A close look at money matters

A close look at money matters

In the earlier piece we looked at the character of money as a commodity

In the earlier piece we looked at the character of money as a commodity. Now let us see what happens when it starts moving around. "Action and reaction", goes the third law of Newton, "are equal and opposite". Such has, broadly speaking, been the case of the relationship between crime and punishment in the history of mankind.

Borrowing and repayment of money are an integral part of day to day life, whether in the shape of money or the things money can be used to buy – barter or exchange, in other words. Even in the celebrated set of moral principles enshrined in "Sumathi Sathakam", in Telugu, one is advised to live in a place where a moneylender, a doctor, a flowing perennial river and a learned person are available!

The very definition of the word 'lend' conveys the meaning that the act is temporary nature and conveys the assurance that whatever has been taken will be returned. Sometimes, of course, the lender may levy a charge, as a result of which what is returned maybe slightly more in value than what was originally taken.

Clearly, such transactions are informed by the cardinal principle that something that is owed needs to be paid back at every cost. And, while the "cost of money", is a reasonable levy on the borrower, the attitude of the lender should stop short of being vengeful or bloodthirsty, as was the case of the demand made by Shylock upon Antonio in Shakespeare's Merchant of Venice.

Usurious interest rates are not uncommon in real life. Freeing the common man, especially the rural agricultural community, from the clutches of money lenders charging exorbitant interest rates, has for long been a policy objective of governments. Among the measures adopted have been encouraging, promoting and supporting formation of credit cooperatives, encouraging and granting credit his to self-help groups bringing in legislation to neutralise indebtedness etc.

From transactions of a day- to - day nature between individuals, the phenomenon of borrowing, lending and repaying extends to individuals and institutions, institutions and institutions and at the international level, between countries and countries as well as international institutions and individual countries.

We know that Vedic prescriptions created 'Varnas', or castes essentially to ensure the orderly performance of functions required by society for its smooth running. There were those who acquired knowledge and performed religious rituals, the warrior clan, meant for defence against enemies, the businessmen community, which bought and sold commodities and supplied daily requirements, apart from lending money in times of need and those who performed tasks needed to facilitate the other classes attending to their own tasks. Elsewhere in the world, races or communities specialised in commerce, trading and money lending as, for instance, the Jews in many parts of the world.

Needless to say the whole business of lending and borrowing is rooted in the qualities of trust and faith. In a famous saying, the character Polonius in William Shakespeare's 'Hamlet', counsels his son Laertes before embarking on a visit to Paris, saying "neither a borrower nor a lender be' for loan oft loses both itself and friend." We find the use of this phrase in everyday life, as it has a didactic tone with universal application. For instance, parents use this to warn their children against lending and borrowing money, because bringing debts into their personal relationships can cause resentment. Financial advisors in governmental or non-governmental sectors use it as a piece of advice to their authorities, to save the organisations from incurring excessive debt.

As far as the habit of repayment is concerned tribals have the culture of queueing up on weekly shandy days, voluntarily repaying the instalment of the loan they have taken, especially from institutions. They need little persuasion, much less pressure. And, at the other extreme, one sees the behaviour of some of the captains of industries. At the international level, one saw how the atrociously irresponsible, almost criminal, attitude of financial institutions led to the financial meltdown which nearly crippled the world economy irretrievably.

In our own country, we have seen the manner in which highflying and influential businessmen callously defaulted, taking entire banking system for a ride, and exacerbating the situation created by non-performing assets (NPAs) (which are loans or advances for which the principal or interest payment has remained overdue for a period of 90 days and more). At least on two occasions this led to recapitalisation of the unfortunate victimised banks. Needless to say, the cycle only repeated itself.

The Reserve Bank of India (RBI) assesses compliance by banks with extant prudential norms on income recognition, asset classification and provisioning (RACP) as part of its supervisory processes.

The issue of NPAs in the Indian banking sector has become the subject of much discussion and scrutiny. The Standing Committee on Finance recently released a report on the banking sector in India, where it observed that banks' capacity to lend has been severely eroded because of mounting NPAs. The Estimates Committee of Lok Sabha also examined the performance of public sector banks with respect to their burgeoning problem.

Then there is the pernicious habit of waiving loans on the part of commercial banks. Waivers have many undesirable consequences, including vitiation of the repayment climate, encouraging the habit of default, and leading to depletion of the total kitty available for lending. Not only is this dangerous practice being repeatedly resorted to but, most unfortunately, at the instance of the political masters presiding over the destinies of the governments of the day, mostly for dubious political benefit.

In any case, most of the small and marginal farmers, who constitute more than three fourths of the country's farming community, have little use for the waiver because they don't borrow at all. Studies have shown that it is the large borrowers, who have been heavily damaging the banking industry in India, by loading on them the enormous amount of NPAs, and not the small borrowers responsible for the present state of affairs.

There are many opinions on the real causes of swelling NPAs in the banking sector. The assumption in some quarters, which is currently gaining currency, is that the NPAs are bred mainly on account of sweet deals between the bankers and the large borrowers. This view has gained currency because of hot revelations of possible corruption in banks at the highest level.

The pressing need for restoring public confidence in the banking sector was noted in earlier times and resulted in the constitution of the Narasimham Committee on the Financial Sector. That Committee stressed the need for the banking sector to undertake asset classification, capital adequacy and income recognition. Concrete action on the recommendations, however, largely remaining on paper and often expressed in the form of lip service.

It was during the time that the world's economy faced an unprecedented international financial meltdown that India was able to hold its head high in the comity of nations, thanks to the manner in which the Reserve Bank of India (RBI) ran a tight ship through its mature and wise policies. In fact Dr Y V Reddy, the then Governor of the RBI was showered with encomiums by the Chairman of the Federal Bank of the United States who went to the extent of saying that, if America had had the good fortune of having a Chairman like him, the meltdown would never have taken place!

Earlier in 1991, India had come close to total financial collapse and was on the brink of defaulting in repayment to the International Monetary Fund (IMF). The situation was so bad that the country's gold reserves had to be pledged and IMF persuaded to come to India's rescue and bail it out of the crisis with a timely loan. Thereafter, thanks largely to the astute leadership of P V Narasimha Rao, the then Prime Minister of India, and the skilful and firm management of the economy by Dr Manmohan Singh, the then Finance Minister, the country was able to wriggle out of a nasty and dangerous crisis. The time has now come for taking quick and urgent action in the interest of saving the economy especially in the context of the current crisis through which the country is passing through.

Even in the celebrated set of moral principles enshrined in "Sumathi Sathakam", in Telugu, one is advised to live in a place where a moneylender, a doctor, a flowing perennial river and a learned person are available!

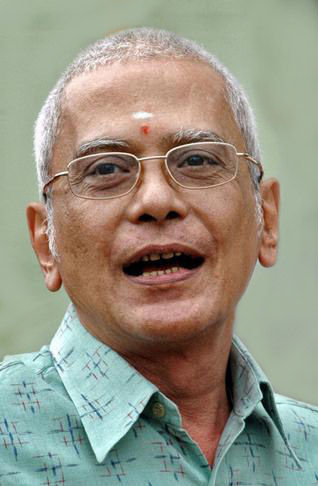

(The writer is former Chief Secretary, Government of Andhra Pradesh)