Live

- Megastar Chiranjeevi lauds ‘KA’ team

- Telangana Government to Study Fish Farming and Sales in Karnataka

- MVA’s Chhatrapati-inspired poll Manifesto promises jobs, freebies & more

- Dattatreya Suggests Development of Triveni Sangam in Nizamabad as a Tourist Hub

- Maruti Unveils first look of ‘Drinker Sai’

- ‘Dhoom Dhaam’ team celebrates film success

- RIL mcap decreases by Rs 74,000 crore; SBI, TCS, Infosys biggest gainers

- Nag Ashwin Eyes Alia Bhatt for Female-Led Project Amidst Uncertainty Around Kalki 2898AD 2

- Citadel: Honey Bunny: A High-Octane Spy Drama with Untapped Potential

- Pacers shine in Perth as Pakistan win first ODI series in Australia since 2002

Just In

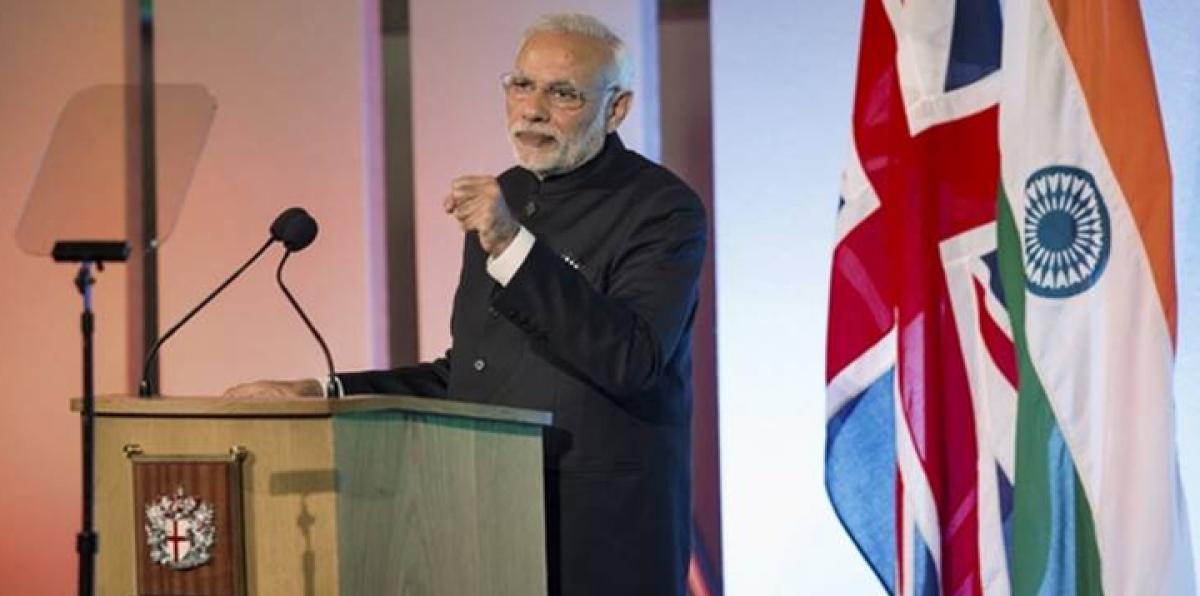

Standard Chartered and UK Government announce new “Financial Services Leadership Programme” during PM Modi’s visit to the UK

14 Nov 2015 2:44 PM IST

x

Highlights

Standard Chartered, the largest foreign bank in India, has partnered with the UK Government to create the “Standard Chartered - Chevening Financial Services Leadership Programme for India”. The new programme was unveiled during Indian Prime Minister Modi’s visit to the UK, and seeks to support his ambitious “Skill India” initiative.

Standard Chartered, the largest foreign bank in India, has partnered with the UK Government to create the “Standard Chartered - Chevening Financial Services Leadership Programme for India”. The new programme was unveiled during Indian Prime Minister Modi’s visit to the UK, and seeks to support his ambitious “Skill India” initiative.

.jpg)

Standard Chartered and the UK Government will award Chevening scholarships to high flying Indian professionals from across the private and public sectors, including Indian regulators, civil servants and academics, who have the potential to become leaders in their field. Applicants will be welcome from a wide range of disciplines and companies, whether in banking, insurance, risk management, accounting, regulation or public policy.

Once selected, the Scholars will study at leading UK universities for 3 months, job shadow senior professionals in leading City of London firms, meet with regulators and government officials in the UK and participate in the prestigious Chevening alumni programmes after returning to India. The first eight Scholars will be enrolled in the programme in September 2016.

Mr. Ajay Kanwal, Regional CEO, ASEAN and South Asia at Standard Chartered, welcomed the new partnership:

“India and Mumbai is home to Standard Chartered, as we opened our very first branch in Kolkata more than 150 years ago and have grown to be the largest foreign bank in the country, with more than 20,000 Indian employees. We are proud to celebrate Prime Minister Modi’s visit to the UK by announcing the Standard Chartered – Chevening Financial Services Leadership Programme. Working closely with the Indian authorities and the British Government, our support will enable talented Indian professionals to benefit from UK universities’ world class expertise and further strengthen skills development in India’s fast growing financial services industry.”

Scholars will return to their professional positions with new specialist skills and experience of cutting edge practice and regulation. The programme will strengthen further cooperation between India and the UK (the world’s largest exporter of financial services) and help improve industry capability in both countries as India seeks to scale up its financial sector capabilities.

Standard Chartered

We are a leading international banking group, with more than 86,000 employees and a 150-year history in some of the world’s most dynamic markets. We bank the people and companies driving investment, trade and the creation of wealth across Asia, Africa and the Middle East, where we earn around 90 per cent of our income and profits. Our heritage and values are expressed in our brand promise, Here for good.

Standard Chartered PLC is listed on the London and Hong Kong Stock Exchanges as well as the Bombay and National Stock Exchanges in India.

For more information please visit www.sc.com. Explore our insights and comment on our blog, BeyondBorders. Follow Standard Chartered on Twitter, LinkedIn and Facebook.

Standard Chartered Bank in India

Standard Chartered Bank is India's largest international bank with 100 branches in 43 cities, a combined customer base of around 2 million retail customers and around 2500 corporate and institutional relationships. Key client segments include Corporate & Institutional Clients, Commercial & Private Banking Clients as well as Retail Clients. The various product groups offered include Corporate Finance, Financial Markets, Transaction Banking, Investment Advisory services, Wealth Services as well as Retail Products.

Next Story

More Stories

ADVERTISEMENT

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com