Live

- Swarna Vaijayanthi Mala presented to Tirumala god

- Physical fitness mandatory for cops: SP Jagadeesh

- Children’s Day celebrated at Ananthalakshmi School

- AHUDA chief Varun gets grand welcome

- Instil moral values in students

- Somishetty takes charge as KUDA chairman

- Foundation partners with BBMP to revamp Bengaluru’s iconic Church Street

- World Diabetes Day observed at Gem Care Kamineni Hospital

- Rural students told to pursue higher education

- Fishery activities get a big boost in TDP budget

Just In

Providing yet another opportunity to black money holders to legalise their wealth, the Union government has proposed to tax at 50 per cent the unaccounted demonetised cash that is disclosed voluntarily till December 30, after which a steep up to 85 per cent tax and penalty will be levied on undisclosed wealth that is discovered by authorities.

New Delhi: Providing yet another opportunity to black money holders to legalise their wealth, the Union government has proposed to tax at 50 per cent the unaccounted demonetised cash that is disclosed voluntarily till December 30, after which a steep up to 85 per cent tax and penalty will be levied on undisclosed wealth that is discovered by authorities.

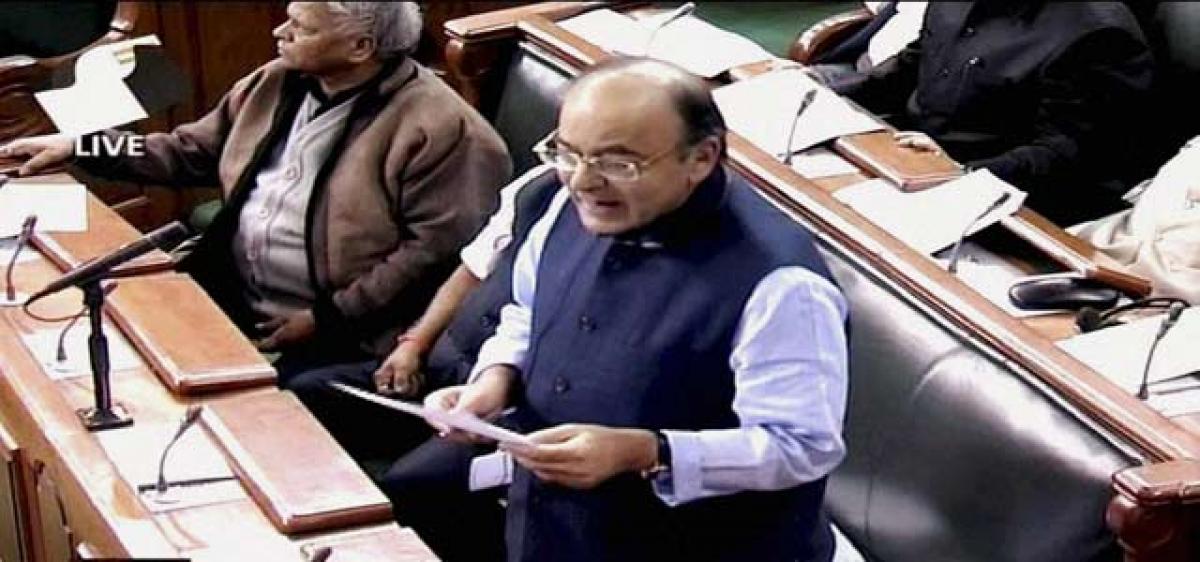

The Taxation Laws (Second Amendment) Bill, 2016, introduced on Monday in the Lok Sabha by Finance Minister Arun Jaitley, nearly three weeks after Prime Minister Narendra Modi banned high denomination currency notes, also provides for immunity from being questioned on the source of funds.

It amends the Income Tax Act to also provide for black money declarants having to mandatorily park 25 per cent of that wealth in zero-interest, four-year-no-withdrawal scheme.

Introduced amid opposition uproar over hardships caused by demonetisation, the Bill proposes a Pradhan Mantri Garib Kalyan Yojana 2016 wherein the unaccounted, now banned 500 and 1000 rupee notes, deposited in banks between November 10 and December 30, will be taxed at 30 per cent plus a 10 per cent penalty.

A 33 per cent surcharge on the tax will take the total levy to 50 per cent. Revenue Secretary Hasmukh Adhia told the media later that "the disclosures in PMGKY scheme will ensure that no questions will be asked about the source of fund.

It would ensure immunity from Wealth Tax, civil laws and other taxation laws. But there is no immunity from FEMA, PMLA, Narcotics, and Black Money Act".

The Bill proposes to amend Section 115BBE of the Income Tax Act to provide for a steep 60 per cent tax and a 25 per cent surcharge on it (total 75 per cent) for black money holders who choose to disclose after PMGKY ends.

Another section inserted provides for an additional 10 per cent penalty on being established that the undeclared wealth is unaccounted or black money, taking the total incidence of levies to 85 per cent.

The scheme comes within two months of the close of domestic black money disclosure scheme wherein the total incidence of tax was 45 per cent. A total of Rs 65,250 crore in black money was brought to book by the close of the scheme on September 30.

"We have seen that some people were trying to convert black money to black again by using new currency," Adhia said adding that the provision has been amended to bring 75-85 per cent tax.

It proposes to make penalty provisions for wealth found during search and seizures more stringent by raising the fines to 30 per cent of the income discovered which is admitted by the assessee and taxes are paid.

This compares to levy of 10 per cent in such cases income admitted, returned and taxes paid and 20 per cent where income is not admitted but taxes are paid. In all other cases the levy remains at 60 per cent.

The current provisions of penalty on under-reporting of income at 50 per cent of the tax, and misreporting (200 per cent of tax) will remain and no changes are being made to them.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com