Live

- CM Chandrababu Naidu to Attend Christmas Celebrations in Amaravati Today

- CM Revanth to Review Projects with Senior Officials Today

- Fix Ozone Layer Depletion

- Harish Rao to Visit Medak Today for Centenary Celebrations

- Irregularities in TUDA under vigilance scanner

- ‘Pushpa-2’ row: Celebs & politicos fail to act fairly

- Learn from fighting spirit of women bravehearts: VHP VP

- BJP MP Arvind, MLA Sanjay Kumar meet CM Revanth

- Rapido partners with L&TMRHL to provide discounted rates

- Kisan Diwas 2024: A Day Dedicated to honor our Farmers.

Just In

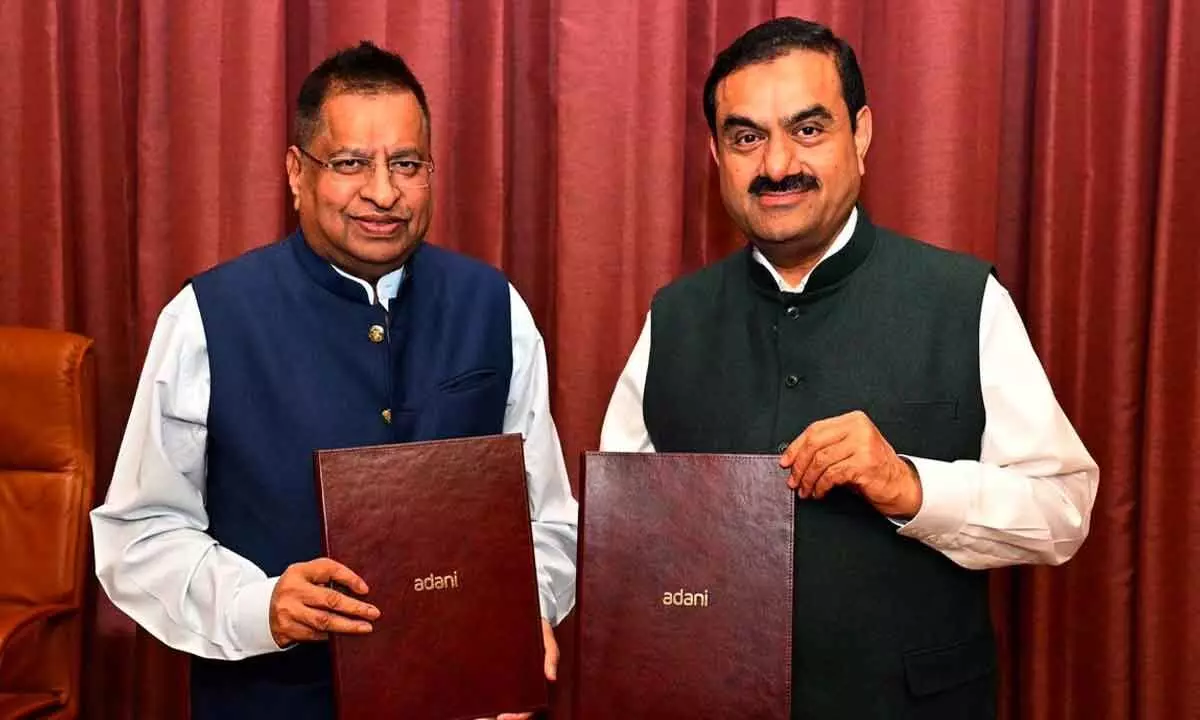

Adani Group firm Ambuja Cements acquires 56.74% in Hyd-based entity; The deal puts enterprise value of SIL at `5,000cr;

By joining hands with SIL, Ambuja is poised to expand its market presence, strengthen its product portfolio, and reinforce its position as a leader in the construction materials sector. With this acquisition, Adani Group is well on course to achieve its target of 140 MTPA of cement manufacturing capacity by 2028 ahead of time - Gautam Adani, Chairman, Adani Group

New Delhi: Gautam Adani-owned Ambuja Cements Ltd on Thursday announced the acquisition of a majority stake in Sanghi Industries at an enterprise value of Rs5,000 crore, in a first major deal since Adani Group was rocked by allegations of financial misconduct by Hindenburg Research. Ambuja Cements, a part of Adani Cement Ltd (ACL), will buy a 56.74 per cent stake in Sanghi Industries Ltd (SIL) from its existing promoter group - Ravi Sanghi & family. The acquisition will be fully funded through internal accruals, said a statement from Ambuja Cements. Besides, it would make an offer to acquire another 26 per cent or 6.71 crore equity shares from SIL’s public shareholders.

“The open offer would be at a consideration of up to Rs114.22 per sale share,” it said.

Adani Group will spend Rs767.15 crore for acquiring 26 per cent share from open market. The company expects the acquisition to be completed within 3-4 months, however, it will be subject to approval from the Competition Commission of India (CCI). If the open offer is fully subscribed, Ambuja Cements will own 82.74 per cent in SIL, the cement maker, which also owns a captive port capacity at Sanghipuram in Kutch district of Gujarat.

Commenting on the development, Adani Group Chairman Gautam Adani said: “This landmark acquisition is a significant step forward in Ambuja Cements’ accelerating growth journey.By joining hands with SIL, Ambuja is poised to expand its market presence, strengthen its product portfolio, and reinforce its position as a leader in the construction materials sector. With this acquisition, Adani Group is well on course to achieve its target of 140 MTPA of cement manufacturing capacity by 2028 ahead of time.”

With SIL’s limestone reserves of a billion tonne, ACL will increase cement capacity at Sanghipuram to 15 MTPA in the next two years, he added. ACL will also invest in expanding the captive port at Sanghipuram to handle larger vessels.

“We will also invest in deepening and expanding the captive port capacity in order to accommodate larger vessel sizes of 8000 DWT,” said Karan Adani. Bulk terminals and grinding units will be created along the western coast to enable the movement of clinker and cement through the sea route at the lowest possible cost. “Our vision is to produce lowest cost clinker in the country at Sanghipuram and then transport this clinker as well as bulk cement through coastal roads to the markets of Saurashtra South Gujarat, Mumbai and Mumbai Metropolitan Region, Karnataka and kerala,” he said, adding "synergies with the assets of Adani ports will help us in implementation of this strategy." He further said that with the right implementation, he is very "confident" that Adani Group will be the lowest-cost supplier of cement in all of these markets.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com