Live

- PM Modi highlights govt's efforts to make Odisha prosperous and one of the fastest-growing states

- Hezbollah fires 200 rockets at northern, central Israel, injuring eight

- Allu Arjun's Family Appearance on Unstoppable with NBK Breaks Viewership Records

- Unity of hearts & minds essential for peace & progress, says J&K Lt Governor

- IPL 2025 Auction: I deserve Rs 18 cr price, says Chahal on being acquired by Punjab Kings

- EAM Jaishankar inaugurates new premises of Indian embassy in Rome

- Sailing vessel INSV Tarini embarks on second leg of expedition to New Zealand

- Over 15,000 people affected by rain-related disasters in Sri Lanka

- IPL 2025 Auction: RCB acquire Hazlewood for Rs 12.50 cr; Gujarat Titans bag Prasidh Krishna at Rs 9.5 crore

- Maharashtra result reflects the outcome of Congress' destructive politics: BJP's Shazia Ilmi

Just In

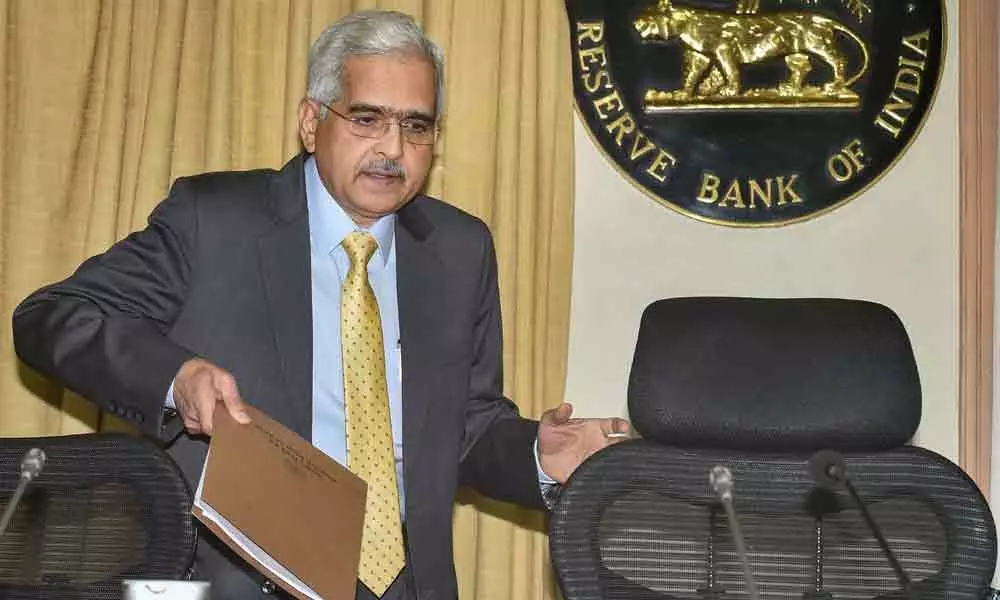

RBI keeps key interest rates unchanged

The Reserve Bank on Thursday expectedly kept interest rates unchanged amid uncertain inflation outlook but left the door open for more easing in future even as it took steps to spur credit growth in an economy facing its worst slowdown in more than a decade.

Mumbai: The Reserve Bank on Thursday expectedly kept interest rates unchanged amid uncertain inflation outlook but left the door open for more easing in future even as it took steps to spur credit growth in an economy facing its worst slowdown in more than a decade.

With all six members of the RBI Governor Shaktikanta Das-led Monetary Policy Committee voting unanimously, the repurchase or repo rate was maintained at 5.15 per cent while retaining its accommodative stance.

With food prices driving retail inflation to a more than five-year high of 7.35 per cent in December, the central bank raised its inflation projection for the six months to September to 5-5.4 per cent from 3.8-4 per cent previously while terming the outlook on price rise as "highly uncertain". The RBI cut its policy rate by 135 basis points over five straight meetings last year, before hitting the pause button in December on inflationary concerns. The RBI stuck to its prediction of 5 per cent GDP growth in the current fiscal - the lowest in 11 years but lowered its growth forecast for the first half of the coming financial year to 5.5-6 per cent from its December projection of 5.9-6.3 per cent.

For the full 2020-21 fiscal, it put the GDP growth at 6 per cent, which is at the lower end of the 6-6.5 per cent expansion projected by the government's Economic Survey. To boost credit growth, it scrapped the mandatory requirement for banks to set aside cash of 4 per cent for every new loan extended to retail automobiles, residential housing, and small businesses till July 2020.

Also, in a major relief to the real estate sector, the RBI extended the restructuring of project loans by a year. Loans for projects that have been delayed for reasons beyond the control of their promoters have been extended by another one year without downgrading the asset classification.

This aligns with the treatment accorded to other project loans for the non-infrastructure sector. The move will bring much-needed relief to the cash-starved real estate sector.

At a news conference, Das said while the pause decision may be on expected lines, the RBI has several instruments up its sleeves, hinting at the use of unconventional tools such as the ones used by the US after the global financial crisis in 2008 to boost growth as rate cuts were not effective enough.

"It has to be kept in mind that the central bank has several instruments at its command that it can deploy to address the challenges the Indian economy faces in terms of sluggishness in growth momentum," he said.

The MPC said that while easing global trade tensions should encourage exports and spur new investment, the outbreak of the new coronavirus may impact tourist arrivals and global trade. "Downside risks to global growth have increased in the context of the outbreak of coronavirus, the full effects of which are still uncertain and unfolding," Das said.

Inflation projection raised to 6.5%

Mumbai: The Reserve Bank of India has raised upwards its retail inflation projection for the last quarter of the current fiscal to 6.5 per cent on increase in prices of milk, pulses amid volatile crude oil prices and termed the overall outlook on price rise as "highly uncertain".

Going forward, the inflation outlook is likely to be influenced by several factors like food inflation, crude prices and input costs for services, RBI said.

On food inflation, RBI said it is likely to soften from the high levels registered in December and the decline is expected to become more pronounced during the fourth quarter of this fiscal as onion prices ease following arrivals of late kharif and rabi harvests, the Reserve Bank of India (RBI) said in its last bi-monthly monetary policy revealed on Thursday.

Bankers hail liquidity boosting policy measures

Mumbai: Bankers and analysts were positively surprised with the slew of liquidity-enabling measures announced in an otherwise expected RBI monetary policy that left the key rates unchanged at 5.15 per cent.

The market has taken the long-term repos worth Rs 1 lakh crore as the biggest developmental and regulatory step that came out of the blue, they said.

So is the CRR buffer benefits for lending to the growth-oriented sectors such as to housing, auto and small units. The Reserve Bank announced long-term repurchase agreements (repos) of one-year and three-year tenors of appropriate sizes, totalling Rs 1 lakh crore at the policy repo rate, from the fortnight beginning on February 15.

Bankers and analysts are unanimous that these measures would infuse liquidity on one hand and ensure cheaper credit flow to the needy segments of the economy.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com