Public health groups, economists for raising excise duty on tobacco

Public health groups, economists for raising excise duty on tobacco

Public health groups and economists are urging the Union Finance Ministry to increase the excise duty on all tobacco products like cigarettes, bidis, smokeless tobacco etc., to generate additional revenue.

Bengaluru: Public health groups and economists are urging the Union Finance Ministry to increase the excise duty on all tobacco products like cigarettes, bidis, smokeless tobacco etc., to generate additional revenue.

According to them, increasing the excise duty on tobacco products can be a very effective policy measure to address the immediate need to raise revenue. It will win all-round praise as it will reduce tobacco use and related diseases as well as COVID related comorbidities, they opine.

The tax revenue from tobacco could significantly contribute to much-needed funds for COVID vaccination drive and augmenting the health infrastructure. Levying excise duty on all tobacco products and retaining these in the highest tax slab in GST, will also ensure tobacco products do not become more affordable. This will provide a solid foundation for reducing tobacco usage among vulnerable populations and have long-lasting impact on the lives of the country's 268 million tobacco users, deter children and youth from getting addicted to tobacco use.

"Making tobacco products unaffordable to children by increasing tax is the best and easy method of deterrent. This needs to be done as tobacco is highly addictive. Further, tobacco companies target children by capitalising on social and legal approval of tobacco as a consumable," said S J Chander, Convenor of Consortium for Tobacco Free Karnataka, a coalition of groups of individuals, public health advocates, economists, health care associations and civil society organizations working towards tobacco control in since 2001.

Ministry of Finance in their reply to a parliamentary question in the ongoing winter session, said that the central excise and cess (NCCD) collected on tobacco products during the year 2018-19 was Rs 1,234 crore, Rs 1,610 crore in 2019-20, and Rs 4,962 crore in 2020-21. The taxes collected from tobacco, similar to taxes collected from other sources together form part of the overall Gross Tax Revenues (GTR) of the Government of India and are used to fund all schemes and programmes.

The share of central excise duties in the total tobacco taxes has decreased from 54% to 8% for cigarettes, 17% to 1% for bidis, and 59% to 11% for smokeless tobacco products, on average, from 2017 (pre-GST) to 2021 (post-GST). There has not been any major increase in tobacco taxes since the introduction of GST in July 2017 and all tobacco products have become more affordable over the past three years. Several countries in the world have high excise taxes along with GST or sales tax and they are continuously being revised. Yet, the excise duty on tobacco in India continues to remain extremely low.

"Tobacco industry in India has been virtually enjoying an extended tax-free season on tobacco products over the past four years since the introduction of the GST as there hasn't been any major increase in tobacco taxation during this time. This has made many tobacco products more affordable. It could turn out to be highly detrimental to public health and potentially reverse some of the tobacco use prevalence reduction India achieved during 2010 – 2017. The Union budget must take a considerate view of public health and increase tobacco taxes significantly especially on bidis", Dr Rijo John, health economist and adjunct professor, Rajagiri College of Social Sciences, Kochi.

The total tax burden (taxes as a percentage of final tax inclusive retail price) is only about 52.7% for cigarettes, 22% for bidis and 63.8% for smokeless tobacco. This is much lower than the World Health Organization (WHO) recommended tax burden of at least 75% of retail price for all tobacco products. According to the WHO, raising the price of tobacco products through tax increases is the most effective policy to reduce tobacco use. Higher tobacco prices that decrease affordability, encourage quitting among users, prevent initiation among non-users, and reduce the quantity consumed among continuing users.

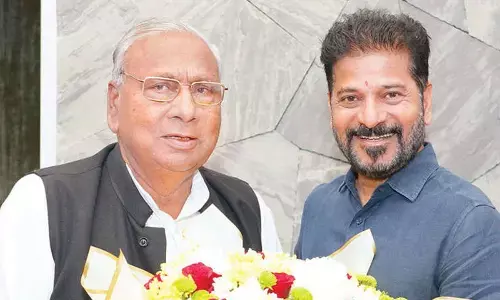

"Tobacco is a medically proven unhealthy substance, and mere persuasion does not help to de-addict the consumers, especially the youths of India. Economic double-edged tool like taxing the tobacco products could be effectively used as a good deterrent and that will also incidentally add to the tax revenue," said well-known economist and former director of Institute of Social and Economic Change Prof R S Deshpande.

India has the second largest number (268 million) of tobacco users in the world and of these 13 lakhs die every year from tobacco related diseases. Nearly 27 percent of all cancers in India are due to tobacco. The annual economic costs from all diseases and deaths attributable to tobacco use is estimated to be Rs 177,341 crores in 2017-18 amounting to 1 percent of India's GDP. This will continue to grow post COVID.