Live

- Shreyas Iyer to lead Mumbai as Prithvi Shaw returns for Syed Mushtaq Ali Trophy

- 'Failed to resolve crisis': NPP withdraws support from BJP govt in Manipur

- Chennai: Actress Kasturi Remanded in Custody Until 29th of This Month

- Aaqib Javed likely to become Pakistan's new white-ball head coach

- BJP panel to draft poll charge sheet against AAP govt in Delhi

- Allu Arjun Thanks Fans in Patna, Teases 'Pushpa 2' Release

- Japan to strengthen measures against illegal part-time jobs

- Gahlot resignation: Delhi Congress calls AAP a sinking ship

- Consultative body on doctors' walkout fails to narrow differences in South Korea

- Honouring bravehearts: Army commemorates Nuranang Day

Just In

After registering best gains in four years in the previous week, the Indian stock markets consolidated ahead of key macro-economic data and US Federal Reserve\'s two-day policy meet in the week ahead.

However, long-term positive; focus on stocks which are likely to declare dividends

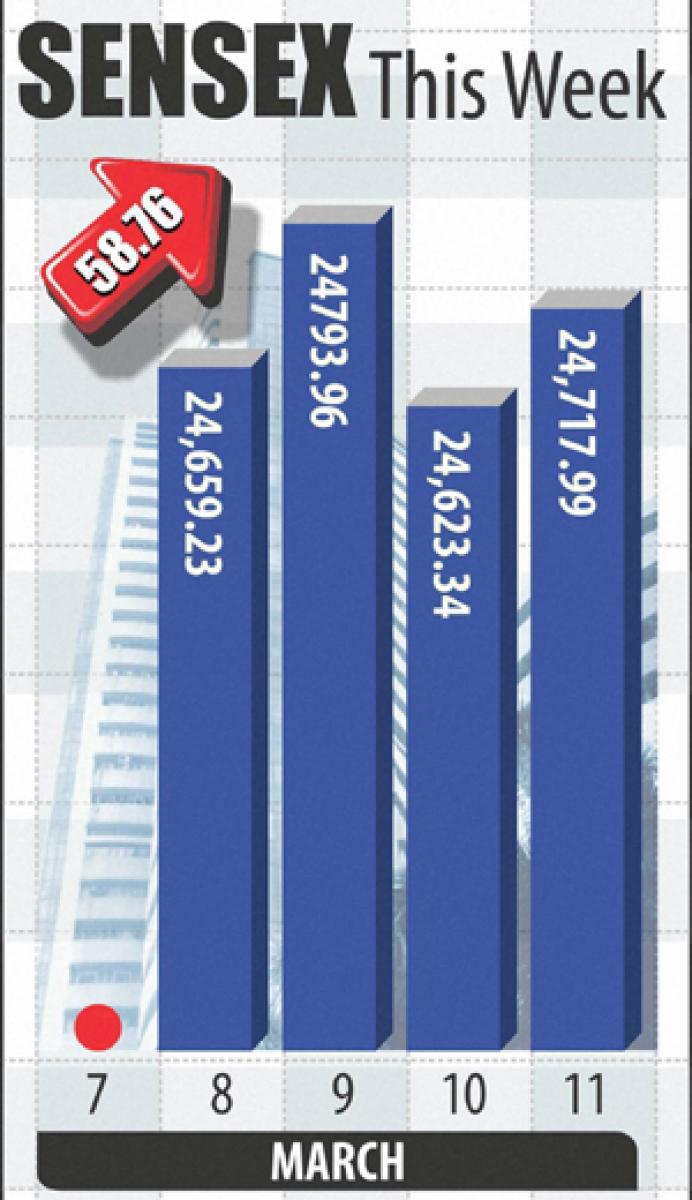

After registering best gains in four years in the previous week, the Indian stock markets consolidated ahead of key macro-economic data and US Federal Reserve's two-day policy meet in the week ahead. In the truncated week ended March 11, the BSE Sensex closed 72 points higher at 24718. Markets were closed on Monday on account of Mahashivaratri.

Although, the markets in the previous week notched a whopping over 1640 points' gain in just four trading sessions post the presentation of the Union Budget, its pace of going up was seen reducing significantly from the very next day of a magnanimous rise of 777 points on Tuesday, cautioning market observers and punters against venturing into fresh buying.

The punters, therefore, preferred to booking profits and the markets, by Thursday, had landed into the red zone. It was only after market hours that the European Central Bank (ECB) announcement of a fresh dose of economic stimulus came that sent the global markets including those in India up and the BSE Sensex higher by 92 points on Friday thus saving it from closing lower than the previous week.

The ECB), on Thursday evening announced a fresh economic package and cut three types of interest rates further besides enhanced monthly bond buying quantum to 80 billion Euro from 60 billion Euro at present. Although most of the global markets ruled mixed and the changes on daily as well as weekly basis were not big, they were mostly tilted in upward direction, and therefore, left the Indian markets nearly untouched.

It was the FIIs that were on buying spree last week that were the most active segment of investors, but, prices of stocks could not rise substantially on their buying support as domestic institutional investors dumped even larger quantities of shares in the markets. The FIIs were reported to have bought shares worth Rs 3,021 crore during the week under review.

With upward momentum tapering after 777 points climb on Tuesday in the previous week the previous week, most of the small and marginal investors stayed away from buying afresh as the uncertainty over the crucial reforms bills like GST and others still pending. Though a few bills, like real estate, gas and mining and Aadhar were through, they could not create much of positive impact on the markets.

The passage of these economic related bills certainly assured investors that the government back on reforms path, what they are eagerly awaiting is the passage of the GST bill and also the Reserve Bank of India to cut interest rates further. The cautiousness that prevailed throughout the week was however not unexpected, given the slew of development and risks lined for the next week.

Industrial output performance that was announced at the end of the last week supported the overtly cautious attitude as it contracted 1.5 per cent in January The downtrend in global crude oil market has already been arrested and an uptrend is on. Commodity prices in the global markets have also seemingly bottomed out.

The Chinese government, its central bank and also the stock market authorities have successfully arrested extreme volatility in their stock markets and therefore, the Chinese stock markets have been seemingly bottomed out. Although, the Fedreal Reserve Chief had previously stated that interest rate would be raised again anytime soon, the datas pertaining to the US economy are still not very supportive and therefore, the next week's policy meet is most likely to remain undecided over a hike in interest rate.

Thus, the markets in India are once again at cross roads and could not be judged as to which direction they would turn to for the short-term, though the long-term trend has become more clearly positive post the Union budget and, therefore, it would be prudent for the long-term investors to pick up gems and blue-chip stocks if the markets enter correction mode this week.

It would be more prudent for the investors seeking immediate rewards to pick up those companies from the PSU herd that are attuned to paying high dividends. There are many private sector companies also that have either already announced or are about to announce interim dividends, before the additional dividend distribution tax as proposed in the budget, becomes applicable. These should also be eyed for picking up.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com