Live

- MP, West MLA distribute cheques to critical patients

- Hyderabad Book Fair a big draw among book lovers

- GVMC secures 1st place in best public awareness programme category

- 39 transgenders recruited as Traffic Assistants

- Jesus’ teachings promote unity, compassion: Haryana Governor

- Special drive held on road safety

- Simultaneous elections not imminent: Purandeswari

- Vaktha helping transform individuals as leaders

- Pariksha Pe Charcha 2025

- Cops crack sensational NH-44 robbery

Just In

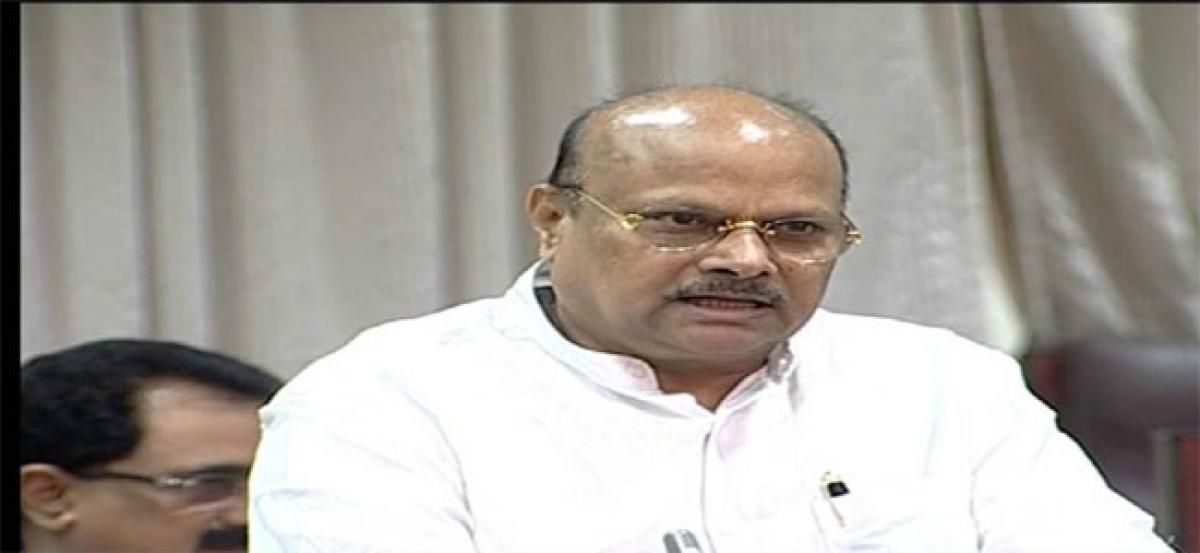

AP Minister for Finance, Planning, Commercial Taxes and Legislative Affairs Yanamala Ramakrishnudu, addressing the 29th GST Council meeting held at Vigyan Bhavan here on Saturday, stated that the issues releated to MSMEs need indepth analysis and study from the perspectives of both financial and legal factors

New Delhi: AP Minister for Finance, Planning, Commercial Taxes and Legislative Affairs Yanamala Ramakrishnudu, addressing the 29th GST Council meeting held at Vigyan Bhavan here on Saturday, stated that the issues releated to MSMEs need in-depth analysis and study from the perspectives of both financial and legal factors.

The Council meeting was called for to discuss the issues exclusively of MSME sector on GST-related issues. The Finance Minister, welcoming concessions/incentives in principle, said that the financial burden of the concessions/ incentives that are intended to be extended to the MSME should be borne by the Central government in the form of re-imbursement of CGST/IGST.

Further, he requested the Council that the Tirumala Tirupati Devasthanams (TTD) may be kept out of the purview of GST registration. And the supplies by Girijan co-operative Corporation of Andhra Pradesh which deals exclusively the forest produce collections may also be exempted. The Minister brought to the notice of the Council, that 29 items need reduction of tax rates which are used by common man.

GST on cement, presently at the rate of 28% has to be reduced to 18 per cent, on movie tickets has to be reduced to !8 per cent (on tickets over Rs 100) and 12 per cent(on tickets less than Rs 100), Aqua, other feed and feed supplements, plastic waste, Jute twine and jute bags, fish nets, fish net fabrics and fish boats must be kept under exemption list.

Dry tamarind, fried gram, rice brawn, cotton hank yarn, silk yarn and handloom products, UHT milk, traditional handicraft works of Andhra Pradesh like Kondapalli, Kalankari, Etikoppaka,etc., vehicles for physically handicapped persons also shall be exempted. Napa slabs, tractor and tractor spares, egg trays, instant convenience products foods, breakfast cereals, preparations of vegetables, non-carbonated drinks and utensils should be kept at the rate of five per cent.

Finally, The Minister agreed in principle the incentives of digital payments, but implementation should be examined in detail by the committees. Therefore, he suggested the formation of two committees 1) Legal committee and 2) Fitment Committee. These committees shall study the issues and submit notes to the Group Of Ministers so that the G.O.M will put for further discussion in the Council.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com