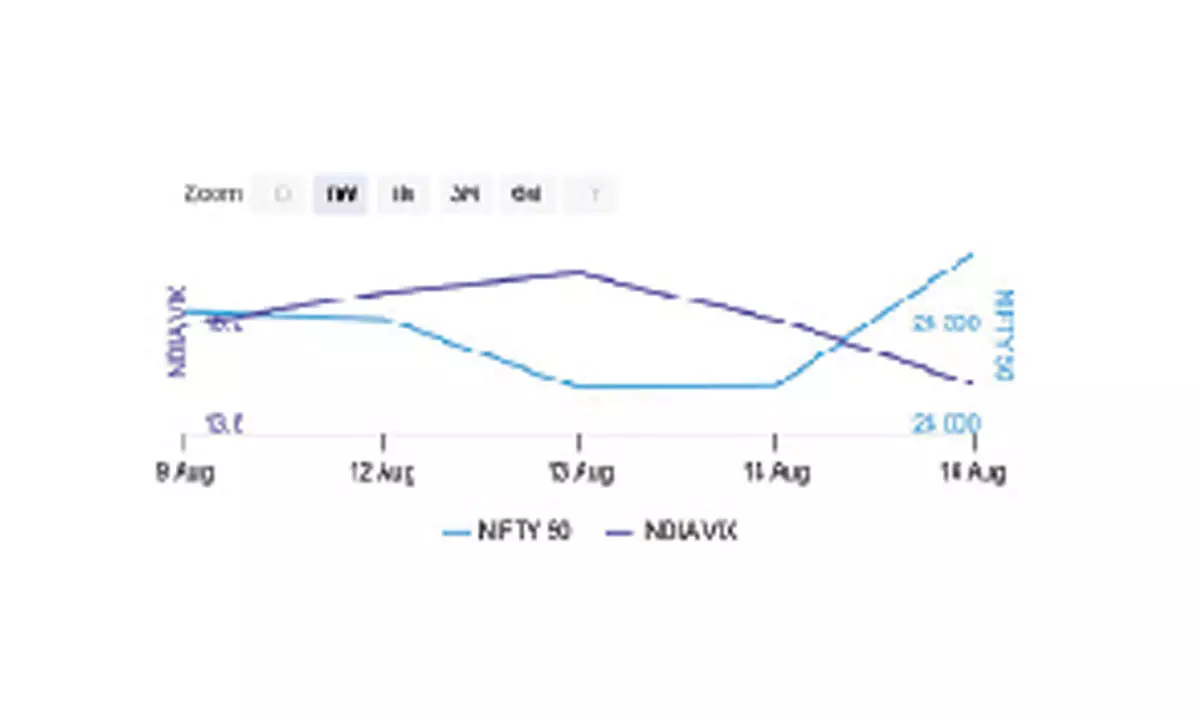

India VIX fell 6.69 per cent to 14.40 level on last Friday.

“Implied Volatility for Nifty’s Call options settled at 14.20 per cent, while Put options concluded at 15.03 per cent. The India VIX, a key market volatility indicator, closed the week at 15.44 per cent. The Put-Call Ratio of Open Interest stood at 1.19 for the week,” observed Bisht.