Live

- Govt sanctions houses to displaced families of Midmanair

- Over 7,000 posts filled in 11 months via recruitment board

- Which one will you prefer caste census or skill census?

- Parents, teachers urged to let children grow freely

- Should State govt crack its whip on Endowment Department's functioning?

- Temple affairs a big task for EOs while few enjoy H.O. cushy stints

- RTA flounders on despatch of documents to motorists in city

- Police destroy ganja plantation

- UBI gesture to 3 welfare hostels

- Overwhelming response to Vijayawada Marathon

Just In

Toshiba Corp\'s U.S. nuclear unit Westinghouse filed for Chapter 11 protection from creditors on Wednesday, as its Japanese parent seeks to limit losses that threaten its future.

TOKYO: Toshiba Corp's U.S. nuclear unit Westinghouse filed for Chapter 11 protection from creditors on Wednesday, as its Japanese parent seeks to limit losses that threaten its future.

A bankruptcy filing will allow Pittsburgh-based Westinghouse, whose nuclear plant projects have been dogged by delays and cost overruns, to renegotiate or break its construction contracts, although the utilities that own the projects would likely seek damages.

For Toshiba, the aim is to mitigate soaring liabilities stemming from guarantees it provided. Toshiba said Westinghouse-related liabilities totaled $9.8 billion as of December, more than an earlier estimate of around $6.3 billion.

As a result, the Japanese industrial conglomerate said it may book a net loss of 1 trillion yen ($9 billion) for the year ending in March, up from an initial forecast of a 390 billion loss.

The move is expected to trigger complex negotiations between the Japanese conglomerate, its U.S. unit and creditors, and could embroil the U.S. and Japanese governments, given the scale of the collapse and U.S. government loan guarantees for new reactors.

Westinghouse, which made the filing at the U.S. Bankruptcy Court for the Southern District of New York, said it has secured $800 million in financing to fund and protect its core businesses during its reorganization.

Toshiba, whose shares have crashed as Westinghouse's problems surfaced, said in a statement it would guarantee up to $200 million of the financing for Westinghouse, adding that the troubled unit would be removed from its consolidated books at the end of the month.

The Japanese company said it would hold a news conference at 0845 GMT.

Westinghouse has nuclear projects in varying degrees of development in India, the United Kingdom and China, and the company said that its operations in Asia, Europe, the Middle East and Africa would not be impacted by the filing.

"We are focused on developing a plan of reorganization to emerge from Chapter 11 as a stronger company while continuing to be a global nuclear technology leader," Westinghouse Interim President and CEO Jos Emeterio Gutirrez said in a statement.

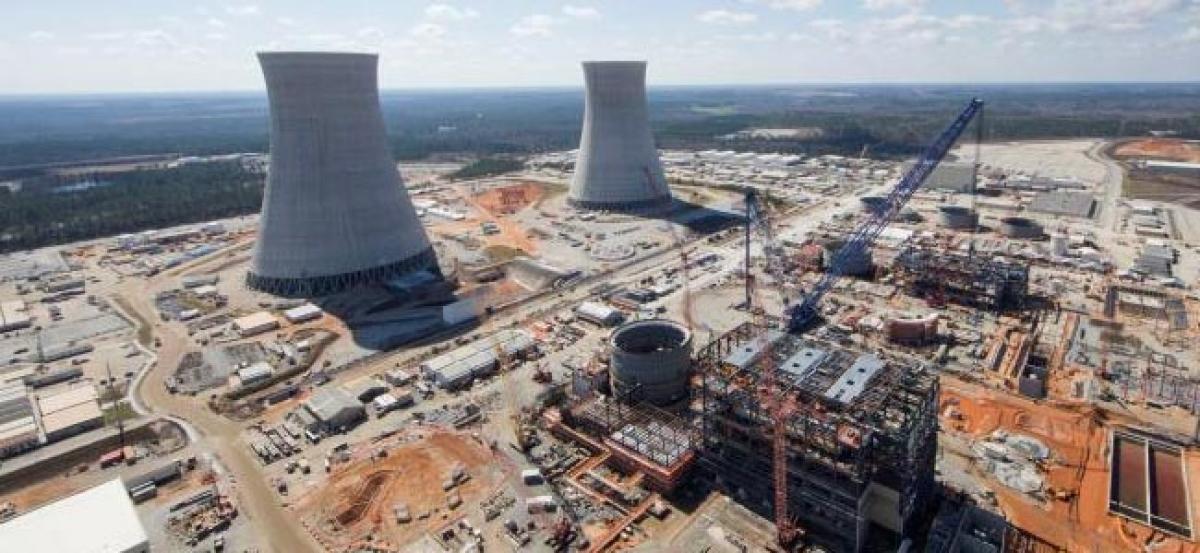

Japan fears that Westinghouse's collapse will incite criticism from U.S. President Donald Trump over the impact it could have on local jobs and finances as a bankruptcy could costs borne by U.S. taxpayers for two nuclear power plants projects in Georgia and South Carolina or even imperil their completion.

The U.S. government has granted loan guarantees totaling $8.3 billion to the utilities commissioning the Georgia project.

Japan's government spokesman Yoshihide Suga said the two governments were having thorough discussions on the issue.

The company, founded by American engineer and inventor George Westinghouse in 1886, employs 12,000 people worldwide, according to its website.

CHIP BUSINESS SALE

Toshiba has been selling other assets including its prized chip unit - the world's second-biggest NAND chip producer which it values at least $13 billion - to bolster its balance sheet.

Toshiba will close the first round of bids for its chip business on Wednesday, several sources with knowledge of the issue said, declining to be identified as they are not authorized to speak on the matter.

One said that about 10 potential bidders had shown interest, including Western Digital Corp which operates a Japanese chip plant with Toshiba, rival Micron Technology Inc (MU.O), South Korean chipmaker SK Hynix Inc (000660.KS) and financial investors like Bain Capital.

The government-backed Innovation Network Corporation of Japan, and Development Bank of Japan are unlikely to join the first round, sources said, although they were expected to enter later bidding rounds as part of a consortium.

A separate source said that Foxconn Technology Co (2354.TW), the world's largest contract electronics manufacturer, is expected to place an offer which is likely to be the highest bid. Other sources have said the Japanese government is likely to block sale to Foxconn due to its deep ties with China.

NUCLEAR REVIVAL FIZZLES

Toshiba acquired Westinghouse in 2006 for $5.4 billion, then a major bet on a rebirth in nuclear projects due to high oil and gas prices, and a conviction governments would cap carbon emissions to prevent global warming.

The company expected that it would win contracts to build dozens of its new AP1000 reactors, allowing it to build a pipeline of future work for its nuclear power plant maintenance division.

Regulators in both Georgia and South Carolina approved the construction of AP1000 reactors in 2009, a sign of a nuclear renewal taking hold. U.S. regulators and countries around the world were then also evaluating other proposals for nuclear projects.

But the activity stalled by the end of 2011 when the United States failed to adopt legislation curbing carbon emissions. The Fukushima nuclear accident in Japan also slowed worldwide nuclear development, causing delays at Westinghouse's projects in Georgia and South Carolina and ballooning safety costs at existing nuclear plants.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com