Live

- Kancha Gachibowli land: Activists launch campaign to preserve urban lung space

- GHMC proposes euthanasia for aggressive strays

- Over 6 lakh Olive Ridleys turn up at Gahirmatha

- Two women journos held for ‘defaming’ CM

- 25 lakh ‘Lakhpati Didis’ in next 5 years: Patra

- Villagers come together against illegal mining

- NALCO holds Customers’ Meet

- Notorious criminal injured in encounter

- Food safety officials inspect mangoes at Mozamjahi mkt

- Oppn seeks withdrawal of Bahinipati’s suspension

Options OI bases point to wider range trading

The 22,500CE has highest Call OI followed by 23,000/ 22,300/ 21,800/ 21,700/ 22,000/ 21,900/ 22,100/ 22,400/ 22,100 strikes, while 23,000/ 21,800/ 21,700/ 22,500/ 23,300/ 21,800 strikes witnessed heavy build-up of Call OI.

The 22,500CE has highest Call OI followed by 23,000/ 22,300/ 21,800/ 21,700/ 22,000/ 21,900/ 22,100/ 22,400/ 22,100 strikes, while 23,000/ 21,800/ 21,700/ 22,500/ 23,300/ 21,800 strikes witnessed heavy build-up of Call OI.

Coming to the Put side, maximum Put OI is seen at 21,000 followed by 21,500/ 21,700/ 20,800/ 20.900/ 21,800/ 21,100/ 20,900 strikes. Further, 21,000/ 21,500/ 20,600/ 20,800/ 21,700 strikes recorded moderate to reasonable addition of Put OI.

Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “In the Nifty options segment, the highest Call Open Interest is at the strikes of 21,700 and 21,800 whereas on the Put side, the highest Open Interest is at the 21,500 strike, which was tested last week.”

According to ICICIdirect.com, the current OI comprising 1.29 crore shares in Nifty is at a 3-year high. The recent up move has put Call writers on the block and positions were moved to OTM strikes towards 22,000 and 22,500. Despite significant writing at ATM and OTM Call strikes on Friday, major Put bases are not breached, one should remain positive. During the last couple of weeks, Put writers continued to strengthen the base. The 21,500 holds noteworthy OI this week.

“Nifty and Bank Nifty closed flat, and profit-booking followed after reaching all-time highs, which sums up the current market action. This correction reflects cautious market attitude and follows a prolonged upward trend. In the last week, real estate, media and pharma were major gainers whereas, profit booking was noted in the auto, metal and IT stocks,” added Bisht.

BSE Sensex closed the week ended January 5, 2024, at 72,026.15, a net loss of 214.11 points or 0.29 per cent, from the previous week’s (December 29, 2023) closing of 72,240.26 points. During the week, NSE Nifty too ended flat on negative note 20.06 points or 0.09 per cent lower at 21,710.80 points from 21,731.40 points a week ago.

Bisht forecasts: “In upcoming week, Nifty is likely to trade in the range of 21,500 to 21,800 and either side breakout can give further direction to the

market.”

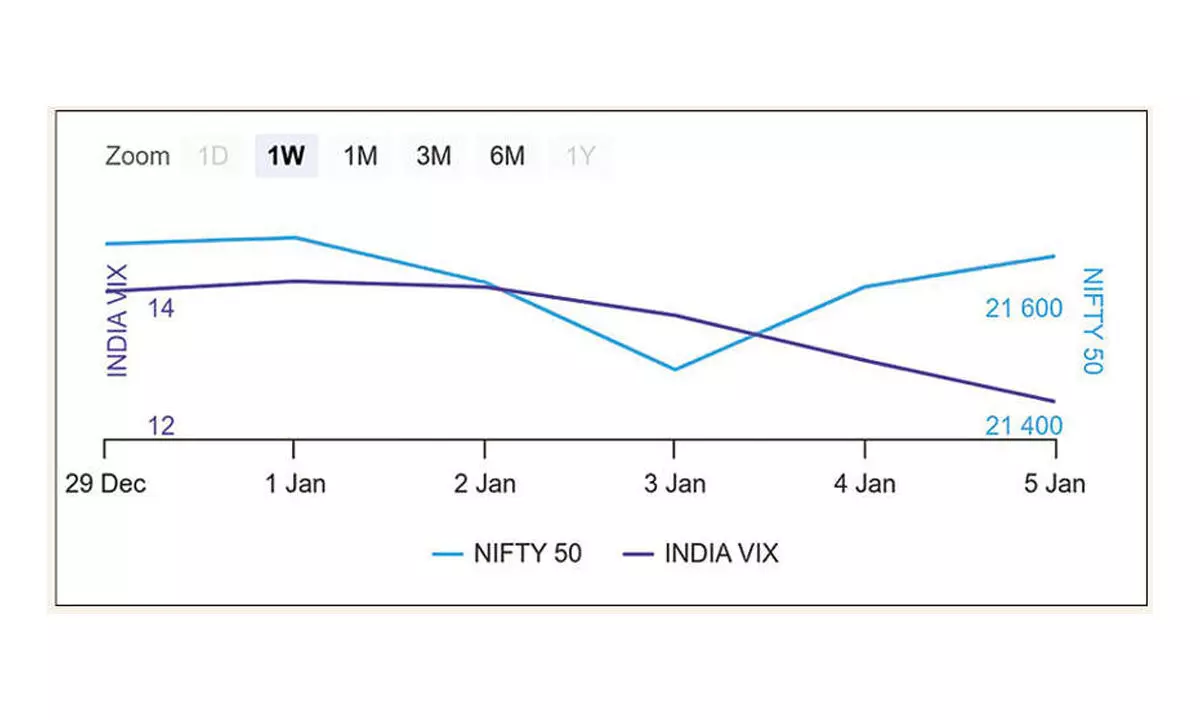

On the volatility front, India VIX fell 5.25 per cent to 12.63 level, its highest level in over six months on the back of closure among the Call writers’ positions.

“Implied Volatility (IV) for Nifty’s Call options settled at 12.22 per cent, while Put options concluded at 13.37 per cent. The India VIX, a key indicator of market volatility, concluded the week at 13.33 per cent. The Put-Call Ratio of Open Interest stood at 1.55 for the week. Following a decline in indices, the India VIX, began to decline. After peaking at 16.47, the volatility index closed at 12.63,” said Bisht. While the market remains in an uptrend, such a sharp rise in volatility ahead of result seasons suggest one should be cautious in highly leveraged stocks. Index may induce some profit booking in the coming sessions. Hence, we advise to hold long positions above 21,400 level.

As per data from ICICIdirect.com, FIIs booked profit in index futures as they sold index futures worth Rs1,800 crore. However, the focus shifted to stocks where FIIs bought over Rs9,500 crore during the last week. FIIs were aggressive in taking longs in the stock futures segment and they are net long of 3,50,000 contracts which is 18 months high. Given the aggressive long positions, downsides should be limited this week as well.

Bank Nifty

NSE’s banking index closed the week at 48,159 points, lower by 133.25 points or 0.27 per cent from the previous week’s closing of 48,292.25 points. “For Bank Nifty, the highest Call Open Interest is at the 48,500 strike, while the highest Put Open Interest is at the 48,000 strike,” remarked Bisht.

© 2025 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com