Live

- ‘Pushpa-2: The Rule’ creates nationwide buzz with electrifying updates

- CERT-In Warns iPhone Users: Update to iOS 18.1.1 Now to Avoid Hacking

- Rana Daggubati’s Show gets huge applause at 55th IFFI

- Jana Sena MLA Pulaparthi Ramanjaneyulu Elected as PAC chairman

- Stage set for counting of votes for Jharkhand Assembly elections

- MLA Sri Ganesh Engages ASHA Workers and Resource Persons in Caste Census Meeting

- Supreme Court verdict on validity of Preamble modification in 1976 likely on November 25

- ‘Zebra’ movie review: A gripping tale of banking fraud and redemption

- Saurabh Netravalkar, Unmukt Chand, Dwayne Smith and Rahkeem Cornwall headline USPL

- NPP asks members not to attend meeting called by Biren govt

Just In

Samunnati Projects offers tailored funding solutions to agri enterprises and small farmers: Anil Kumar SG

India is a land of farmers and agriculture. We believe in farming as a spiritual practice - especially in villages.

New Delhi: India is a land of farmers and agriculture. We believe in farming as a spiritual practice - especially in villages. On the one hand, farmers of many states in India are protesting against the government on their many issues whereas firms like Samunnati Projects Private Limited are a standalone beacon in the agri-tech industry by bridging the gap and providing market linkage with customised financial solutions to Agri enterprise and small producers.

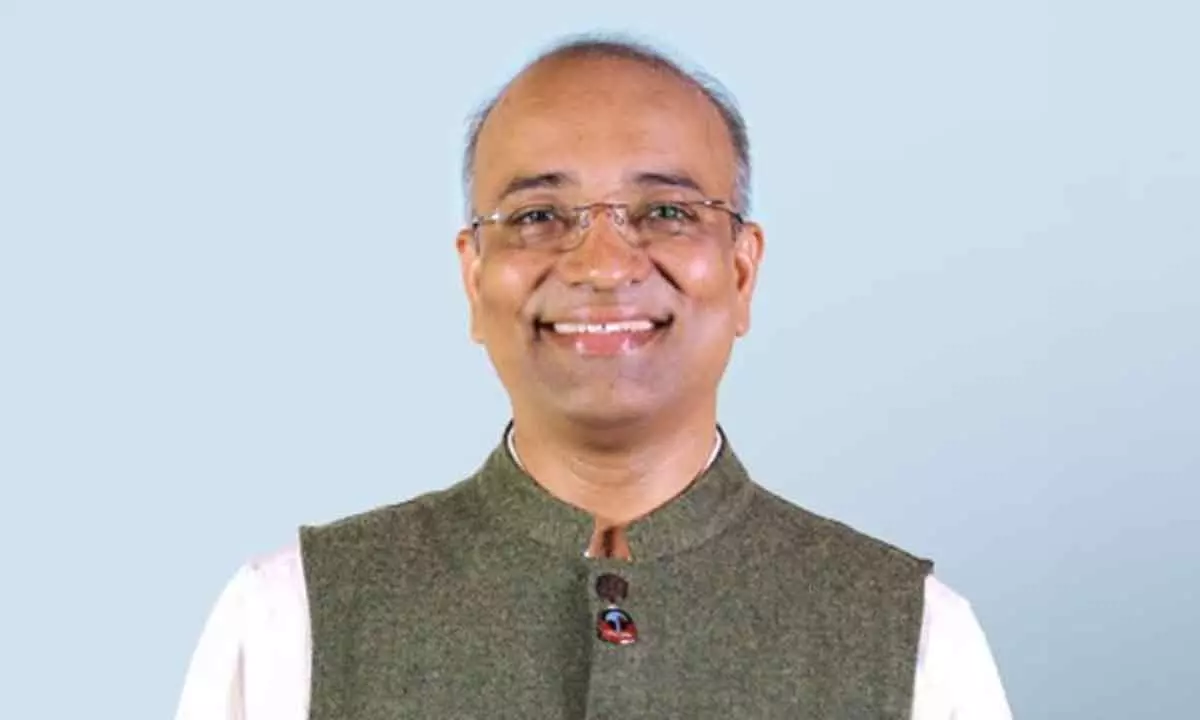

Founder of Samunnati Projects Private Limited Mr. Anil Kumar SG interacts with The Hans India on how they help farmers and enterprises:

1. Can you take us through the inception of Samunnati and its key achievements over the years?

The vision behind Samunnati is to transform the agricultural sector by enhancing market dynamics for FPOs which enables smallholder farmers and improving the efficiency of agri value chains. We focus on creating accessible and profitable markets for FPOs members by bridging gaps in capital, technology, and market information. Our Agri Commerce and Agri Finance solutions, equipped with advanced technologies, not only improve market access and financial inclusion for farmers but also aim to boost productivity and sustainability.

We have a presence across 28 states and are actively engaged with over 6500+ FPOs having a network of 8 million farmers nationwide. The organization’s vision to impact 1 in every 4 farming households by 2027 underscores our goal of transformative change, where smallholders are not merely participants but key beneficiaries in a thriving agri value chain.

