Range-bound trading on positive bias

The latest options data is signaling narrowing down of trading range though heavy build-up of Open Interest (OI) on both the Call and Put sides. The support level rose 1,250 points to 23,500PE, while resistance level eased by 1,450 points to 23,550CE

The latest options data is signaling narrowing down of trading range though heavy build-up of Open Interest (OI) on both the Call and Put sides. The support level rose 1,250 points to 23,500PE, while resistance level eased by 1,450 points to 23,550CE. Implied Volatility (IV) declined significantly to below 2 level indicating more stability or consolidation at this level. However, heavy addition of OI indicates that the market is gaining steam. The 23,550CE has highest Call OI followed by 23,600/ 24,200/ 24,500/ 24,000/ 23,700/ 23,800 strikes, while 23,550/ 23,600/ 23,400 strikes recorded hefty build-up of Call OI. However, 24,000/ 22,800/ 24,100/ 24,200/ 25,000/ 26,900 and several OTM strikes recorded heavy fall in Call OI. Particularly, heavy fall is visible at the 26,000/ 26,800/ 26,900 Call strikes. Coming to the Put side, maximum Put OI is seen at 23,500PE followed by 23,550/ 23,000/ 23,100/ 23,400/ 23,450/ 21,800/ 22,250 strikes. Further, 23,500/ 23,650/ 21,800/ 23,100/ 22,900 strikes recorded heavy addition of Put OI. Select Put ITM strikes and all OTM strikes witnessed offloading of Put OI. Nifty OI rose heavily including major fresh short positions at select strikes. FII net shorts have increased to nearly 1.8 lakh contracts, retail participants increased their long bias and hold nearly 2.4 lakh net long positions. A move above 24,500 may trigger a short covering move.

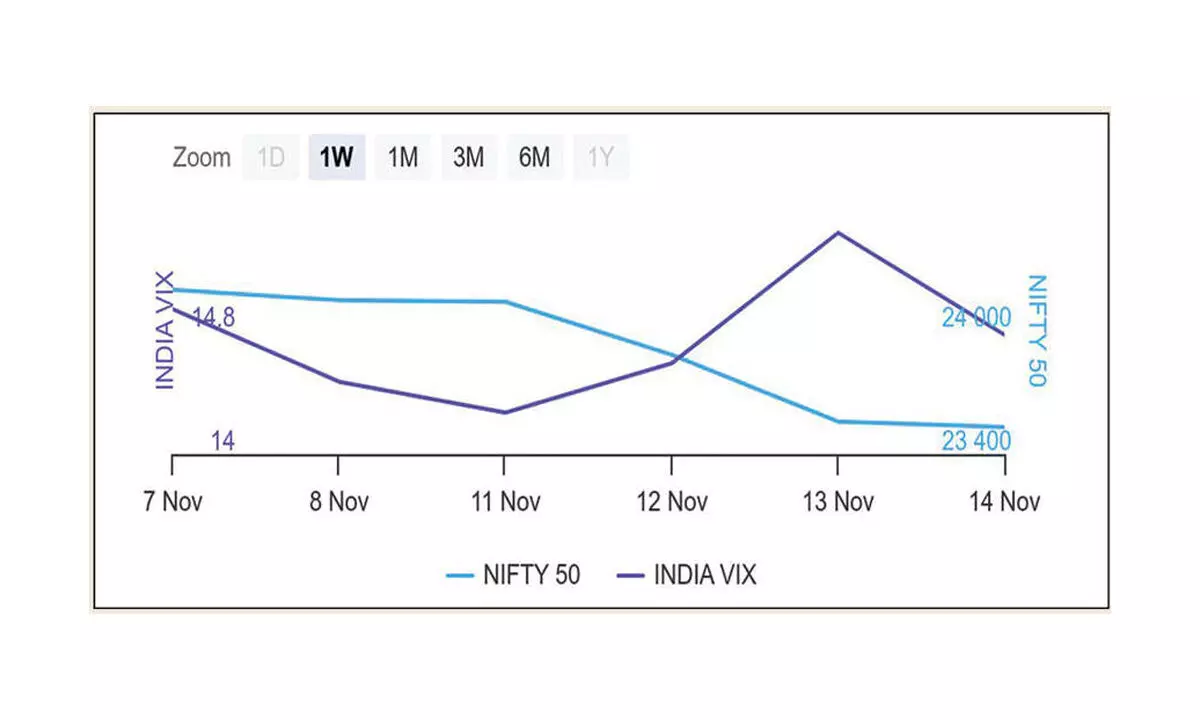

BSE Sensex closed the week ended November 14, 2024, at 77,580.31 points, a net fall of 1,906.01 points or 2.39 per cent, from the previous week’s (November 8) closing of 79,486.32 points. For the week, NSE Nifty also moved down by 615.50 points or 2.54 per cent to 23,532.70 points from 24,148.20 points a week ago.