Live

- Hyundai Motor India Limited Announces 2024 Edition of ‘Hyundai Always Around’ Campaign

- World Quality Day: Hindustan Zinc Reaffirms Commitment to Superior Product Quality & Innovation

- Samsung TV Plus Announces the Launch of Four New FAST Channels From Viacom18 Exclusively on Samsung Smart TVs

- Arun Pandey 3.0 set to revolutionise lottery industry with Great Goa Games (GGG)

- How Organisations Can Support Mobile Workforces with Diabetes - From Prevention to Management

- Google Rolls Out Real-Time Spam Detection Feature for Pixel Users

- Marriott international and Samhi hotels announce strategic expansion, sign agreement to open three more properties in india

- Telangana Group-4 Results Declared: 8,084 Candidates Selected for 8,180 Posts

- 2024 Is Shaping Up to Be the Smallest Black Friday Ever: GoDaddy Study

- LG LAUNCHES NEW XBOOM SERIES, WITH POWERFUL SOUND WITH PORTABILITY AND STYLE

Just In

In the last five to ten years, India has been among the leading foreign direct investment destinations in the emerging markets.

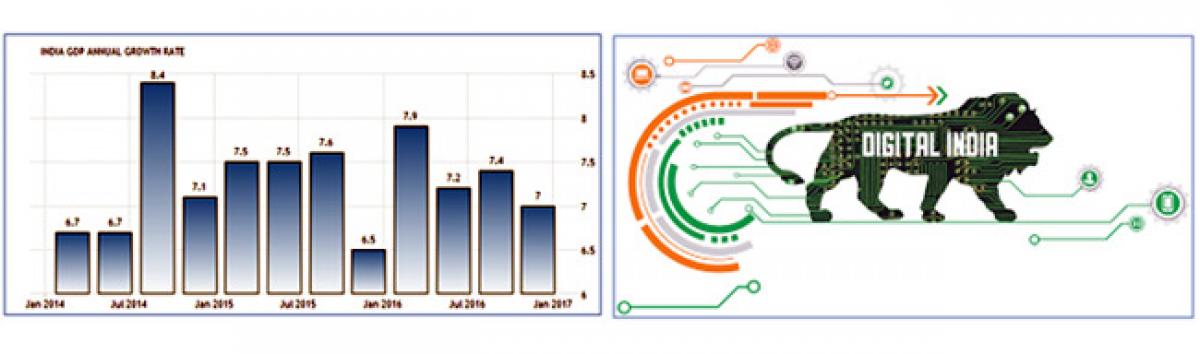

In the last five to ten years, India has been among the leading foreign direct investment destinations in the emerging markets. It is not by coincidence that India found itself among the BRICS (Brazil, Russia, India, China and South Africa); countries whose rapid economic growth was projected to realign global economic powers in the next decade. The cool off in oil and other commodity trading globally due to lower prices in the past couple of years reduced some of the external vulnerabilities for India; hence attracting investors who were looking for higher returns in emerging markets. Low interest rates and diminishing returns from other asset classes in developed economies also fueled the rush to India; but the tide might now be changing soon.

India’s Economic Challenges in 2017

At the beginning of this year,economic analysts in India projected that 2017 would be a tough year for India due to the changing waves in global economic trends and the accompanying geopolitical realignments.The same external forces that acted in our favor could now be strategically positioned against us both in the short-term and in the medium term; as other developed countries restructure their economies.Interest rates hike in the US is among the major draw backs in the growth trajectory for India in 2017. As the Federal Reserve raises its interest rates, foreign investors will tend to shift their capital to the developed economies and thereby draining India and other emerging market countries of a key source of Foreign Direct Investments which drive growth in these countries.

A United Nations study conducted towards the end of 2016 projected that India would maintain its momentum of being one of the fastest growing economies in the world at about 7.6% GDP growth in 2017. However, according to the latest data from IMF, India’s GDP is poised to grow at a rate of about 6.6%; which is one whole percentage lower than the previous forecast. Most analysts believe that the current GDP series for India overestimates growth figures; and therefore the slowing rate in GDP growth for India could be worse.

Besides the external factors that are drawing India behind economically, there are other internal issues that are also tainting the great economic growth reputation India has earned in the past few years. The financial system in India is now being haunted by some legacy issues relating to excessive corporate leverage on the boom the country experienced in the past few years.Bad debts are rising and now both the commercial lenders and the borrowers are treading softly on borrowing. This has the ultimate effect of credit tightening which suffocates the private sector; and denies it the funds it needs to invest in business expansion in order to increase production and create more jobs.The economy therefore ends up stagnating due to a slowdown in the private sector growth.

Long term growth for India

The long term view of growth in India is however looking better than the short term outlook; if a few new economic strategies are adopted. More than two decades ago India opened its doors to economic liberalization through the adoption of globalization and subjecting its goods and services to global market forces. The outcome of this economic paradigm shift was high rate of economic growth, increased consumer choices and reduction of poverty in India significantly.However now that global markets and economic trends have become uncertain, India will have to change tact in order to achieve sustainable development.

According to a 2016 report “India’s ascent: Five opportunities for growth and transformation”by the management consulting firm McKinsey; India now needs to refocus on its rapidly growing consuming class which is expected to triple to about 89 million households by 2025. The report summarizes five keyareas India should invest in, in order to maintain its global leadership in economic growth and development. First India needs to start moving towards the direction of acceptable living standards for all its citizens. Second, development should be done with a focus on sustainable urbanization so that industries and business processes outsourcing hubs can be expanded without affecting negatively the social lives of the urban dwellers. Third, the mantra of manufacturing for India in India needs to be reinforced since the country has a ready market of about 1.3 billion people. Fourth, India should ride on the technology wave to harness its power for economic growth; and finally prioritize women economic empowerment in order to increase their contribution to economic growth.

Much as 2017 appears to be having dark clouds hanging on it, there seem to some glimmer of hope for India to still continue being among the fastest growing economies in the world. All that is needed is a change in economic strategy to focus on the five things outlined above.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com