Live

- Veer crowned PGTI Ranking champion, Shaurya wins emerging player honour

- Sr National Badminton: Unseeded Rounak Chauhan, Adarshini Shri reach singles semis

- Punjab seeks central assistance to strengthen security in areas adjoining Pakistan

- Malaysian national held from Tamil Nadu for cyber fraud of Rs 2.81 crore

- Child marriage will be eradicated by 2026: Assam CM

- PMK President Anbumani Ramadoss urges TN government to act against online gambling

- From defence to culture and sports, India and Kuwait sign key agreements during PM Modi's visit

- Mahakumbh 2025: 110 mist blower machines and 107 fogging units to keep Akharas insect-free

- Piyush Goyal participates in Mahila Shakti Shivir event, calls Bima Sakhi Yojana 'a revolutionary initiative'

- Death toll from Cyclone Chido in Mozambique rises to 94

Just In

REITs thrived while other asset classes bear negative returns

The last one year has been a turbulent year for investing. All asset classes including bonds have seen volatility and negative returns.

The last one year has been a turbulent year for investing. All asset classes including bonds have seen volatility and negative returns. Though, the larger indices have managed to pull up some recovery in the last part of the year, most of the investment returns have been turbulent.

Amid all this, REIT (Real Estate Investment Trust) have stood out resilient, though not high generation of return but remained an island of positive returns among the asset classes. Of course, during the latter part as the RBI (Reserve Bank of India) began to increase interest rates, did the fixed deposits (FDs) have taken part of the sheen off them.

Traditionally, Indians have exposure to real estate through agricultural land, plots, residential houses and/or flats. Very few have exposure to commercial property and that too in cities especially in malls, office buildings, etc. This is due to the exorbitant and at times prohibitive cost of acquisition that shuns retail investors to gain exposure into such real assets.

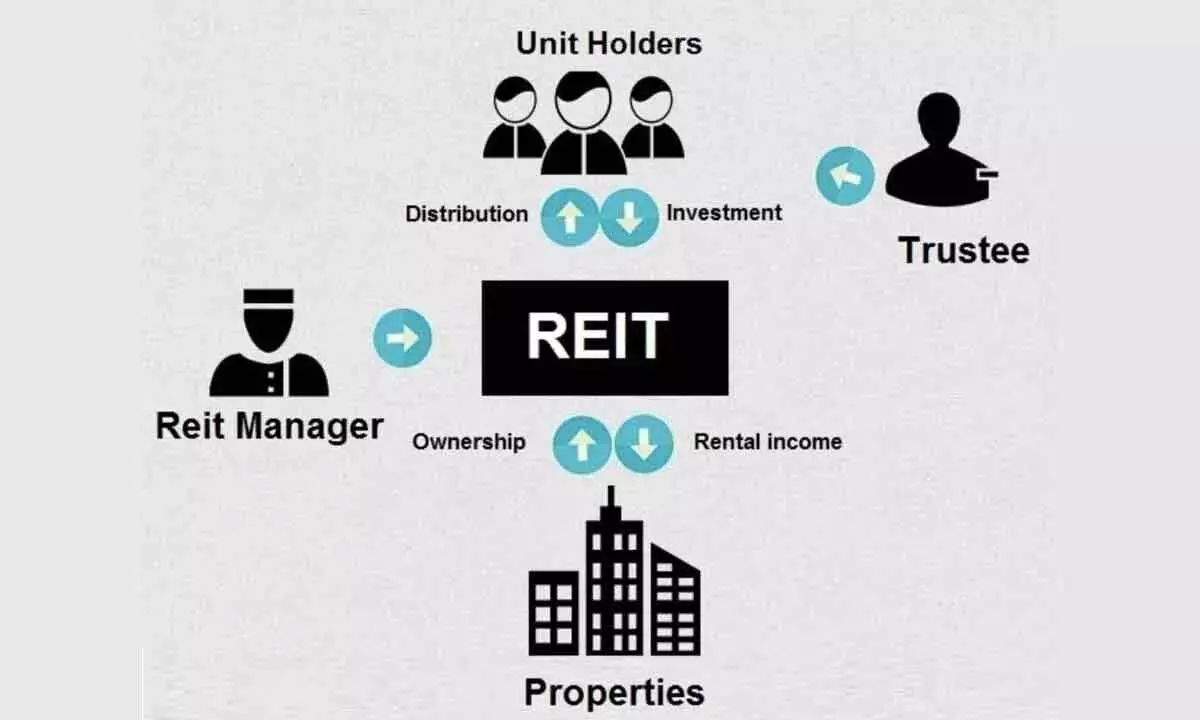

The REIT is an investment vehicle that comprises of real estate assets mostly commercial that generate income to the investors. They could crudely be compared to a mutual fund where investors money is pooled by managers with underlying asset to be real estate to generate both income and profit from capital appreciation. These help even retail investors to participate in the commercial real assets by contributing smaller amounts where units (like the MF) are allocated depending upon the NAV (Net Asset Value) of the REIT.

Though the regulations were released by Securities Exchange Board of India (SEBI) in 2007, the first REIT was launched in India in 2019 and now has three listed funds.

The REIT is sponsored by a sponsor who's also the major shareholder of the REIT. A trustee who acts on behalf of the unitholders (investors) is appointed to serve the beneficiaries ie, the investor or unitholders. A REIT manager, the fund manager or asset manager is responsible for the acquisition of new properties for the fund. A project manager is appointed by the REIT manager to foresee the day-to-day operations of the property. SEBI regulations require REITs to hold at least 80 per cent of the assets be in completed and/or income-generating. It also requires payout of 90 per cent of the distributable cash to unitholders. The sponsor is obliged to hold certain units of the REIT & remaining are issued to investors in the form of an IPO. Once listed, they serve as a permanent vehicle to raise debt and equity in the capital markets to acquire new assets.

The key features that differentiate the REIT versus a traditional real estate investment are as follows. REIT offers great diversification for the investors where they could get an exposure to a basket of properties covering across different types ie, residential, commercial, etc. It's always difficult to sell a property, at least, at the price and time one wants. REITs, however, offer better liquidity as investors get an option to make exits at the available NAV.

The advantages include investors to not scout for a suitable or opportunistic asset, a professional team takes care of it. Thus they also reduce the costs and efforts to be put in by investors. This also thus brings out the transparency which is mostly missing in a traditional real estate investment. Moreover, they offer a non-correlated option of investment from that of the other asset classes.

The taxation is a bit complicated as it involves interest income, dividends and capital gains. Sale of units attract capital gains and are subjected to short or long-term capital gains depending upon the tenure of investment held. Sale of units held for less than one year are treated as short-term capital gains and attract 15 per cent taxation while that of the units held for more than three years are treated as long-term to be taxed at 10 per cent if the gains exceed 1 lakh in a financial year. interest from REIT is treated as income at the hands of the unitholder and is accordingly taxed. Dividend from REIT is again differentiated by the status of the REIT. If the fund is under Special Tax Concession Status, the dividend is considered as income at the hands of the unitholders to be taxed as per the slab. If not, such dividend is non-taxable. While investing in REITs, investors are better off taking these aspects into consideration. A pertinent issue with any commercial property is the vacancy. So, investor should look for the weighted average lease expiry of the fund when shortlisting a fund. This is the time left for the tenant to renew the lease or time for the property to go vacant. It's usually measured in years and the higher the better. Another metric that's complementary is the occupancy rate which gives the information on the consistency of the future cash flows. Here too, the higher the better.

(The author is a co-founder of Wealocty, a wealth management firm and could be reached at [email protected])

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com