Live

- EFLU hosts talk on 75 years of the Indian Constitution

- Mohan Babu: Half a Century of Cinematic Brilliance and Unwavering Legacy

- Chandrababu Vows Strict Measures for Women's Safety and Drug Control

- Deputy CM Bhatti Vikramarka Highlights Congress Government's Achievements

- PCC Expansive Meeting Held at Gandhi Bhavan in Hyderabad

- Formula 1: I didn't really want to come back after Brazilian GP, admits Hamilton

- IND vs AUS BGT 2024-25: Pat Cummins says the pressure of playing at home is there but team well prepared to beat India and win Border-Gavaskar Trophy

- Yastika Bhatia ruled out of remainder of WBBL 10 due to wrist fracture

- Telangana Assembly Sessions to be Held in the Second Week of December

- Must watch, says CM Yogi after seeing ‘The Sabarmati Report’; makes it tax-free in UP

Just In

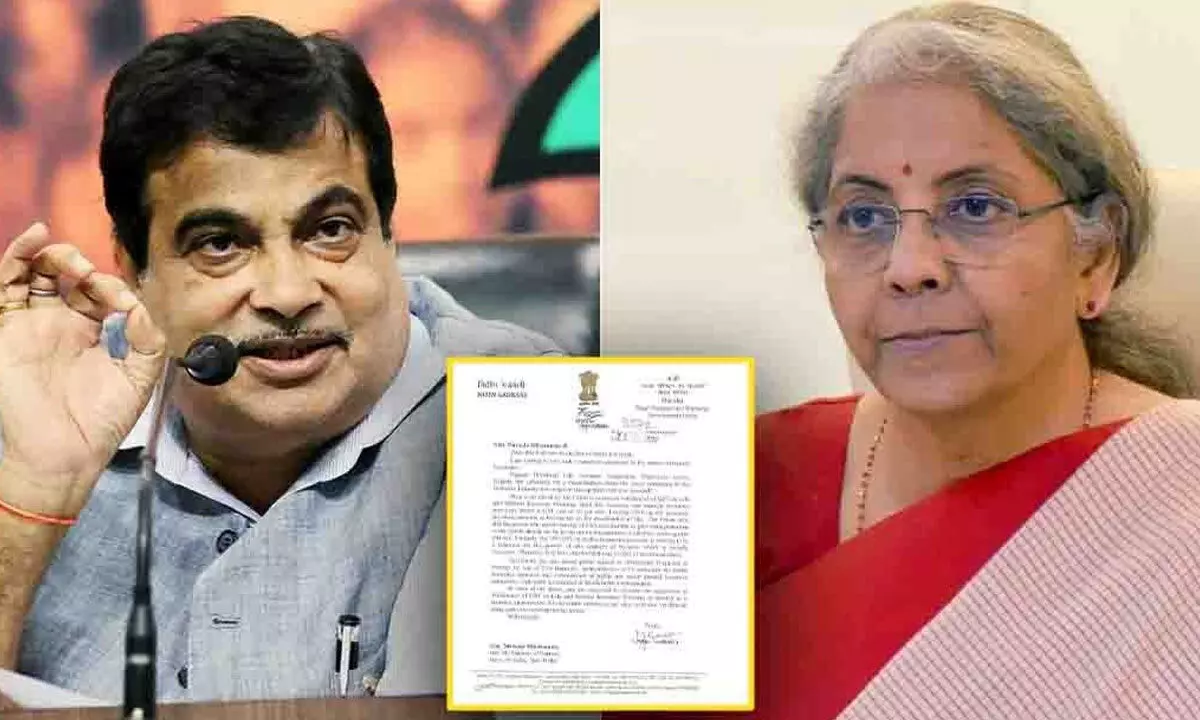

Stop levying tax on uncertainties of life

Union Minister of Road Transport and Highways Nitin Gadkari has urged Union Finance Minister Nirmala Sitharaman to consider withdrawing 18 per cent goods and services tax (GST) on life and medical insurance premiums

Union Minister of Road Transport and Highways Nitin Gadkari has urged Union Finance Minister Nirmala Sitharaman to consider withdrawing 18 per cent goods and services tax (GST) on life and medical insurance premiums. It is really a great move that should be supported by everyone, both those who buy insurance policies and those who intend to buy, and even those who sell, should back the suggestion of Gadkari.

This will help in making healthcare accessibility more affordable. When it comes to opting for appropriate cover or even minimum insurance cover, many individuals hesitate to go in for it due to high costs. Exemption from GST will reduce the cost of insurance premiums and as for the insurance business it will help them in greater penetration and draw more and more people even in tier two and three areas to get the most needed financial protection against medical emergencies. It will also give a push to the hospital inpatient and outpatient strength.

Because of the GST, the financial strain increases tremendously on the policy holders and they get disheartened and, thus, remain underinsured. Life is a fundamental right and, hence, the government needs to ensure everyone gets fully insured, and, therefore, do away with GST. It will be such a great relief for them. It can also help in reducing the strain on government-funded healthcare schemes like Ayushman Bharat and the government would be able to allocate more resources for other critical areas.

Both life insurance and medical insurance premiums attract a GST rate of 18 per cent. Levying GST on life insurance premium amounts to taxing the uncertainties of life. This certainly is not a good move. Insurance is taken by a person or a family, seeking protection from unexpected health emergencies. Levying tax on the premium to purchase cover against this risk needs to be seriously reconsidered. Similarly, the 18 per cent GST on medical insurance premium is proving to be a deterrent for the growth of this segment of business which is socially necessary.

Therefore, the letter of the Union Minister Nitin Gadkari assumes high importance and both the Prime Minister and the Union Finance Minister should look into it with all the seriousness it deserves. Just as SC and STs are happy with the Supreme Court’s decision on identifying the creamy layer, if the Union government considers the issue of removing GST on insurance schemes, it would win the hearts of crores of people more so the senior citizens.

Another pertinent issue is adequate social security for the country. The ageing population is a rising concern and health insurance and subsequent tax exemption for them is required. On the taxation front, one should understand that insurance is not like a luxury commodity, and taxing it heavily makes it difficult for people to get financially protected. We should see insurance as a necessity that everyone should be able to afford.

The Parliamentary Standing Committee on Finance has recommended that GST on health insurance, particularly for senior citizens, should be lowered. It has simultaneously pitched for a level-playing field between public and private sector insurance companies in terms of TDS on GST and participation in government-run insurance schemes.

The GST’s fitment committee also discussed the issue and had recommended that reinsurance should not be treated as supply and hence no GST should be applicable on it. All that needs now is a large-hearted PM and FM to take a call on it and decide to withdraw the GST on insurance schemes.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com