Live

- Living to Dance

- MyVoice: Views of our readers 17th November 2024

- Congress dares Kishan to bathe in Musi

- Kishan launches Musi Nidra programme

- ‘Yuva Utsav-2024’ commences

- Fire safety drill held at Secretariat

- Meru Srujan 2024: A Spectacular Celebration of Talent and Culture

- Representatives of VIDASAM demand resignation of YSRCP MLAs

- Police grill BRS leader Jaipal Yadav

- Revanth sells 6Gs to woo voters in Maharashtra

Just In

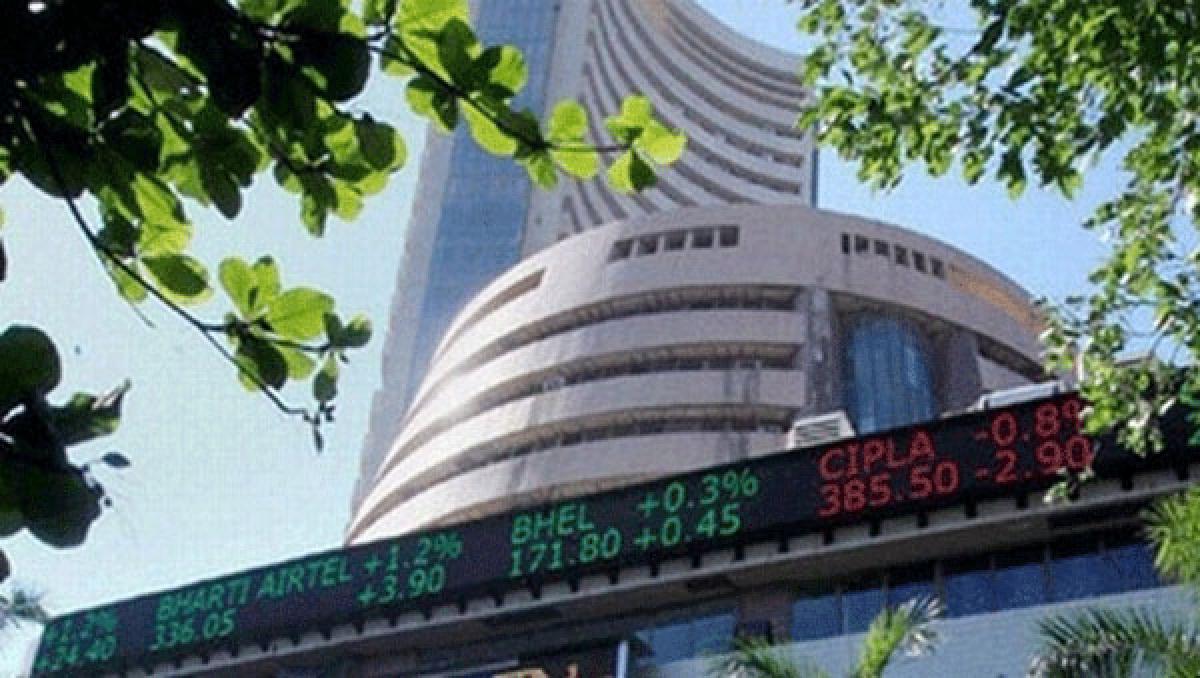

The key Indian equity market indices on Thursday opened higher after the Reserve Bank of India (RBI) maintained its hawkish stand refusing to cut rates in view of the rising inflationary pressure and concerns over fiscal slippage.

The key Indian equity market indices on Thursday opened higher after the Reserve Bank of India (RBI) maintained its hawkish stand refusing to cut rates in view of the rising inflationary pressure and concerns over fiscal slippage.

The Sensitive Index (Sensex) of the BSE, which had closed at 31,671.71 points on Wednesday, opened higher at 31,725.85 points.

Minutes into trading, it was quoting at 31,686.19 points, up by 14.48 points, or 0.05 per cent.

At the National Stock Exchange (NSE), the broader 51-scrip Nifty, which had closed at 9,914.90 points, was quoting at 9,923.55 points, up by 8.65 points or 0.09 per cent.

Continuing with gains for the fourth consecutive session, key Indian equity indices closed on a higher note on Wednesday as positive global cues, coupled with healthy buying in healthcare, oil and gas and FMCG stocks, buoyed investors' sentiments.

According to market observers, the equity markets -- which had already discounted any further reduction in key lending rates -- made substantial gains as the RBI reduced the SLR (statutory lending rates), which created healthy demand for banking stocks.

The Sensex was up by 174.33 points or 0.55 percent at the Wednesday's closing. In the day's trade, the barometer 30-scrip sensitive index had touched a high of 31,752.16 points and a low of 31,457.78 points. The Nifty too was up by 55.40 points or 0.56 per cent.

On Thursday, Asian indices were mostly showing a positive trend. For instance, Japan's Nikkei 225 was trading in green, up by 0.03 per cent.

Nasdaq closed in green, up by 0.04 per cent while FTSE 100 was down 0.01 per cent at the closing on Wednesday.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com