PL Stock Report - Kansai Nerolac Paints (KNPL IN) - Q2FY24 Result Update - 2H24 positive; Grasim's entry key to re-rating - ACCUMULATE

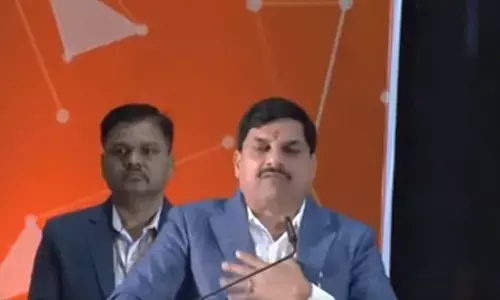

Kansai Nerolac Paints (KNPL IN) – Amnish Aggarwal – Head of Research, Prabhudas Lilladher Pvt Ltd

Kansai Nerolac Paints (KNPL IN) – Amnish Aggarwal – Head of Research, Prabhudas Lilladher Pvt Ltd

Rating: ACCUMULATE | CMP: Rs306 | TP: Rs351

Q2FY24 Result Update – 2H24 positive; Grasim’s entry key to re-rating

Quick Pointers:

§ Volume grew 1.7% YoY, decorative volumes declined 1.5% & Industrial paints volumes expanded 6% led by automotive and other industrial segments.

§ Festival season led decorative demand and strong auto demand can enable double digit volume growth in 2H24.

Kansai has given positive growth outlook in 2H24 led by festival demand in decorative paints and revival of demand from 2W even as PV’s and CV are expected to maintain strong growth. kansai is making right moves by sustained innovation in decorative, focus on projects, new products in EV, Premium Appliances, New ancillary products, Alloy wheels and Railways. New products are 10% of sales while new businesses are 7% of sales.

2H outlook on both sales and profits looks positive, although volatility in crude and inputs is a key determinant. With Grasim expected to enter decorative paints in 4Q24, the change in competitive landscape and industry pricing would be a key factor to watch out for. We estimate 422bps EBITDA margin expansion over FY23-26 and 28bps over FY24-26. While we estimate 57% PAT growth in FY24, FY24-26 CAGR is expected to be 13.3%. retain accumulate with target price of Rs351. Increasing competition from Grasim/JSW and JK Cement remains a key risk to our call.

Revenues up 1.7%; Volume grew by 1.7% YoY: Revenues grew by 1.7% YoY to Rs18.5bn (PLe: Rs19.6bn). Gross margins expanded by 707bps YoY to 35.7% (Ple: 35.7%). EBITDA grew by 36.8% YoY to Rs2.7bn (PLe:Rs2.99bn); Margins expanded by 375bps YoY to 14.6% (PLe:15.3%). Adjusted PAT grew 53.4% YoY to Rs1.8bn (PLe:Rs2bn). Decorative demand was impacted in July and due to late festivals while Auto segment had good demand from PV and CV but Tractors and 2W dragged growth, power coating was sluggish.

Concall Highlights: 1) Rural demand is seeing pressure amid adverse rainfall, however urban demand remains resilient. 2) Industrial business is witnessing decent growth led by growth in performance coating & Automotive segment, however subdued demand in decorative business pulled the growth in downward direction 3) Project business is seeing good traction with opportunity to penetrate into more markets, It has increased presence to 75+ towns in Q2. 4) Paint service business is good traction and has increased its silence to more than 150 cities 5) Contribution of premium product increased in Q2 led by better product mix 6) RM basket remains stable, however geopolitical crisis could impact crude oil prices going ahead 7) No price cuts in decorative/industrial business 8) Ad spend increased by 20% in Q2 in order to market new launches 8)Network expansion saw double digit growth in Q2 9) Q3 & Q4 is expected to have better demand scenario compared to 1HFY24 ahead of robust festive & wedding season 10) New business is seeing good traction with contribution of 8%-9% in Q2.