Live

- Police case against farmers for tilling land claimed by Waqf Board in Karnataka

- Commendable move: Sandeep Dikshit on renaming Sarai Kale Khan ISBT chowk after Birsa Munda

- MahaYuti will come back to power with a thumping majority despite Oppn's tirade: Eknath Shinde

- ‘Hanging up my racquet. Thank you’ - India’s Prajnesh Gunneswaran retires from professional tennis

- Pawan Kalyan to Campaign for NDA Alliance in Maharashtra

- Eight killed, five injured in Nepal's traffic accident

- Technical snag grounds PM Modi's aircraft in Jharkhand

- Divya Pillai FL from ‘Bhairavam’ unveiled

- Tension in Lagcherla as BRS Leaders Allegedly Incite Landless Poor

- India vs South Africa 4th T20I Today: Know About Venue, Squad, Start Time, and Live Streaming Details.

Just In

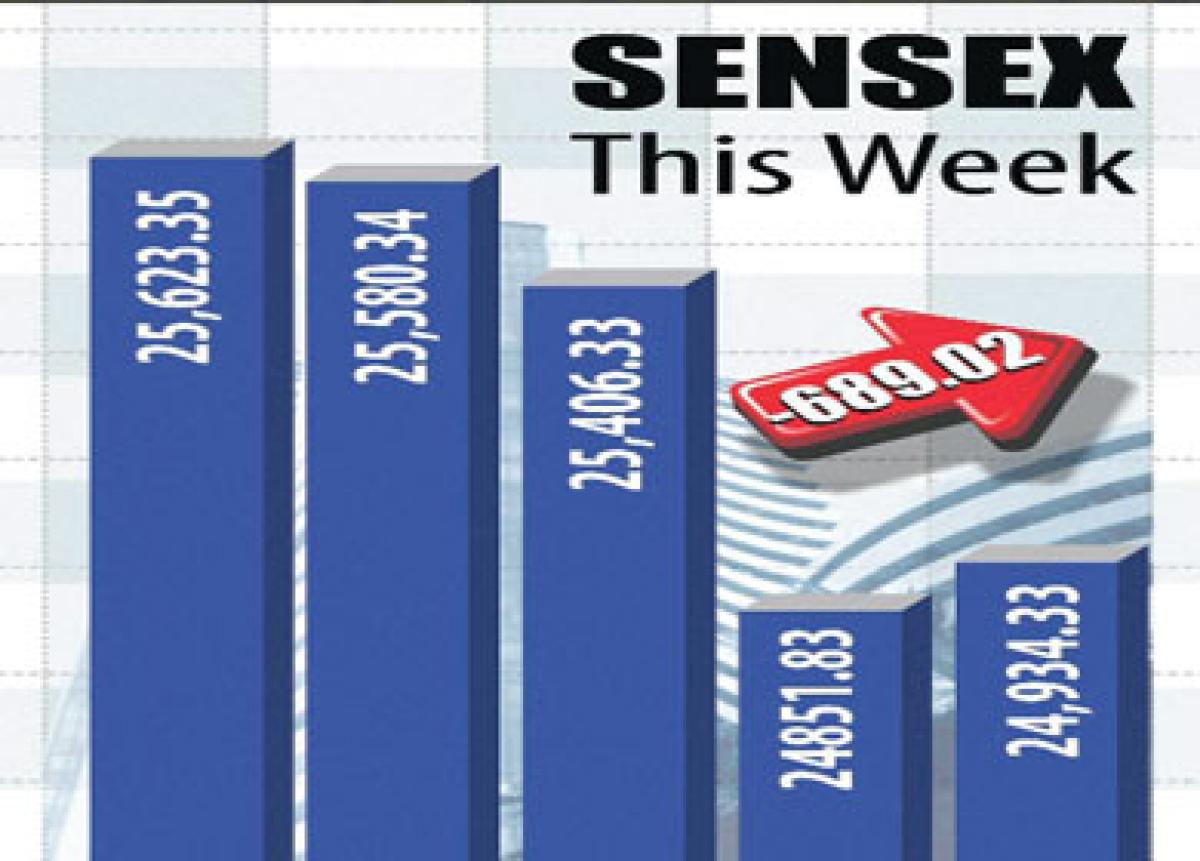

The total damage the market was suffered in the first four trading sessions ended Thursday, last week, amounted to as many as 1309 points. A small rally of 82 points on Friday, however,

The total damage the market was suffered in the first four trading sessions ended Thursday, last week, amounted to as many as 1309 points. A small rally of 82 points on Friday, however, helped stock market investors breathe a sigh of relief and also restrict the weekly loss to the Sensex up to 1,227 points which still turned out to be the worse in more than four years.

On the other hand, it was the very bad news emanated from China that caused frantic sell-off not only in the Indian stock markets, but also severely hurt stock markets globally. Benchmarking indices crashed, amid a selloff in Asia and Europe, after suspension of trading in Chinese shares post the sharp plunge in Shanghai Composite.

Further, geo-political tensions in the Middle-East also dampened sentiment. Also, the Indian manufacturing activity contracted in December for the first time in more than two years on the back of softening domestic demand coupled with weak rupee dampened sentiments.

The rupee weakened against the US dollar marking its steepest fall in nine weeks mirroring losses in the local equity and Asian currencies. Crude oil prices stumbled down to nearly 11 year low level, causing tremors in global commodity markets thus creating a picture as if the entire globe has been engulfed by a severe recession.

At the end of the previous week, after their market hours, Chinese statistical department had reported a sustained and sharp fall in its December factory output. Also, the six months long ban on selling of stake by major stakeholders holding five per cent or more in Chinese listed companies, as imposed by its market regulator in June last year got over in December, 2015, triggering fears that major holders of equities would now dump their shares in the markets.

The news spread at electrifying speed globally and the global stock markets also caught the contagion. The grinding halt in trading activity in stock exchanges in China also resulted in further devaluation of its currency, the Yuan, which added fuel to the fire.

But for the jerk received from China, the Indian stock markets would have continued their slow but steady surge in the fourth week straight the way they did in the preceding three straight weeks. Since, the Indian stock markets have left the worst behind and were preparing to stage their customary or traditional pre-budget rally that usually starts from early days or January or later days of December, the uptrend would have continued.

The foreign institutional investors, who had been persistent sellers of Indian equities in the past many months, also turned frequent net buyers in the preceding three weeks. In the wake of global shake-out after China, the foreign institutional investors who were to start investing afresh, turned into timid sellers that provided a downward momentum to the markets. In fact, these were reported to have sold shares on net basis, this week.

Since the Indian stock markets have been severely punished and that too not for a fault of theirs, good senses are most likely to prevail in the days to come as the new corporate number season is going to kick-start from this week onwards and it is considered more crucial for judging the performance of the companies.

The time is ripe for the markets to stage the customary pre-budget rally. The FIIs are also expected to bring in more funds to invest in the Indian stock markets as with the Chinese stock markets and also China's industry being in doldrums, the only alternative investment destination left is the Indian stocks. The FIIs are expected to get bumper fund allocation from their parent bodies, for investing in the Indian stock markets this year.

Thus, though the short or near term future in the Indian markets has turned uncertain, the long-term trend appears to be extremely bullish.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com