Live

- Telangana CM Reviews Plans for First Anniversary of State Government

- Vijayawada: Kindness Day celebrated

- Rajamahendravaram: Students advised to set clear goals

- Digital locker facility now available at Namma Metro stations

- Swarna Vaijayanthi Mala presented to Tirumala god

- Physical fitness mandatory for cops: SP Jagadeesh

- Children’s Day celebrated at Ananthalakshmi School

- AHUDA chief Varun gets grand welcome

- Instil moral values in students

- Somishetty takes charge as KUDA chairman

Just In

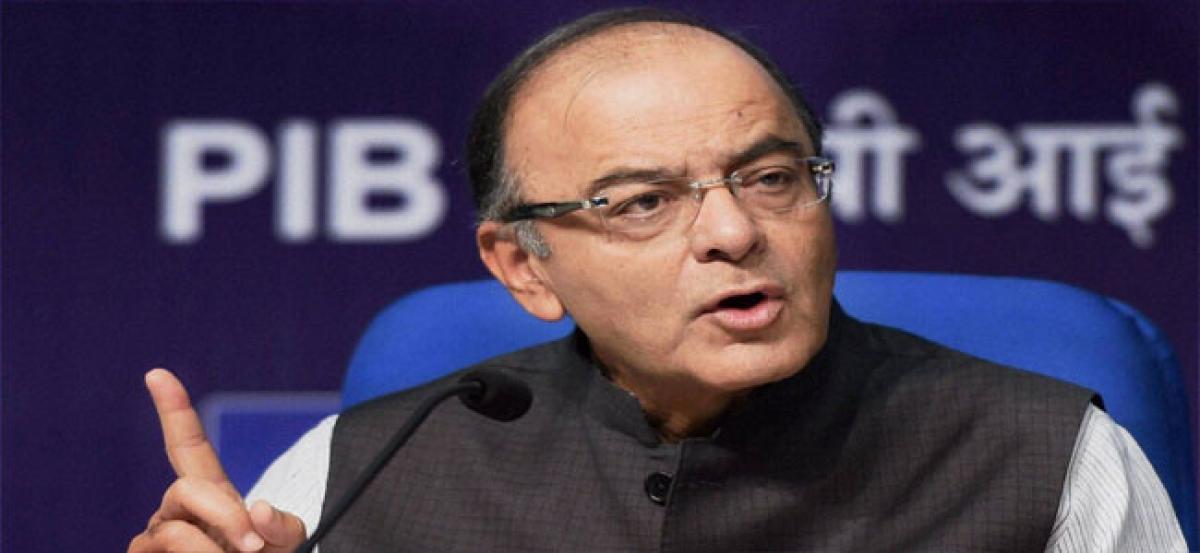

Finance Minister Arun Jaitley said that the number of tax payers increased by 1.54crore significantly from 4.72 crore in 2012-13 to 6.26 crore in 2016-17. Highlighting the impact of noteban and the ‘proactive initiatives,’ he said the revenue collections in case of direct taxes rose to Rs8,49, 818 crore during 2016-17 at a growth rate of 14.5 per cent.

Note ban widens tax base; slew of measures for better tax administration: Jaitley

New Delhi : Finance Minister Arun Jaitley said that the number of tax payers increased by 1.54crore significantly from 4.72 crore in 2012-13 to 6.26 crore in 2016-17. Highlighting the impact of noteban and the ‘proactive initiatives,’ he said the revenue collections in case of direct taxes rose to Rs8,49, 818 crore during 2016-17 at a growth rate of 14.5 per cent.

He said net direct tax collections up to September 18, 2017 in the current financial year rose to Rs 3.7 lakh crore, showing a growth of 15.7 per cent.

Jaitley further said that the government has taken a slew of measures in the last 2-3 years to increase transparency and fairness in the tax administration. He was addressing the second meeting of the Parliamentary consultative committee attached to the finance ministry on ‘Initiatives of IT Department’ here on Friday.

Jaitley, who also holds the Corporate Affairs portfolio, told Member of Parliaments that the Income Tax Department has taken ‘various initiatives in the last 2-3 years in order to bring about efficiency, transparency and fairness in tax administration,’ said a release from Union Finance Ministry.

Elaborating the initiatives, Jaitley said that a Single Page ITR-1 (SAHAJ) Form was introduced for tax payers having income up to Rs50 lakhs. The tax rate for individuals having income of Rs 2.5 lakhs to Rs5 lakhs was reduced from 10 per cent to 5 per cent, which is one among the lowest in the world, he said.

Jaitley further said the concept of ‘no scrutiny’ was introduced for the first time non-business tax payers having income up to Rs5 lakh so that more and more people are encouraged to join the tax net and file their IT returns and pay the due amount of taxes.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com