Live

- MyVoice: Views of our readers 17th November 2024

- Congress dares Kishan to bathe in Musi

- Kishan launches Musi Nidra programme

- ‘Yuva Utsav-2024’ commences

- Fire safety drill held at Secretariat

- Meru Srujan 2024: A Spectacular Celebration of Talent and Culture

- Representatives of VIDASAM demand resignation of YSRCP MLAs

- Police grill BRS leader Jaipal Yadav

- Revanth sells 6Gs to woo voters in Maharashtra

- Cong govt striking balance between welfare, devpt

Just In

The Rail Budget fails to rave up markets, which extended losses to close lower for the third straight day on Thursday, even as the Rail Minister tried to please both passengers and industry by maintaining status-quo on fare and freight rates.

Mumbai: The Rail Budget fails to rave up markets, which extended losses to close lower for the third straight day on Thursday, even as the Rail Minister tried to please both passengers and industry by maintaining status-quo on fare and freight rates.

Experts say the market will be more volatile for some more time and Union Budget may not be bid driver. Although analysts say reforms on track, on Railway Budget, fiscal 2016 target is likely to be missed.

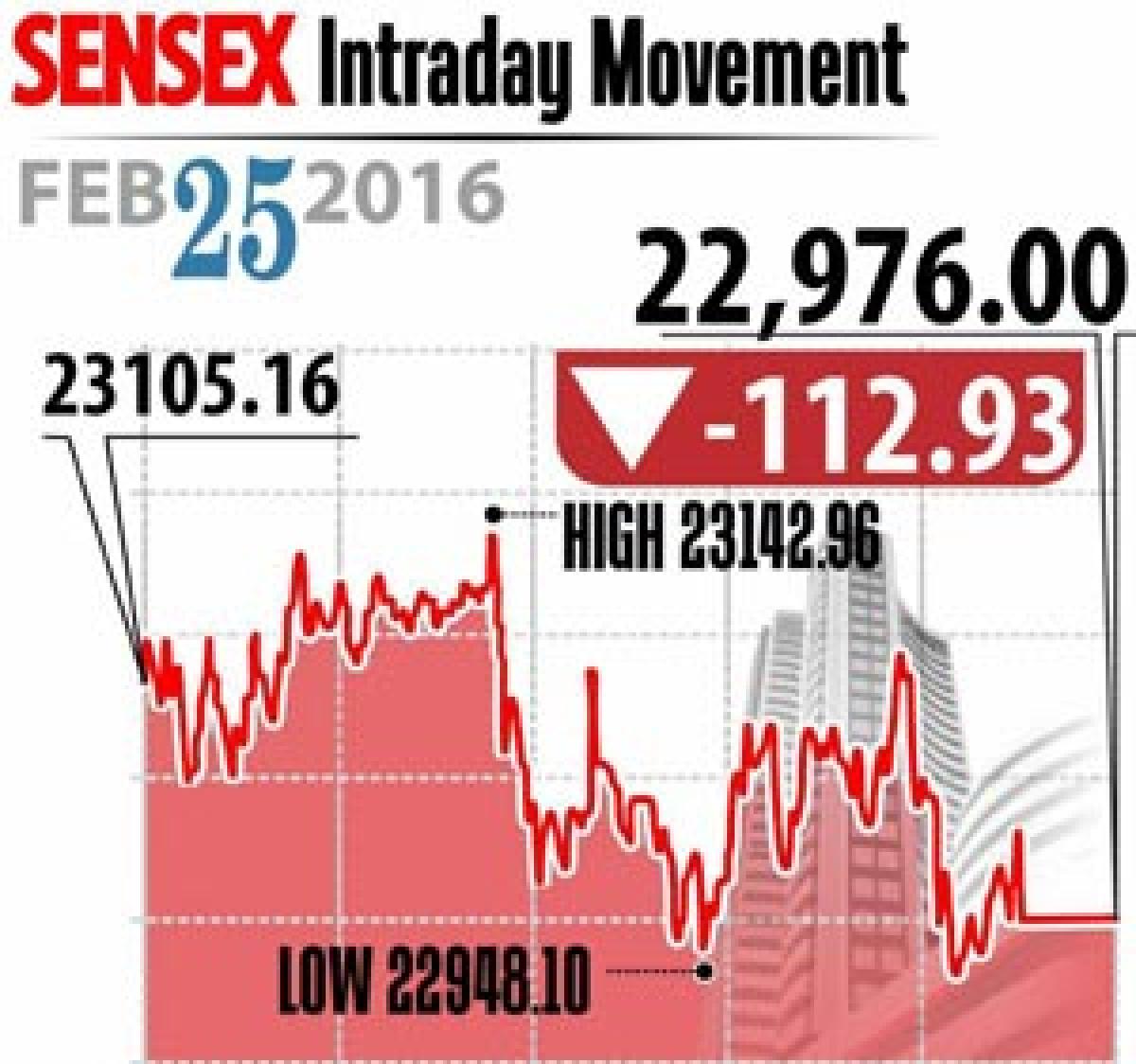

Sensex closed down 113 points at 22,976, Nifty ended lower by 48 points at 6,971. Meanwhile, broader markets underperformed compared with index shares as midcap and smallcap indices ended down 1.14 per cent and 0.9 per cent, respectively.

On sectoral front, most of the sectors closed in red led by bank shares, followed by autos, capital goods, IT and Oil and gas stocks, on the other hand, metals and pharma stocks gained.

In the post Railway budget, railway stock traded highly volatile with wagon makers like Kalindee Rail, Texmaco Rail and Titagarh fell up to 6 per cent each. Also cement stocks closed lower with ACC, Ultratech Cement, Ambuja and JK Cement down 0.1 to 2 per cent each.

Technology stocks related railways like MIC Electronics gained by 3 per cent, Zicom Electronic closed up 5 per cent, as the budget proposed CCTV surveillance.

The gainers: ONGC, up 2.88 per cent at Rs 215.90; Sun Pharma, up 2.38 per cent at Rs 874.85, HDFC, up 1.85 per cent at Rs 1,041.90; Coal India, up 1.32 per cent at Rs 299.50 and Cipla, up 0.87 per cent at Rs 518.25.

The losers: State Bank of India (SBI), down 3.06 per cent at Rs 151.90; Gail, down 2.96 per cent at Rs 304.95; Tata Motors, down 2.90 per cent at Rs 298; Larsen and Toubro (L&T), down 2.37 per cent at Rs 1,086.90; and ICICI Bank, down 1.98 per cent at Rs 183.35.No cheer on Dalal Street

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com