Live

- Tirupati: Take up repairs of damaged roads, officials told

- Pawan Kalyan meets Vice President Jagdeep Dhankar, Continues Delhi Visit

- Heavy rain alert for Tirupati district due to low pressure

- EPACK Prefab constructs India’s fastest-built structure in 150 hrs

- Woman and her kids die under suspicious circumstances

- BMTC to increase bus running time on each route to drivers and conductors

- PDS implementation in Nalgonda sets a benchmark

- Ph D awarded

- BJP stands strong against Waqf Board misuse

- Urandur ZPHS adopts school Constitution

Just In

With financial services market growing in leaps and bounds, young professionals are in great demand

MBA with specialization in Finance has been one of the most sought after courses and more so, now with many additional avenues opening up in finance, financial services and related industries.

There cannot be a better time to opt for a MBA in Finance

MBA with specialization in Finance has been one of the most sought after courses and more so, now with many additional avenues opening up in finance, financial services and related industries. Many may associate ‘Finance’ with job in banking sector but in reality banking is only a small sector compared to the huge opportunities lying to be grabbed in the non-banking sector. Much more lucrative offers come from non-banking sectors and financial consulting companies as talented financial analysts are in great demand. Consulting companies such as JP Morgan, Ac Nielsen, Morgan Stanley, Boston Consulting Group, Avendus Capital etc. are consistently in search for talent and trainable resources in this field.

Huge amount of scope lies in the sectors like - Financial Accounting & Planning, Corporate Finance & Governance, Venture Capitalists, Personal Finance, Personal Equity Investments, Capital & Stock markets, Asset Management, Port Folio Management.

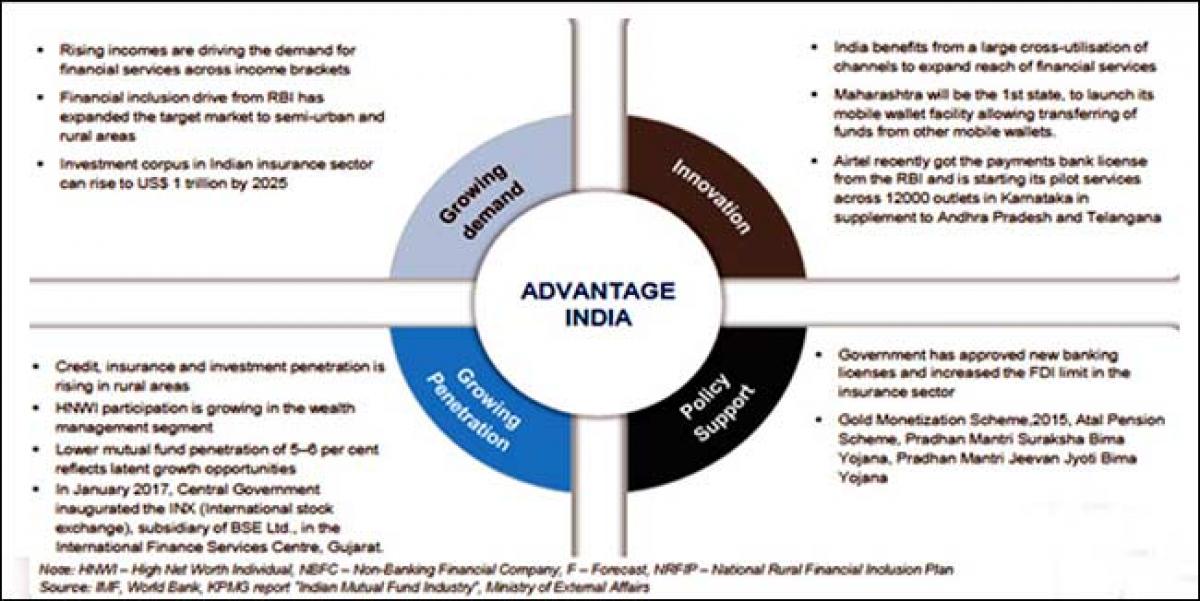

Global consultancy firm BCG reports India to have topped the chart denoting the progress made by countries on the financial inclusion front as around 20 crore people have "gained access" to financial services. According to a 2018 report by Grant Thornton, PE investments touch an all-time high in 2017 and saw six USD 500 mn plus investments compared to only three in 2016. The report further reveals E-commerce, start-ups, banking and financial services, real estate, and IT/ITeS continued as top sectors. A common theme across investments has been ‘technology as an enabler’. Technology driven financial organisations or FinTech companies contributed in the growth for this sector.

According to George Mitra, CEO, Avendus Wealth Management, “We have grown substantially in the past couple of years. Few years ago, we were at Rs. 4,000 crore. We should reach assets under management (AUM) of almost $3 billion USD (approximately INR, 20,107 Crore) in the next couple of months”. Incidentally, Avendus visited campuses of top B Schools in the country, in search of talents.

With a host of Fintech companies and other startups in Online financial services, electronic payments and Digital Reimbursement sectors, there are many more avenues where enormous amount of opportunity lies for a MBA in finance.

According the Amit Pachauri, Founder Member of Lucro - a digital payment and financial services startup company, “The digital payments, pre-paid gift cards, digital reimbursements and allowances is gradually becoming popular with industry due to the ease of doing business, faster processing as everything is generated in electronic format. The financial management technology tools provide greater cost transparency, total cost views of technology, applications and services spend with better budgeting and forecasting. Just the physical & virtual gift cards/voucher market in India is approximately worth of INR 9,000 Crore and reimbursements / allowances are in couple of thousands of crores and are growing at a steady and fast rate.”

It is important to make a correct choice of Institution opt for a college which offers curriculum in sync with industry needs.

Listed below are some of the popular management schools for recruiters of financial services providers:

1. Indian Institute of Management, Ahmedabad

2. FMS – Faculty of Management Studies, University of Delhi

3. Indian Institute of Management, Bangalore

4. XLRI – Xavier Labour Research Institute, Jamshedpur

5. Jamnalal Bajaj Institute of Management Studies (JBIMS)

6. MDI Gurgaon

7. S. P. Jain Institute of Management and Research

8. NMIMS Mumbai

9. FORE School of Management, New Delhi

10. IFMR Chennai

Author: Nirmalya Pal

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com