Live

- RG Kar protest: Junior doctors to render medical services, carry out hunger strike in parallel

- Traffic Violators Counseled by Nagarkurnool Police

- Bathukamma Celebrations at Government Boys Junior College

- I Will Stand by the Mudiraj Community - MLA Dr. Rajesh Reddy

- Mission Bhagiratha DEE Hemalatha Distributes Certificates to Water Assistants in Achampet

- Elderly Man Dies Suddenly at Bus Stand

- DMK MP Wilson's conduct a threat to judicial impartiality and independence: BJP

- Lightning strikes claim nearly 300 lives in Bangladesh

- Haryana polls: Sohna records highest voting at 68.6 pc, Gurgaon registers lowest turnout

- Multiple attacks in Syria result in casualties

Just In

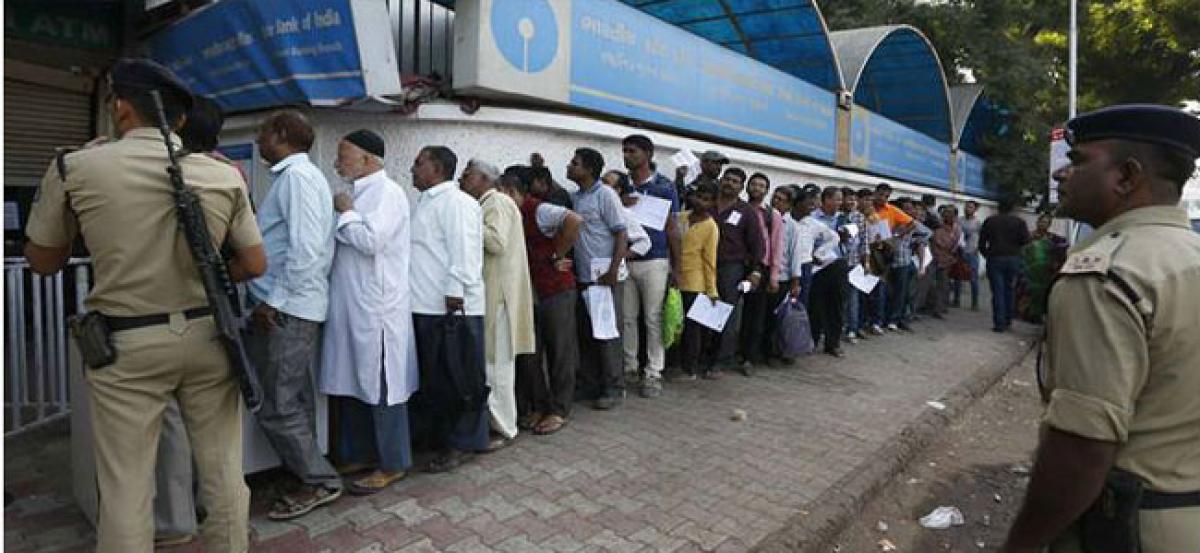

The cash crunch is being witnessed at banks and ATMs in Andhra Pradesh and Telangana even after the huge cash inflow from the Reserve Bank of India (RBI).

The cash crunch is being witnessed at banks and ATMs in Andhra Pradesh and Telangana even after the huge cash inflow from the Reserve Bank of India (RBI).

The massive withdrawal in the two states has been triggered due to the fear of losing deposits due to the bail-in clause under the Financial Resolution and Deposit Insurance (FRDI) Bill wherein depositors will be responsible to bear a part of the resolution cost by a corresponding reduction in claims.

The FRDI Bill aims to set up a Resolution Corporation which will monitor financial companies such as banks, categorise them according to their risk profiles and prevent them from going bankrupt by writing down their liabilities.

Bail-in clause is one of the many options to rescue a financial institution on the brink of failure through the help of creditors and depositors money.

Fearing the banks would collapse, the public from both the states are withdrawing money from ATMs and banks.

The bail-in clause can subject to money barring which is insured but it can be invoked only if prior consent is given at the time of signing the deposit forms.

The Union Government has given out a clarification that the bail-in clause will not be used for public sector banks (PSBs), however, the apprehensions are ceasing to exist.

The government has also said that under the FRDI Bill, the claims of uninsured depositors i.e. beyond Rs 1 lakh would be given precedence over the claims of unsecured creditors and government dues adding that the bail-in clause can only be used in private banks only if the customers allow it.

The Resolution Corporation, under the FRDI Bill, will be empowered to increase this limit to whatever it chooses protecting at least that much and ensure that depositors get back as much money as they would have if the bank had been liquidated in case of a bail-in.

Telangana finance minister Etela Rajender addressed the crisis in the Legislative Council wherein he stated that ATMs are going dry and banks are also not giving cash due to an inadequate supply of currency by RBI.

According to the analysis of transactions, the salaried class members are withdrawing the entire amount from ATMs immediately after the salary is credited in the first phase of every month causing the reduction in cash inflow.

While Hyderabad is not yet reeling under the cash crunch crisis, other parts of the city along with rural Telangana and AP are dealing with a severe shortage of currency as the ATMs are now being filled with cash only once a month in few places.

Many ATMs in places such as Moula Ali, Tarnaka, Kushaiguda, Neredmet, Sainikpuri, ECIL, Nagarjuna Nagar, AS Rao Nagar, Kamala Nagar, Dammaiguda are having no cash inflow.

With people closing fixed deposits and withdrawing money from saving bank accounts, banks are imposing unauthorised rationing on cash disbursals, ranging from Rs 20,000 to Rs 40,000 per day per person in their home branches.

However, assuring that the depositors will be protected, the bankers are urging public against accelerated withdrawals from their savings bank accounts and deposits.

Cash is being brought in from neighbouring states over the past two months by the banks to disburse money to customers at their branches to overcome the cash crunch. Cash was shipped from Maharashtra and Kerala for Telangana while AP did from Odisha and Tamil Nadu.

Nevertheless all the efforts, the currency is still being available in ATMs of big banks only 60 percent of the time on any given day. Some banks have even halted ATM services for the past three months.

Reports also reveal that a severe shortage of Rs 2,000 denomination currency notes are being faced. Since September 2017, the Rs 2,000 currency notes are neither being supplied by the RBI to banks nor are they coming back from customers in the form of deposits.

With the Telangana government all set to disburse cheques towards input assistance to farmers per acre of land held by the banks, a tougher challenge is waiting ahead.

71.75 lakh farmers will be given 4,000 per acre for the Kharif season from April 19 under the scheme for which the government will need a total amount of Rs 6,000 crore.

The state government has already written to the Centre and RBI seeking cash for the scheme with six banks designated to disburse the cash.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com