Live

- Banks report synchronised growth in credit, deposits

- PM Awas 2.0 launched

- Target Kohli’s body, his front pads to put him on back-foot: Healy’s advice to Oz quicks

- LIC accused of thrusting Hindi

- Will make Warangal a la Hyderabad

- Will showcase Indiramma Rajyam: CM

- HC orders attachment of Himachal Bhawan

- Plane from Vedic era, not Wright Brothers: UP Guv

- Trump fancies himself a skilled dealmaker, but ME peace might be beyond him

- Six Useful Strategies to Control Your Heart During the Pollution Season

Just In

Indian stock markets continued to fall for fourth consecutive day on Monday following sustained foreign outflows on caution ahead of a likely US rate hike in June and weakness across global markets due to subdued commodity prices. Profit-booking towards the close of the session added to the losses.

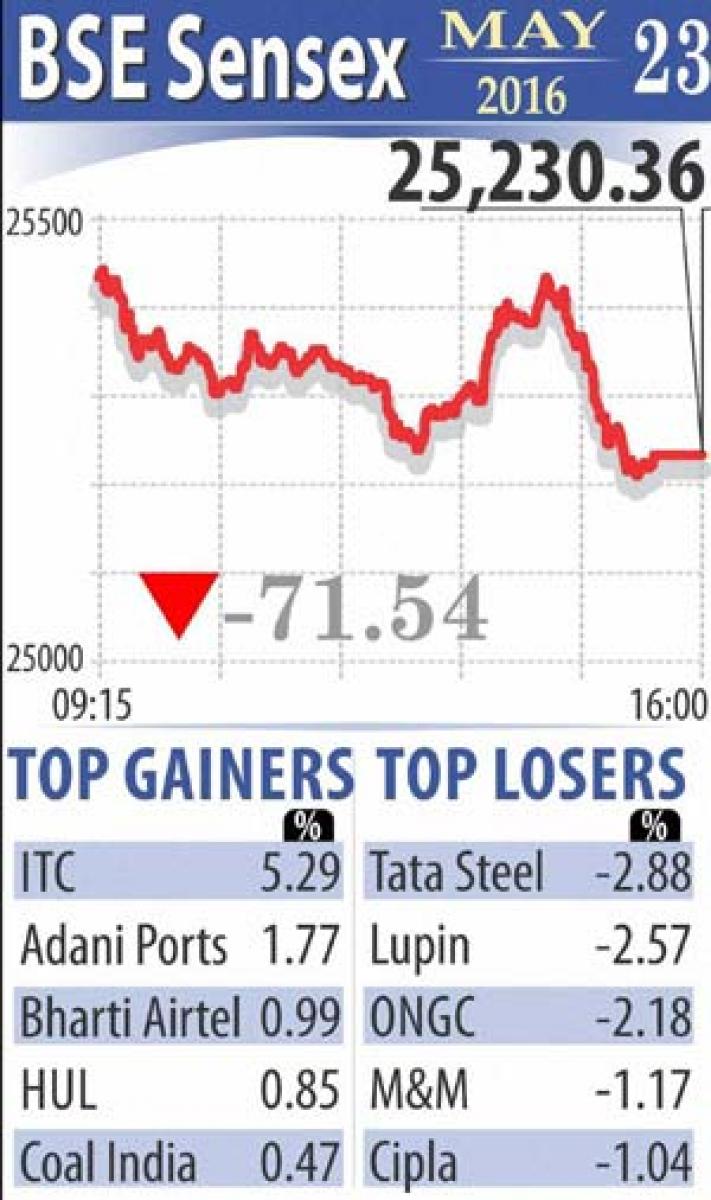

Sensex sheds 71 points to close at 25,230; Nifty down 19 points

Mumbai: Indian stock markets continued to fall for fourth consecutive day on Monday following sustained foreign outflows on caution ahead of a likely US rate hike in June and weakness across global markets due to subdued commodity prices. Profit-booking towards the close of the session added to the losses.

Sentiment took a hit after investors started cutting down bets in view of the upcoming expiry of derivative contracts for the May series on Thursday. Caution was writ large after FOMC minutes hinted at the US Fed tightening the policy as early as June, which weighed on mood. The quantum and spatial distribution of the monsoon is also being closely tracked.

The benchmark BSE Sensex resumed higher, but profit booking later on dragged it down to the negative zone, which ended lower by 71.54 points, or 0.28 per cent, at 25,230.36. The gauge had lost almost 478 points in the previous three sessions. The 50-share NSE Nifty shed 18.65 points, or 0.24 per cent at 7,731.05, after moving between 7,820.60 and 7,722.20.

ITC was the star of the day though, which ended higher by 5.29 per cent after better-than-expected earnings numbers. As many as 23 Sensex stocks closed with losses, including Tata Steel, Lupin, ONGC, Cipla, Bajaj Auto, HDFC and TCS. However, Adani Ports, Bharti Airtel, Hindustan Unilever, Coal India and ICICI bank notched up gains, which capped the fall.

Among the sectoral indices, capital goods suffered the most falling by 0.91 per cent, followed by healthcare, IT and realty. The broader markets too lay low, with the BSE small cap index declining 0.38 per cent and the mid-cap index shedding 0.29 per cent. Foreign portfolio investors (FPIs) net sold shares worth Rs 743.86 crore last Friday, provisional data showed.

Rupee falls further

Extending its fall for the eighth straight session, the rupee on Monday depreciated by another 5 paise to end at 67.49 per dollar on sustained demand for the US currency from banks and importers.

A massive outflows of foreign funds on the back of stricter participatory notes (P-Notes) and renewed possibility of the Federal Reserve lifting US interest rates as early as June along with sluggish domestic equities largely impacted the domestic unit.

The domestic unit resumed higher at 67.30 per dollar compared to weekend's closing value of 67.44 at the Interbank Foreign Exchange market and added strength to touch a fresh intra-day high of 67.25. Later, it hit a low of 67.50, before concluding at 67.49, revealing a loss of 5 paise.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com