Live

- All you need to know about PAN 2.0

- Akasa Air redefines travel experience with industry-first offerings

- MP: Residents stage protests against liquor shop in Indore

- Telugu Actor Shri Tej Booked for Alleged Cheating and False Promise of Marriage in Live-in Relationship

- Toyota Kirloskar Motor Celebrates 1 Lakh Urban Cruiser Hyryder on Indian Road

- MLS: New York City FC part ways with head coach Nick Cushing

- Delhi CM says Centre cutting AAP voters’ names from rolls, BJP hits back

- Hyderabad Metro Rail Phase-II Works to Begin in Old City in January 2025

- Odisha: 668 persons killed in human-elephant conflicts in last three years

- DEFENDER JOURNEYS: TO EMBARK ON ITS THIRD EDITION FROM NOVEMBER 2024

Just In

Finance Minister Arun Jaitley on Wednesday said the 2017-18 budget was one of its kind where every taxpayer was liable to pay reduced taxes. \"It is the first budget in which every taxpayer has reduced tax liability.

New Delhi: Finance Minister Arun Jaitley on Wednesday said the 2017-18 budget was one of its kind where every taxpayer was liable to pay reduced taxes. "It is the first budget in which every taxpayer has reduced tax liability.

- Tax liability of people with incomes of up to Rs 5,00,000 to be halved

- 5% income tax on incomes between Rs 2,5 lakh and Rs 5 lakh per annum

- Tax cut to 25% on micro, small and medium firms earning up to Rs 50 cr

- Of a total of 6.94 lakh companies filing returns, 96% comprise MSMEs

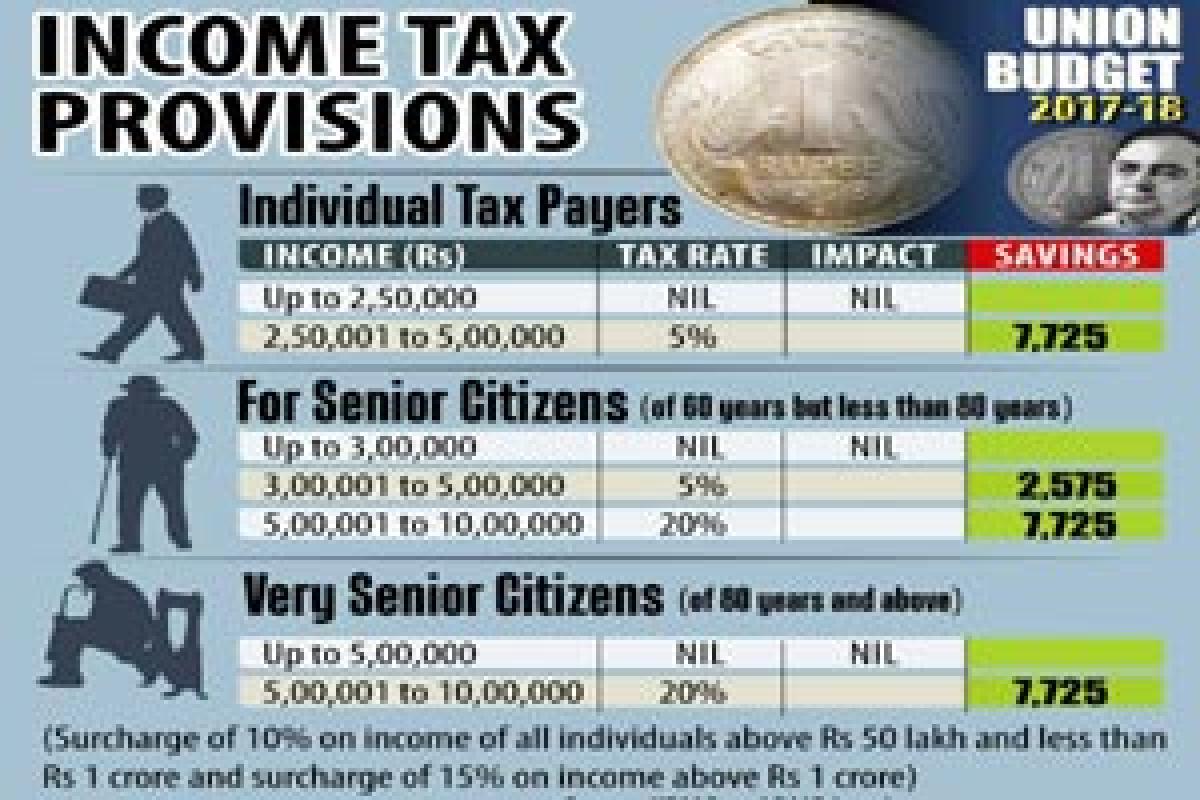

While the tax liability of people with incomes of up to Rs 500,000 is proposed to be reduced by half, all other categories of taxpayers in the subsequent slabs will also get a uniform benefit of Rs 12,500 per person," Jaitley told DD News in an interview.

In a relief to the middle class, Jaitley proposed in the budget to halve the income tax to 5 per cent for those earning between Rs 250,000 and Rs 500,000 per annum. "This will reduce the tax liability of all persons with incomes below Rs 500,000 either to zero (with rebate) or 50 per cent of their existing liability," he said.

This will reduce their tax liability to half while all other tax payers above this slab will also be benefited in terms of lesser tax of Rs 12,500 per individual. This would result in a revenue loss of Rs 15,500 crore to the government. The levy of surcharge of 10 per cent on individuals with income between Rs 50 lakhs to Rs 1 crore would lead to a revenue gain of Rs 2,700 crore.

The tax exemption for affordable housing has been proposed, to be applied on area of 30 and 60 square meter of carpet area and not built-up area with 30 sq mt limit, for the four metropolitan city limits and 60 sq mt for the rest of the country. Also, tax on notional rental income for builders would be calculated only after 1 year from the end of the year in which the completion certificate is received.

Making changes in capital gains taxation for immovable properties, Budget reduced holding period for computation of long term capital gain from three years to two years and shifted the base year for counting the cost of property from April 1, 1981 to April 1, 2001. Also, the basket of financial instrument in which capital gain can be invested without payment of tax to be expanded.

To stimulate growth, concessional withholding rate of 5 per cent for interest received by foreign entities on loans given in India would be continued for another 3 years beyond June 30, 2017. Start-ups would get two relaxations under the scheme of Income Tax holiday given last year. Also, exemption will be available for three years out of any 7 years from the date of establishment instead of 3 out of 5 years.

Jaitley said the reduction in the income tax for smaller companies was necessary after demonetisation as they were the major job creators. "Post-demonetisation, I had a promise to keep to help the micro, small and medium enterprises (MSMEs) sector. MSMEs are the job creators," he said.

In order to make MSME companies more viable and also to encourage firms to migrate to the company format, the budget proposed to reduce the income tax on smaller companies with annual turnovers of up to Rs 50 crore to 25 per cent.

As per the data of Assessment Year 2015-16, there are 6.94 lakh companies filing returns, of which 6.67 lakh fall in this category and, therefore, percentage-wise 96 per cent of companies will get this benefit of lower taxation.

"This will make our MSME sector more competitive compared with large companies. The estimated revenue forego vis-a-vis this measure is expected to be Rs 7,200 crore per annum," Jaitley said in his speech.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com