Why this race to the bottom?

The global car industry is going through a churn like never before

The globalcar industry is going through a churn like never before. The entry of the electric vehicle is set to depose the internal combustion (IC) engine, but this is also destabilising the industry giants. What will this mean for the commitment of countries to the green transition, as their crucial industry declines in the face of competition from new players in other countries?

I am speaking about China, which today dominates the electric vehicle industry – in terms of raw materials, battery technology and production of cheaper yet state-of-the art cars. China invested deliberately in e-vehicles, knowing that its industry could not ever compete with the conventional IC engine. Now, as the world takes action to combat climate change, e-vehicles are part of the change agenda. The EU has set stringent targets for CO2 emissions from cars and decreed that only zero-emissions vehicles can be sold from 2035. This would mean there can be no new petrol or diesel vehicles in the next 10 years across the EU. In the US, President Joe Biden’s government has set a goal of 50 per cent new vehicle sales to be electric by 2030. This push for greener transportation – crucial for combatting climate change – has landed the Chinese industry in a sweet spot. The question is, what will happen as the western e-vehicle industry crumbles in the face of the Chinese dominance?

The vehicle industry has traditionally been the backbone of manufacturing and jobs in many countries. According to data from the European Commission, the automotive industry provides jobs to some 13.8 million Europeans; directly employing 2.6 million people, which is 8.5 per cent of the employment in manufacturing. But this is now in jeopardy. In September, German car major Volkswagen announced that it plans to shut down two of its manufacturing plants in the country, which puts jobs at risk and has led to a political furore. The western car industry is finding it difficult to compete in terms of costs with its Chinese counterparts. European e-vehicles are still more expensive as compared to the petrol variants; and now as more countries seek to withdraw subsidies and incentives for these green vehicles, car owners get pushed to imported vehicles.

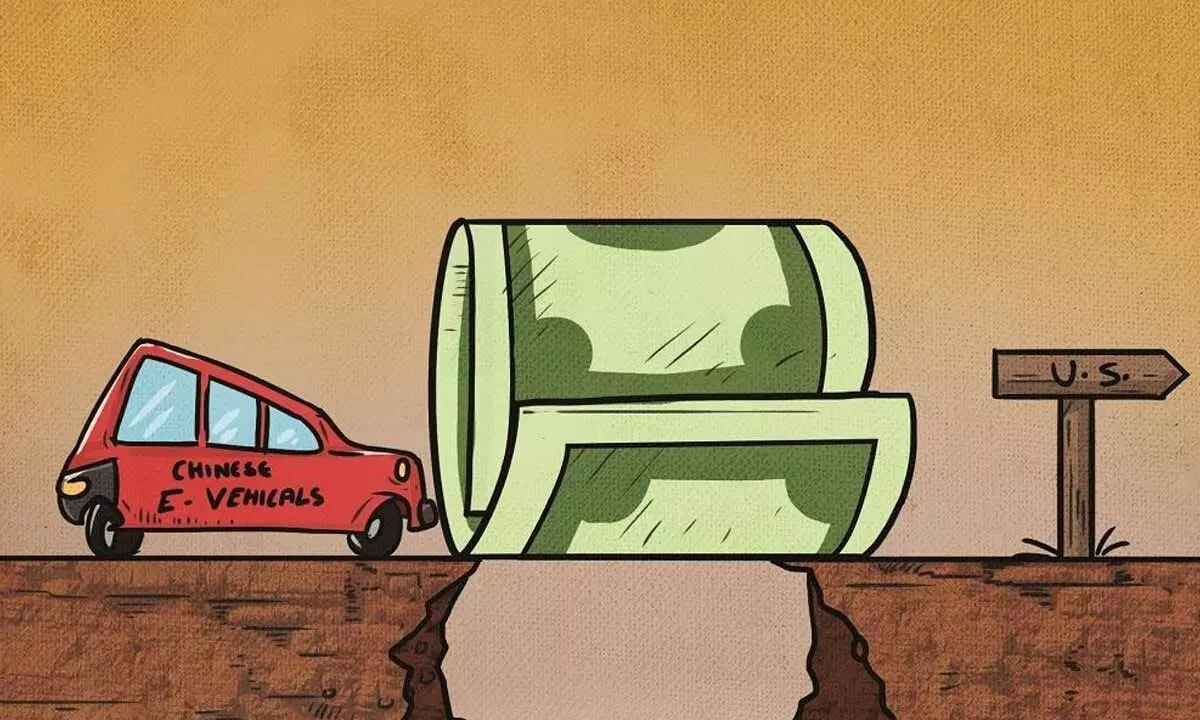

The only way then is to do what the US (and now the EU) is doing – put high import duties on Chinese-made vehicles or even components. The US has put a 100 per cent duty on Chinese e-vehicles, Canada has followed suit and now Europe is looking to increase its 10 per cent duty. In addition, the US, which provides a substantial subsidy on e-vehicles, stipulates that the vehicle will qualify for the incentive if it does not contain critical minerals or batteries supplied by a foreign entity of concern, namely China. This would mean that vehicles containing nickel from an Indonesian company with a Chinese collaborator could also be denied the subsidy—crucial for consumers to make the switch to e-vehicles.

In China, e-vehicles are taking off big time. As per official data, sales of e-vehicles overtook IC engine vehicles in July 2024—as many as 853,000 e-vehicles were sold in a single month. This is because Chinese e-vehicles are substantially cheaper and so affordable. The Chinese say the key reason for this, which is disputed by western governments, is their dominance in battery technology, critical mineral processing and low labour costs. BYD, the Chinese e-vehicle giant, is now expanding operations to Vietnam, Indonesia and Malaysia. The good news is, increased sales of e-vehicles will bring the much needed green transition at least in these countries.

But will the green mobility transition succeed in the western world, which has put restrictions on Chinese imports, fearing the collapse of its own industry? These countries are stepping up their efforts to secure supply chains—western countries and their allies (India is part of this) have created the Minerals Security Partnership to secure these minerals and promote recycling. The objective is to “friendshore” mineral extraction, processing and recycling so that these countries build the supply chain together. It is still a work in progress and much more needs to be done to mine and process these raw materials, and at competitive costs. Northvolt, the massive battery factory set up in Sweden’s freezing far north to take advantage of the cheap hydropower energy, is said to be running into trouble. As per British daily Financial Times, the factory, which attracted huge investment, produces much below its potential; this means, it is unable to compete with the prices of Asian rivals.

It is important that countries have an economic stake in the green transition, which requires domestic manufacturing and job creation. At the same time, climate change is a reality; the world needs a fast transformation to low-carbon economies. How will this work? Is it possible to do both? This is an issue that needs open discussion—but is getting lost in the intolerance of our times.

(Courtesy: https://www.downtoearth.org.in/; Writer is Director General of CSE and editor of Down To Earth, an environmentalist who pushes for changes in policies, practices and mindsets)