Live

- All you need to know about PAN 2.0

- Akasa Air redefines travel experience with industry-first offerings

- MP: Residents stage protests against liquor shop in Indore

- Telugu Actor Shri Tej Booked for Alleged Cheating and False Promise of Marriage in Live-in Relationship

- Toyota Kirloskar Motor Celebrates 1 Lakh Urban Cruiser Hyryder on Indian Road

- MLS: New York City FC part ways with head coach Nick Cushing

- Delhi CM says Centre cutting AAP voters’ names from rolls, BJP hits back

- Hyderabad Metro Rail Phase-II Works to Begin in Old City in January 2025

- Odisha: 668 persons killed in human-elephant conflicts in last three years

- DEFENDER JOURNEYS: TO EMBARK ON ITS THIRD EDITION FROM NOVEMBER 2024

Just In

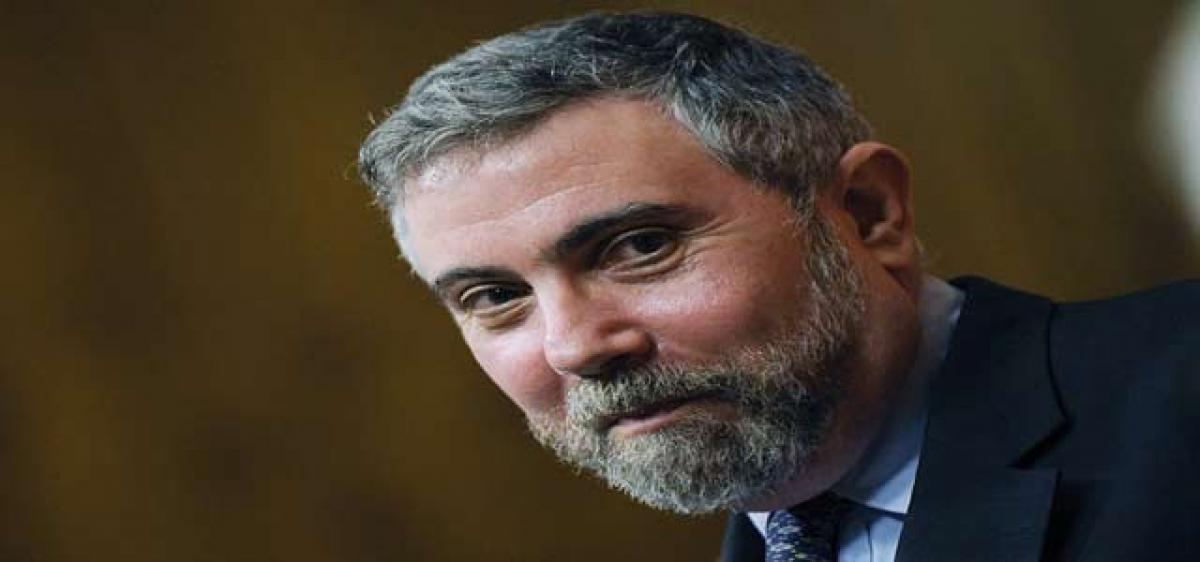

Describing the demonetisation move by the NDA government as being \"unusual\", American Nobel laureate and economist Paul Krugman said on Friday while the November 8 decision carries \"significant to low costs\", he found it hard to see \"significant gains\" accruing from the measure.

New Delhi: Describing the demonetisation move by the NDA government as being "unusual", American Nobel laureate and economist Paul Krugman said on Friday while the November 8 decision carries "significant to low costs", he found it hard to see "significant gains" accruing from the measure.

"Unusual would be the word to describe it," Krugman said in answer to a query at the Hindustan Times Summit here.

The 2008 Nobel Prize-winning economist said there is a good case to be made for not having high-value currency notes, but noted that the “unusual move” of discontinuing old Rs 500 and Rs 1,000 notes was only a one-time effort to flush out hoarded money, and not to eliminate the denominations forever. “I understand the motivation, but it is a highly disruptive way to do it.

I hardly see significant long-run gains, but there certainly are significant, although temporary, costs,” Krugman, a professor at The Graduate Center, City University of New York, said.

Prime Minister Narendra Modi on 8 November scrapped the high-denomination currency notes in a crackdown on unaccounted wealth, tax evasion, terror finance and counterfeit currency.

The move took out 86% of the value of currency in circulation, and economists have warned that it would dent consumer demand in the short term, set back gains to agriculture from a bountiful monsoon and harm productivity.

One of the reasons for Krugman’s disapproval of demonetisation as part of a drive to tackle income tax evasion is his belief that it is practically difficult for developing economies with large unorganised sectors to raise the share of taxes as a proportion of GDP by relying too much on income taxes.

Although considered regressive, indirect taxes, such as the central excise duty and service tax levied by the central government in India and value added tax (VAT) by states, are more practical tools to raise tax revenue, he said.

Indirect taxes are generally considered regressive as they affect the rich and the poor alike, unlike income tax, the burden of which increases progressively on tax payers with high income levels.

India is now leading the discussions among G20 nations for a multilateral framework to prevent income tax evasion, especially corporate tax, based on principles laid down by the Organisation for Economic Co-operation and Development (OECD), a group of developed economies.

“Trying to have an OECD style income tax system in a country which has a per capita GDP far below OECD levels is not doable,” Krugman said.

The American economist said India could be hit by a recession in China stemming from declining investment, but has no reason to worry about the US turning more protectionist under Donald Trump.

Krugman said it would be difficult for China to sustain investments as a share of GDP and a readjustment can spell trouble for other economies including India.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com