Live

- Russia needs a peace deal as it is running out of soldiers

- MyVoice: Views of our readers 25th November 2024

- Lack of planning, weak narrative behind MVA debacle

- UTF dist unit golden jubilee celebrations begin

- TSIC launches ‘Innovations 101’ coffee table book

- Drone technology for crime control

- Do you support caste census? Which one will you prefer caste census or skill census?

- DSS to launch gender campaign today

- MJCET holds first-ever 24-hr datathon

- TDP, JSP, YSRCP urged to oppose Wakf Bill

Just In

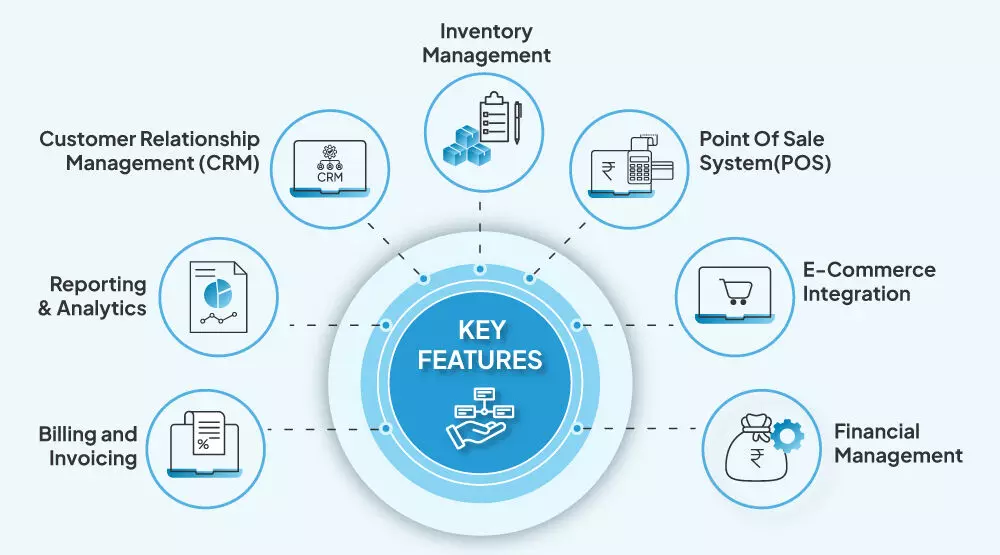

How MSMEs Can Optimise Operations with Accounting and Business Management Software

Running a small or medium-sized business comes with a unique blend of difficulties—limited funds, scarce personnel, and the necessity to multitask...

Running a small or medium-sized business comes with a unique blend of difficulties—limited funds, scarce personnel, and the necessity to multitask continuously. In such a rapidly moving environment, keeping close watch over finances, resources, and cash flows can feel overwhelming. This is where accounting and business management software can streamline processes, seamlessly integrating everyday activities. Let us explore how MSMEs can optimise their operations by using such applications.

1. GST invoicing

One of the most labour-intensive tasks for MSMEs is ensuring invoices stay compliant with Goods and Services Tax (GST) regulations. The right software solutions simplify this process by allowing companies to easily generate GST-compliant invoices. Not only can MSMEs create professional, accurate invoices in seconds, but they can also personalise them by incorporating their business logo, making each invoice a representation of the brand.

The program also aids businesses in handling different types of GST invoices—tax invoices, supply bills, or export invoices. Additionally, e-invoicing software can instantly generate e-invoices and e-way bills, removing the manual work from the equation. This degree of automation confirms compliance, decreases human mistakes, and helps businesses focus more on growth.

2. Inventory management

For MSMEs, keeping tabs on inventory can be complicated, particularly when the company is expanding. Business management software presents a flexible inventory management framework that allows MSMEs to arrange stock based on product type, brand, size, colour, and more. With limitless stock groupings and classes, businesses can accurately oversee their inventory.

Real-time tracking of inventory guarantees that nothing is overlooked. MSMEs can monitor their stock across different sites and stay up-to-date by batches or lots, ensuring they account for expiration dates. With proper management of manufacturing activity from raw materials to final dispatch, businesses can effectively control the whole production process.

3. Business reports

Access to insightful trade reports can produce all the difference for an MSME. The best accounting software generates myriad reports, offering an exhaustive 360-degree vision of the company. Whether financial health or sales execution, these reports deliver crucial insights that enable informed decision-making.

The user-friendly report dashboard displays graphs and visuals that render complex data easier to apprehend. MSMEs can cut and dice info to get multiple perspectives, helping them tailor strategies as necessary. The program even allows users to personalise reports, offering adaptability and convenience when inspecting data.

4. Credit & Cash flow management

Managing credit and cash flow efficiently is vital for any MSME. With the right accounting software, businesses can track receivables and payables effortlessly through bill-by-bill tracking, ensuring no overdue payments are missed. The system also provides ageing analysis reports, which help MSMEs identify long-pending bills and send out timely payment reminders.

Cash flow administration is simplified, with effortlessly accessible cash and fund flow reports available with a single click. Small and medium enterprises can also leverage cash flow projection reports to strategise future expenditures or investments, guaranteeing that liquidity is always maintained. This type of oversight over finances permits businesses to more productively oversee credit and improve their cash flow cycles.

5. Order to delivery management

Order tracking is crucial to maintaining consumer happiness and functional flow. Business management software offers a flexible order system for various sales and purchase cycles. Small and medium enterprises can easily generate orders, delivery notes, and goods receipt documents (GRNs) with just a handful of clicks.

Comprehensive order processing reports allow companies to monitor the status of orders, providing real-time updates that reduce miscommunication and delays. The software also tracks sales and purchase returns and debit and credit notes, allowing for smooth adjustments when necessary.

Final words

By incorporating accounting and business management software, small and medium enterprises can significantly optimise their operations, reduce manual work, and make more informed business decisions. From GST billing to inventory administration and credit surveillance, these tools provide much-needed assistance to ensure smoother workflows and better fiscal management.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com