PNB eyes 12% biz growth in Hyderabad Zone

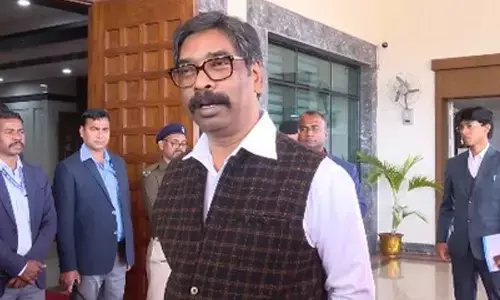

Ashutosh Choudhury, Zonal Manager, Hyderabad Zone, PNB

- Hyd ZM Choudhury confident of achieving the growth target this fiscal year

Hyderabad: Punjab National Bank (PNB), the country's second largest public sector bank, is eyeing 12 per cent business growth this financial year in the newly created Hyderabad Zone which handles the bank's operations in Telangana, Andhra Pradesh and Karnataka.

"We have set a target to achieve 12 per cent business growth in this financial year. We are hopeful of achieving it," Ashutosh Choudhury, Zonal Manager, Hyderabad Zone, PNB, told The Hans India. According to him, though there was no growth during April-June period (first quarter) due to Covid, but bank witnessed traction in the second quarter, clocking 5-6 per cent upswing in credit business. In Hyderabad Zone, the bank is focusing on home, auto and education loans. "Our bank registered very good growth in vehicle loan portfolio in October as there was lot of demand. Home loans will also pick up once registrations begin in Telangana," he explained.

As Hyderabad is a hub for the pharmaceutical sector, the bank is eyeing this key sector as well. "We are also expecting good credit offtake from medical and healthcare sector, especially in the mid category. We tied up with several hospitals in Hyderabad. We will also focus on this segment in Bengaluru and Visakhapatnam," he said.

On bank's growth plans in the next financial year, he said it would depend on the performance in current and next quarter. "Given the challenging environment now, it's very difficult to predict the growth in the next financial year,"he maintained.

PNB created Hyderabad Zone to strengthen its operations in the three key States in South India in which it gained substantial presence post the merger of the Oriental Bank of Commerce and United Bank of India with it. Prior to the merger, the bank had only Chennai Zone which looked after its operations in five Southern States.

"The establishment of new Hyderabad Zone is expected to drive higher growth in the three States. That's the reason why we have opened the new zone. The bank will definitely see more growth and more quality growth. We will also acquire more customers," he said.

The bank has 448 branches in three States, with Telangana accounting for 141 branches. It operates 125 branches in Andhra Pradesh and over 160 in Karnataka. Its network includes two large corporate branches.

"We undertook organisational restructuring post the amalgamation which took place on April 1 this year. Under this, we established PNB Loan Points (PLPs) for the marketing of our loan products. loan processing, disbursement, collections," he said, adding that PLPs handle loans from Rs 10 lakh to Rs 1 crore.

PNB's total business in Hyderabad Zone stood at Rs 76,000 crore by the end of September. Excluding large corporate business, the bank's business was Rs 51,500 crore with credit accounting for Rs 25,500 crore. "We have a fair mix of credit. Retail credit represents 20 per cent of our total credit while agriculture accounts for 10 per cent. The rest is MSME sector," he said. Asked whether there was any rationalization in the branches post the merger, he said rationalization was undertaken in two ways. "Where two branches are nearby, we merged them into one. At the same time, we used the license to open a branch where there is business potential. As consequence, the number of branches has not come down", hesaid.

He mentioned that there was no spike in non-performing assets (NPAs) in Hyderabad Zone. "Recovery is really good in the zone. Our current NPAs are lower than those in March quarter", he added