Samunnati plays a significant role in transforming Indian agriculture and Farmer Producer Organizations (FPOs) by addressing various challenges in accessing financial resources and market opportunities. It bridges the credit gap by leveraging technology to offer tailored solutions and assistance to over 3000 FPOs, ultimately improving their financial stability and growth. FPO Gateway, developed with advanced technologies, facilitates better risk assessment and operational efficiency. Our comprehensive support approach, including training and capacity building, empowers FPOs to thrive and enhance financial engagement and agricultural productivity.

2.How does Samunnati's focus on sustainable agriculture align with the objectives of the FPO Conclave?

The conclave envisions stimulating collective efforts to increase food production while fostering sustainability and climate resilience. Samunnati’s initiatives, such as integrating climate-smart practices and promoting renewable energy solutions, directly support this vision. By showcasing successful implementations of transformative technologies and sustainable practices, Samunnati contributes to the Conclave’s agenda, which includes exploring sustainable practices, discussing next-gen technologies, and understanding use cases for sustainability in agriculture. This synergy reflects a mutual commitment to transforming the agri value chain and ensuring long-term resilience in agriculture.

Through climate-smart agriculture, renewable energy solutions, and innovative technologies, Samunnati enhances productivity and reduces cultivation costs for farmers. These initiatives enable FPOs to adopt and scale sustainable practices. Over time, this approach will not only improve agricultural efficiency but also bolster resilience against climate change. Samunnati’s efforts drive growth and aim to build a more sustainable, productive, and resilient agricultural sector.

3.Could you highlight some of the FPO products in Telangana and Andhra Pradesh that have been particularly successful?

The affiliated FPOs have been doing great stuff around the country. Talking about Andhra Pradesh, several FPO products have seen significant success, including cashews, millets, jaggery, millet-based biscuits and snacks, and honey. These products have gained traction due to their high quality and growing demand in both local and external markets.

In Telangana, FPOs have found success with cotton-based products such as cotton bales, cotton cake, and cottonseed oil (non-edible), along with pulses and millets. These commodities have contributed to the region's agricultural strength and economic growth, empowering local farmers and communities.

4. Can you share insights into Samunnati's funding model and how it supports your operations across India?

Samunnati, founded in 2014, follows an innovative funding model that strategically supports its operations across India. As of August 2024, Samunnati has raised 760 cr- equity funding so far from Elevar Equity, Accel, responsIbility among others. The company has also received debt funding of 1800 cr from various VC funds which includes Blue Earth & Equitane and others.

Samunnati’s business model leverages social and trade capital to foster buyer-seller relationships that lead to sustainable growth. The company’s use of Samunnati Aggregators (SA) enables it to harness non-traditional methods of sourcing, risk assessment, and mitigation, paired with technology to bolster agricultural value chains. This model ensures not just growth but also the inclusivity of smallholder farmers, particularly through employment creation in rural India.

The funding has allowed Samunnati to scale its operations significantly, especially in key agri-centric states like Bihar, Uttar Pradesh, and Madhya Pradesh. The infusion of capital supports the company’s outreach through initiatives such as Farmer Producer Organizations (FPO) funding, advancements in technology, and comprehensive training programs. By empowering local agricultural communities, Samunnati is able to deepen its penetration into rural markets, making a tangible impact on the sector’s overall development

5. What are Samunnati's plans for the next five years, and how do you aim to achieve your goals?

Over the next five years, Samunnati aims to solidify its leadership in the agri-fintech space by focusing on climate sustainability initiatives, expanding support to Farmer Producer Organizations (FPOs), and driving inclusive growth in India's agricultural sector.

Key goals include scaling operations to reach more FPOs and farmers, particularly in underserved regions, while fostering sustainable agricultural practices. Samunnati plans to channel its financial resources toward climate sustainability projects, recognizing the critical role that environmentally conscious farming practices play in long-term agricultural viability. A key focus in the upcoming years is to secure more Green Finance, which can be utilized for climate-smart projects that contribute to the overall development of the rural agricultural economy.

The company also aims to leverage technological innovations to enhance its agri-value chain solutions. This includes deploying advanced tools for risk assessment, data-driven decision-making, and creating tech-enabled platforms that connect farmers with buyers more efficiently. Expansion into new markets and the development of new partnerships with financial institutions, technology providers, and climate-focused organizations are also on the agenda to support these goals.

Samunnati’s overarching vision for the future continues to center on inclusive growth. By empowering FPOs, it seeks to build resilient and sustainable agricultural communities, while its initiatives will drive employment and boost incomes for smallholder farmers. Through collaboration, innovation, and sustainability-focused investments, Samunnati is poised to make a lasting impact on India’s agricultural landscape in the coming years.

6.How do you foresee Samunnati’s role evolving in India’s agricultural landscape in the coming years?

Samunnati envisions a growing role in India's agricultural landscape by driving innovation, sustainability, and inclusivity. In the coming years, the company aims to enhance support for Farmer Producer Organizations (FPOs) through tech-enabled solutions and financial tools that improve market access and scale.

Securing more Green Finance to fund climate-smart agriculture projects will be a priority, helping to promote sustainable farming and boost rural economies. By leveraging innovation, trade capital, and technology, Samunnati will continue to foster inclusive growth, create rural employment, and contribute to the overall development of India's agriculture sector.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com