Live

- NCC 2nd officer Narendra Babu secures Best Officer award

- Employees warn government to fulfill demands as KSRTC, BMTC gear up for strike

- Jagan took Rs 1,750 cr bribe from Adani: Anam

- Bhumana Abhinay hoists YSRCP flag at Everest base camp

- VHP resolves to oppose Waqf Board’s land claims

- Youth dies by suicide on moving APSRTC bus

- Don’t harass students for fees: Collector

- K’taka HC dismisses interim application of Subbareddy

- Will keep our promise of developing Channapatna: DCM

- Don’t collect excess fee from students

Just In

Portfolio management company Equity Intelligence, whose investors wealth was eroded by almost 44 per cent in the current fiscal, has apologised to its investors admitting that investing in LEEL Electricals Ltd formerly Lloyd Electric Engineering was a mistake

New Delhi:Portfolio management company Equity Intelligence, whose investors' wealth was eroded by almost 44 per cent in the current fiscal, has apologised to its investors admitting that investing in LEEL Electricals Ltd (formerly Lloyd Electric & Engineering) was a mistake.

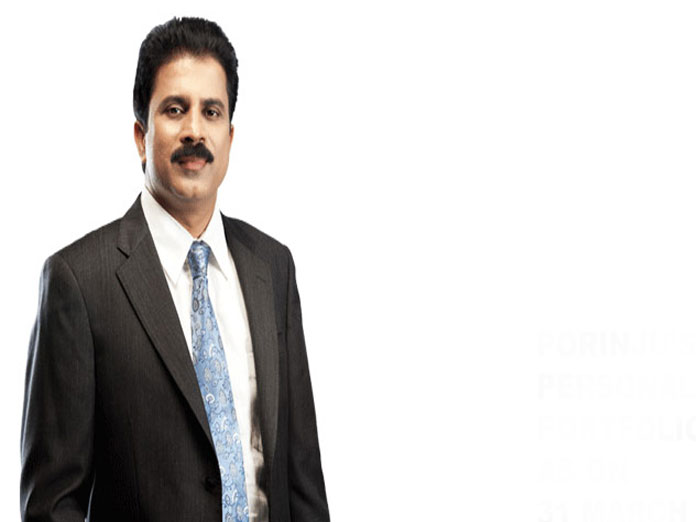

When contacted by IANS, Porinju Veliyath confirmed that he had written the note saying - I write to my investors whenever I feel like communicating something in the natural course of service.

In a private letter to investors on Friday, a copy of which is with IANS, Portfolio Manager Porinju Veliyath, founder and the CEO of the company, said the damage had already been done through the "flawed investment" and that attempting to liquidate the investment now would only lower the realisable value and won't make any material positive impact to NAVs.

He said he continued to hold the stock amid a sell-off triggered by the company arbitrarily writing back the profit from sale of its Consumer Durable division to Havells in May, 2018 "to the shock of entire minority shareholders", including Equity Intelligence, in the hope of a better exit, eventually given the value in company's operations and assets, illiquidity at the counter and the portfolio's significant holding in the company.

The company stock fell from Rs 215 to Rs 127 in five days. As per SEBI data, while Equity Intelligence continued to hold the stock, its portfolio value meanwhile fell by 11.9 per cent in May, 12.3 per cent in June and 20 per cent in September last year. Till December, the investor's wealth was eroded by 43.7 per cent in FY19.

Alleging fraud and siphoning off company's wealth for personal enrichment by LEEL promoters, Veliyath said he had filed a complaint with SEBI seeking a forensic audit of books of accounts of LEEL Electricals, without which the suspected fraudulent actions of the promoters and senior management to siphon off company's wealth for personal enrichment cannot be proven legally.

"Our investment in LEEL has witnessed a significant capital erosion and I admit that in hindsight it looks a mistake. My assumption that siphoning off in a changing regulatory environment would be difficult appears faulty," he wrote in the letter.

He said the LEEL share price was nearly 80 per cent lower from the cost in most of the accounts.

"Rare but costly misjudgements like LEEL resulting in permanent loss of capital are humbling and thought provoking for us in our pursuit to create wealth for our investors through long term value investing. Such flawed investments though big enough to be a drag on our investment journey, I am confident, would not deter us from creating wealth going forward," he added.

Veliyath said he invested in LEEL on behalf of his investors taking into account that the company had received Rs 1,550 crore cash from sale of Consumer Durable division to Havells and was trading at Rs 1,000 crore market cap (now Rs 200 crore), had a good long-term operating track record and had just sold the brand "Lloyd" along with associated intangible assets but had retained the operating assets of the company, including eight manufacturing facilities in India and abroad.

He added that being cash-rich after the sale, the most logical path for the promoters who had been in the business for around three decades would have been to take the company to higher orbits.

He said he was also under the impression that under the new circumstances, with reforms like GST, demonetisation, the amended Companies Act and various SEBI initiatives, the likelihood of LEEL promoters siphoning-off the cash received from sale of the Consumer Durable division was low.

Veliyath had accumulated nearly 5.4 per cent of LEEL by October, 2017. The company reported a Rs 946.43 crore profit from sale of the Consumer Durable division in Q2 of FY18 and confirmed this in Q3.

"We continued to buy LEEL. By end of February 2018, we held nearly 8 per cent of company's equity," he said.

He added that after LEEL's promoter Brij Raj Punj passed away in December, 2017 his son Bharat Punj, who took over the reins of the company, and other senior management continued to "sound optimistic about the business and future of the company, in line with our investment rationale".

Veliyath said Equity Intelligence reached out to the management of LEEL for clarification and seeking more transparency after the latter arbitrarily wrote back the profit from the sale of the Consumer Durable division in FY18 annual results to Rs 663 crore and also diverted nearly Rs 340 crore to promoter entities including the listed debt-laden entity, Fedders Electric Ltd., as capex and loans for buying land and factories of their own plants.

"We are hopeful that given the circumstantial evidences of fraud involved, the regulator (SEBI) would act judiciously, protecting interests of the entire minority shareholding community of the company, and set an exemplary precedent.

"While we cannot rule out a possibility of eventual recovery in the share price, as on date the damage has already been done. Value of LEEL, in most of the accounts have fallen below 3 per cent of the account NAV.

"Attempting to liquidate the investment at a time without liquidity in the counter will only lower the realisable value and this would not make any material positive impact to NAVs," Veliyath wrote.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com