Live

- Agri Minister Tummala: Bhadradri Kothagudem will be a model district

- Skilled workers urged to avail of PM Vishwakarma Yojana

- Ajit Pawar’s power play backs Fadnavis for CM post

- France's TotalEnergies halts new investment in Adani Group

- Oppn stalls Parl over Adani issue, Manipur

- Sharmila demands scrapping of agreements with Adani firm

- 75 Yrs Of Constitution: President Murmu to address joint sitting of both Houses

- Are strict laws needed to ensure MLAs attend Assembly sessions?

- Centre leveraging innovation, tech for capacity building among teachers

- Oppn members seek more time for JPC on Waqf Bill

Just In

Why you must Supplement your Mediclaim with a critical Illness Cover?

Diagnosis of many critical illnesses requires the patient to be hospitalized and while you are preparing for the treatment, your health insurance will take care of the expenses. Therefore, health cover does not become useless at diagnosis of life-threatening disease but helps scaffold the brunt of expenses further.

It is true that irrespective of the covered illnesses that you get admitted to the hospital for, a good health insurance cover can take care of, almost all major expenses incurred in the treatment, be it hospital room rent, surgery expenses or even daily commuting expenses for the family members.Then what is the use of Critical Illness Insurance, you must be wondering.

First, let us compare hospitalization for a relatively less dangerous disease and hospitalization for a life-threatening disease.

Pradeep Rao has spent 15 years of his prime with two of the big-five business consultants in the world and has been around the world, working on different projects. He has a legacy to be proud of and loads of stories to tell. Pradeep had been very clear about what he wanted out of his life

when he graduated from IIM Ahmadabad in 1997, which was to retire before 40, and that’s what he achieved in 2014, at the age of 38.Throughout his entire career, he had been hospitalized only once for three days for an intestine-related issue, and was discharged fit and healthy. He has accumulated funds which he feels will be enough to last till his retirement. What he could not have foreseen in his (until now) enviable course of lifewas the detection of bowel cancer!

Fast forward two years later, Pradeep is, thankfully, healthy again, leading a normal life and has made many changes to his lifestyle to be healthier., But alas, his erstwhile dream to retire at 40 no longer stands fulfilled. He is looking for a new job now while also mulling over the thought of starting his own consulting business.

But two years away from the market seem to have reduced his value, and it’ll take some catching up before he can feel like himself again.

Life-threatening diseases, can not only land you in hospital but may keep you away from your profession for an extended period of time, causing significant financial stress on you and your family. It could also cause you to lose yourjob and be forced to spend a lot of money to come back to normalcy.

This is where a Critical Illness insurance policy comes into play. It offers you the entire sum assured on the diagnosis of a critical illness, enabling good treatment and compensating for lost income.

Health insurance is an indemnity insurance, unlike critical illness cover; i.e. it will cover only the expenses incurred, and does not consider economic recovery of the insured. However, critical illness insurance is an assured cover, which will pay a lump sum amount, regardless of your treatment cost.

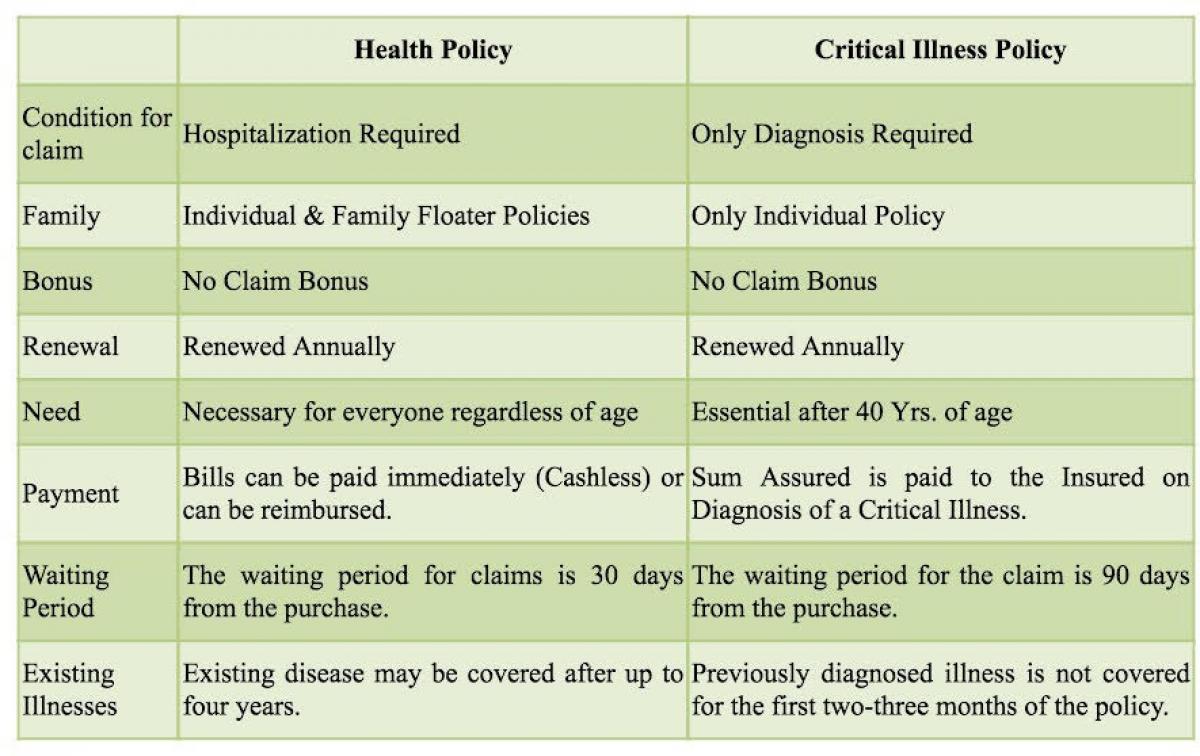

What you need to be careful about the critical cover is that you will need to plan for your future amount at the time of purchase. You may increase it, however, over time as per your medical condition and medical inflation.You should be aware of the following attributes if you are looking for health insurance to cover the risk of critical illnesses:

Why Both Health & Critical Illness Covers?

The primary question we sought to address at the beginning of the article was that you need both critical illness and health covers and it should not be just one of them. Both covers supplement each other, as a health cover will work where critical has no role, but critical cover comes into the picture, where health insurance hits the limit.

Diagnosis of many critical illnesses requires the patient to be hospitalized and while you are preparing for the treatment, your health insurance will take care of the expenses. Therefore, health cover does not become useless at diagnosis of life-threatening disease but helps scaffold the brunt of expenses further.

Another major factor that makes these policies supplementary to each other is that health policy may be able to cover ‘entire’ treatment expenses for 8 – 10 different surgeries depending on the sum insured of the policy but it falls short in case of major emergency treatments.This is where a critical cover offers greater coverage and lightens your burden for more than 20 such ailments. Most of which, have the potential to change your life significantly.

Critical Cover as a Rider or Standalone Policy?

Critical illness cover can be bought as an independent policy or as an add-on cover with the health insurance itself. Some experts recommend buying them separately to keep at least one running in case of financial hardships. Thus, it will also depend on how safe you feel about your financial future. If not very, go for separate policies even if it is from a single insurer, however it may cost you a little more.

So, if you have been looking for a health insurance cover, perhaps you should also consider critical insurance as part of your protection. One criteria which is easy and often used for the selection of critical plans is the number of illnesses and conditions covered by the plan. Modern health insurers like Apollo Munich cover more than 30 critical illnesses and conditions including blindness and hearing loss. The higher the number of conditions covered by the plan the better it is.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com