Live

- Hyundai IONIQ 5 takes part in GUINNESS WORLD RECORDS™ title for the Greatest altitude change by an electric car

- Xiaomi Pad 7 India Launch on January 10: Expected Price, Specifications, Features, and More

- Muzigal launches its State-of-the-art Music Academy in Miyapur, Hyderabad.

- AP Weather Alert: Meteorological Department Issues Rain Warning for Next 2 Days

- Toyota Kirloskar Motor Unveils “Happier Paths Together” – A Corporate Campaign Championing Happiness for All

- Promoting Sports and Athletes is Telangana Government’s Priority – MLA Rajesh Reddy

- CM Revanth Reddy Urges Tollywood to Collaborate on Social Issues

- Karnataka BJP Protests Congress Over Alleged Misuse Of Public Funds

- Thousands Pay Tribute to Lance Havaldar Anoop Poojary in Udupi

- People should take advantage of Pradhan Mantri Surya Ghar: Muft Bijli Yojana: PM

Just In

x

Highlights

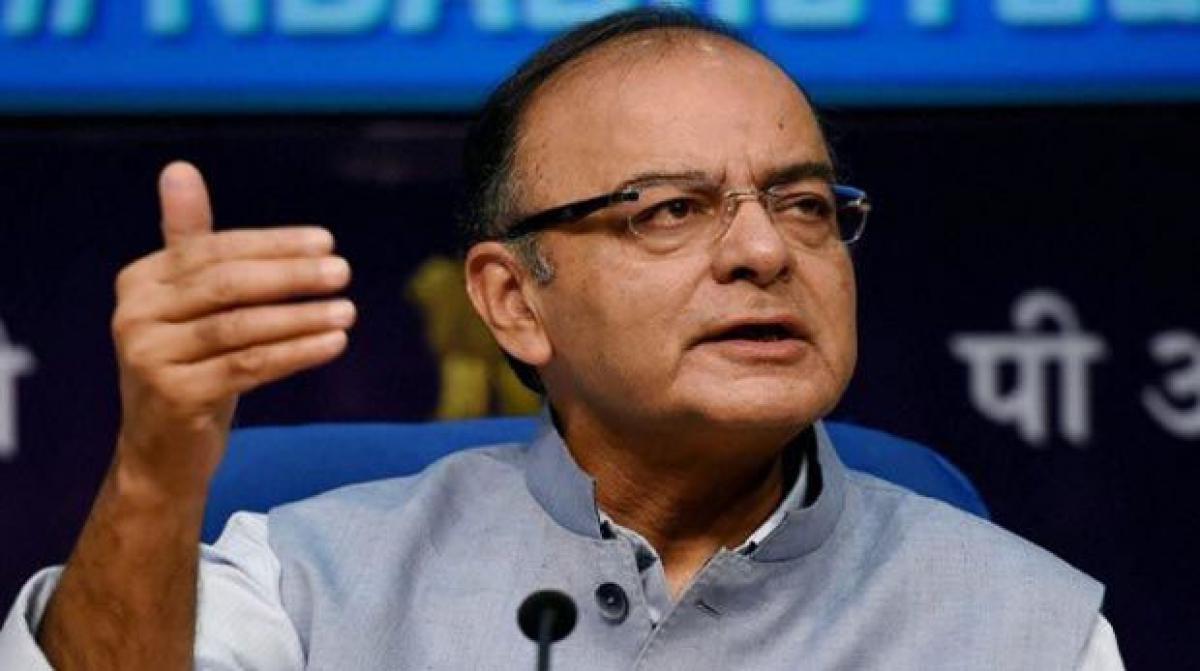

Retrospective tax law has hurt the country as it scared away the investors, Finance Minister Arun Jaitley on Saturday said and stressed on the need for maintaining the standards of fairness in taxation.

Retrospective tax law has hurt the country as it scared away the investors, Finance Minister Arun Jaitley on Saturday said and stressed on the need for maintaining the standards of fairness in taxation.

.jpg)

Addressing the officer trainees of the Indian Revenue Service, Jaitley said taxes, which are realisable, have to be collected, but the taxes that are not realisable, should not be collected.

"If you ask me 4-5 years later, in Income Tax Act... did the provisions of the retrospective taxation help India or did they hurt India? My answer is very clear, they hurt India because at the end of the day we have not been able to collect those taxes and we scared investors away," he said.

He was referring to the retrospective tax law brought in by the previous UPA government. Jaitley said investors want stability and predictability and they don't want to hit by a surprise that upsets the business planning and "therefore it is important that standards of fairness in taxation must be maintained.

"Under the taxation law, if a tax is payable it is payable, he said, while adding that "there is no compassion that he is an old man, she is a widow. So an so doesn't have the means to pay... those are not considerations in taxation law".

Jaitley further said that the law at times might imply that taxes are not payable and that might result in loss of revenue."... the difficulty is that, both in direct tax and indirect tax, at times we deviate from this principle and we think that it's in the larger national interest to collect more taxes, and we become extra-aggressive, either in our interpretation process or even in the legislation process," he said.

Jaitley told the IRS officer trainees that they should ensure 100 per cent integrity in order to ensure professional excellence.

"When in doubt, always go straight. If you lean either way without being straight, then you will unfairly cost there venue or you may be unfairly taxing an asses see. Now that unfairness either way will have to be avoided," he said.

The UPA regime had amended the Income-tax Act in 2012 to get powers to tax deals with retrospective effect. This law was used to raise a total tax demand of Rs 20,000 crore on UK's Vodafone for its 2007 purchase of Hutchison Whampoa Ltd's Indian assets.

The retrospective taxation evoked sharp reaction from both domestic as well as global investors. The same law was used by Income-Tax Department in January2014 to raise a tax demand of Rs 10,247 crore on Edinburgh-based Cairn Energy plc.

Jaitley said though the job of an IRS officer is to collect taxes, this job has to be performed fairly. "Taxes which are realisable are to be collected, taxes which are not realisable are not to be collected.... There are no grey areas in taxation law. Either a tax is payable or a tax is not payable," he said.

Jaitley said collection of taxes is the starting point of economic activity as more the taxes are collected, more they are invested which in turn leads to economic activity.

"If this circle get disrupted in any moment, you find an economic paralysis taking place, you find a slowdown taking place," he said. Addressing the officer trainees of 67th batch of IRS, he said the aim of any professional should be to achieve excellence. "In any service if you choose to join the batch of mediocres, you will find yourself stagnating in the crowd at the bottom.

But there is always room and space at the top". "You will always face a lot of pulls and pressures in your career, and you will always be in doubt what direction to follow. There will be pressures from seniors, from peers, from politics, from governments, from powerful individuals, and business interest, there will be temptations.

"What you will do when you are in doubt? The simple answer is when in doubt go straight, you will never go wrong. The moment you deviate a few inches, there is no limit to which you can fall," he said.

Jaitley said standards of ethics, integrity, hard work; professionalism and positive attitude followed by IRS officers would have to be absolute.

"If you followed this, you will probably end your career of 30-35 years with the same element of enthusiasm with which you started it, not fatigued, not compromised, not cynical, but probably with your heads held high and your honours intact," he said.

Next Story

More Stories

ADVERTISEMENT

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com