Live

- Collector lays stress on institutional deliveries

- Should temples be free of govt control?

- Should temples be free of govt control?

- Pawan Kalyan Mourns the Death of Ratan Tata, says a Huge Loss for India

- Meet mulls ways to curb tobacco use

- Indrakeeladri Sharannavaratri Celebrations; Goddess Durga appears as Durga Devi

- Tourism corpn focuses on expanding tourism potential

- Rich tributes paid to Kanshiram

- Lord rides Swarna Ratham

- First ask BJP chief to quit: Minister Kharge

Just In

Stock markets edged up marginally on Wednesday as the Centre and States reached a broad consensus on key issues in the long-pending GST bill amid caution ahead of outcome of the Federal Reserve meet.

Mumbai: Stock markets edged up marginally on Wednesday as the Centre and States reached a broad consensus on key issues in the long-pending GST bill amid caution ahead of outcome of the Federal Reserve meet.

Covering-up of short positions ahead of Thursday’s July month expiry in derivatives segment, too gave equities a push.

Country's largest mortgage player HDFC Ltd jumped 1.48 per cent to Rs 1,387.80 after it reported a 26.86 per cent rise in consolidated net profit to Rs 2,796.92 crore helped by receipts from stake sale in general insurance arm.

Drug major Dr Reddy's Laboratories plunged by 10.07 per cent to Rs 2,988.40 after 80 per cent fall in consolidated net profit.

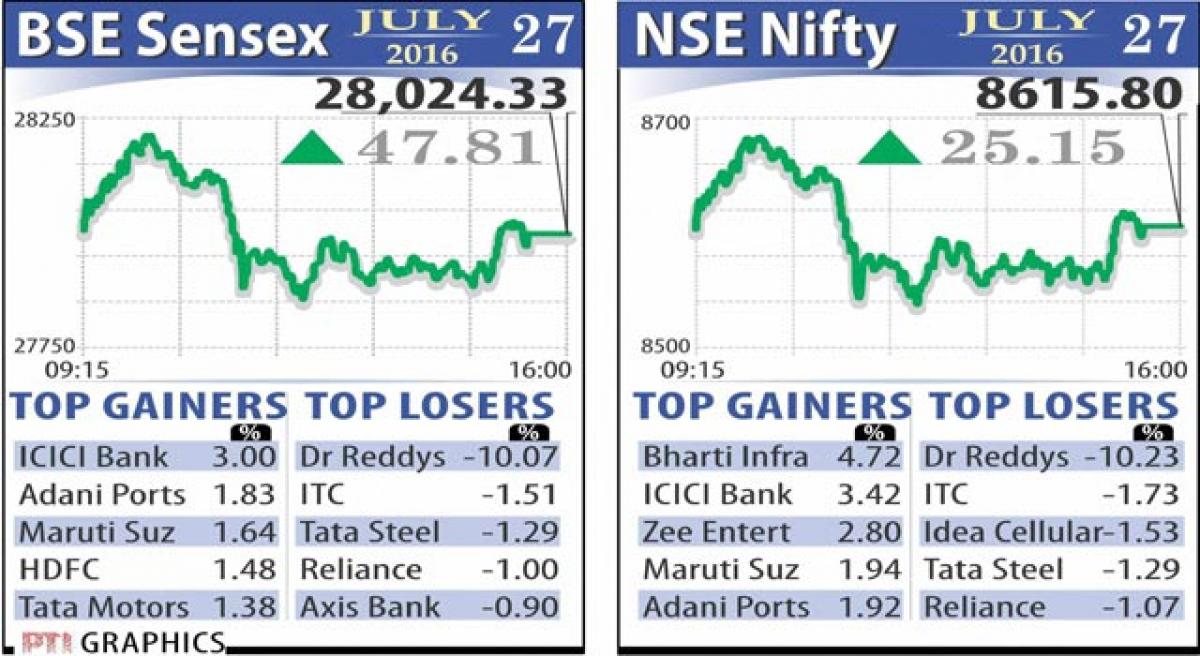

The benchmark BSE Sensex, after moving both ways during the session, settled 47.81 points or 0.17 per cent higher at 28,024.33.

The NSE Nifty ended at 8,615.80, a gain of 25.15 points or 0.29 per cent after shuttling between 8,665 and 8,572.05.

Of the 30-stock Sensex pack, 17 registered gains. Major gainers included ICICI Bank (3 pc), Adani Ports (1.83 pc), Maruti Suzuki (1.64 pc), Tata Motors (1.38 pc), Lupin (1.12 pc), TCS (1.09 pc), Sun Pharma (1.02 pc), SBI (0.95 pc) and Bharti Airtel (0.87 pc).

However, major losers were ITC 1.51 per cent, Tata Steel 1.29 per cent, RIL 1 per cent and Axis Bank 0.90 per cent.

Among the BSE sector and industry indices, telecom rose by 1.26 per cent followed by finance 0.93 per cent, bankex 0.89 per cent, auto 0.71 per cent, industrials 0.70 per cent, metal 0.60 per cent and capital goods 0.50 per cent while healthcare fell 0.75 per cent followed by FMCG 0.51 per cent, energy 0.39 per cent and consumer durables 0.23 per cent.

The market breadth remained negative as 1,342 ended lower, 1,316 closed higher while 207 ruled steady.

Meanwhile, global markets edged up after media reports suggested that Japanese Prime Minister Shinzo Abe plans to unveil a stimulus plan worth over 28 trillion yen, days before the central bank is expected to unveil its own growth-boosting measures.

From Asia, Japan's Nikkei ended 1.72 per cent higher, while indices like Hong Kong, Singapore and Taiwan moved up by up to 0.43 per cent.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com