Live

- Gold rates in Vijayawada today slashes, check the rates on 13 November, 2024

- AP assembly session Begins with question hour, Key issues raised

- Modi, BJP, RSS working 24x7 to finish off Constitution: Rahul

- Spewing poison over AMRUT stirs up political storm

- Congress has double PhD in stalling projects: Modi

- No oral mentioning of urgent cases: SC

- Russia plans to boost birthrate with 'Ministry of Sex'

- Govt glare on fund misuse by digital media wing of IT

- Ongole Police to serve notices to director Ram Gopal Varma Over social media posts

- Attackers will not be spared, says minister

Just In

Adequate and timely access to agricultural credit plays a crucial role in improving farm production and productivity and thereby the livelihood of farmers. Nearly 80 percent of the agriculturists in India are small and marginal farmers, heavily dependent on credit.

Adequate and timely access to agricultural credit plays a crucial role in improving farm production and productivity and thereby the livelihood of farmers. Nearly 80 percent of the agriculturists in India are small and marginal farmers, heavily dependent on credit.

The over 100-year-old Cooperative Credit System (CCS) in the country has been a major provider of agricultural credit, mainly short term loans for raising crops.

Although, the system was inspired by the Raiffiesen Cooperatives in Germany as autonomous self-reliant institutions, over time it took shape as a government supported mechanism.

Over the decades and right into the early 90’s, the Cooperative Credit and Banking system shored up as the mainstay for providing Credit to the agriculturists, with the Reserve Bank of India right from its own inception detailing a policy of production-oriented systems of lending for agriculture and providing concessional refinance to the Cooperative Banks, towards supplementing their resources in meeting the Credit requirement of agriculturists in the rural areas.

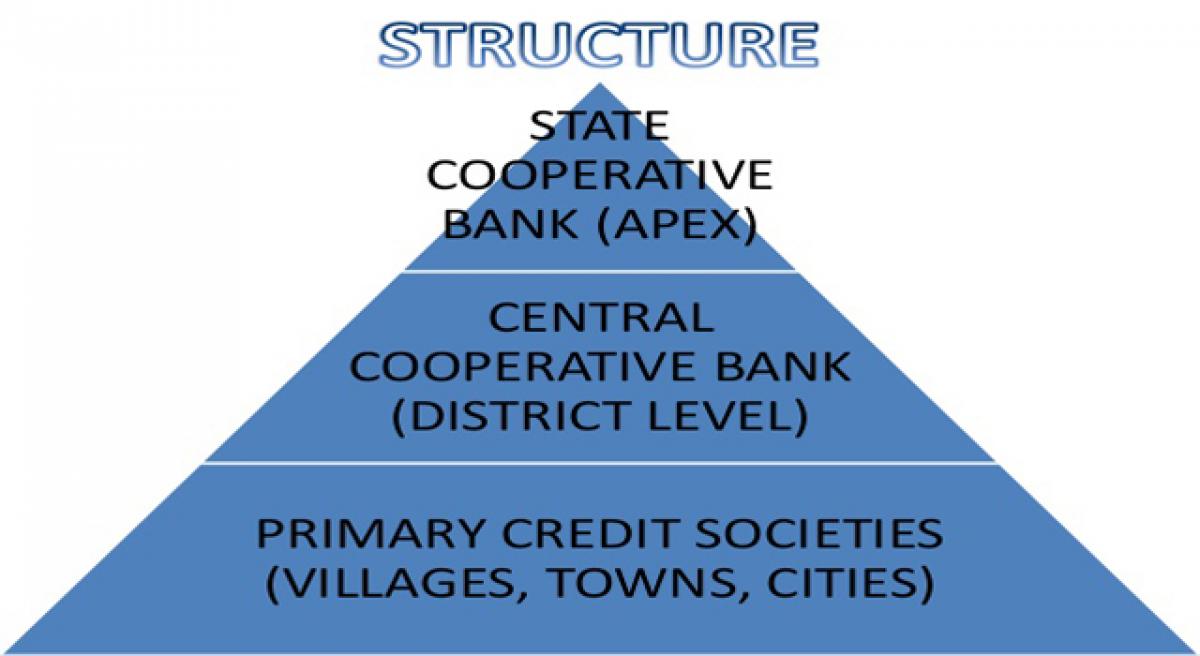

The Rural Cooperative Credit mechanism in India essentially comprises two parallel structures viz. the three tier Short-term Credit structure for dispensation of short- and medium-term Credit for Crop production and agriculture allied activities; and the Long-term Credit Structure for providing Long-term credit for Investments in agriculture e.g., land development, farm mechanization, horticulture etc.

These institutions have been supported both by way of policy and refinance supported for a considerable time by the RBI and later by the ARDC and NABARD. The Short-term credit and Banking structure in most States comprises of State Cooperative Banks, District Central Cooperative Banks (DCCB/CCB) and Primary Agricultural Credit Societies (PACS) at the village-level.

The foray of commercial Banks into agricultural credit post-nationalisation, setting up of RRBs, adoption of the multi-agency approach and directed credit programmes, saw in their wake the fall in the share of amount disbursed by Rural Cooperative Banks for agricultural credit.

In the euphoria of expanding credit supply by commercial banks, the need to shore up these institutions that up until then had played a major role and are geographically positioned for a better outreach, had been lost sight of. Around 5.5 crore farmers, mostly small and marginal farmers, continue to be dependent on the PACS supported by DCCBs, numbering 380 with around 14000 branches and 32 State Coop Banks for their agricultural loans.

There are around one lakh PACS spread across the rural areas of the country, with over two-third of them being operationally viable. However, the grassroots level operations of this century old structure continue to be driven by outdated manual systems and processes, standing in the way of timely and adequate provision of credit to the farmers.

In the context of renewed signals of distress from farmers across various parts of the country, It is imperative to rejuvenate PACS through technology and provide them the interface to the mainstream banking environment and enable digital banking and payments related services at their end, so that their outreach can be fully harnessed in meeting the various needs of the farmers.

The ideal technology solution must facilitate Rupay Card based operations through ATMs and Micro-ATMs on KCC Accounts by farmer members on their accounts with the PACS, in tune with RBI/NABARD guidelines. The technology solution needs to be a cost-effective centralised solution and support local usage and custom; be easy to use by grassroots level staff, preferably being icon-driven and having online help facility as well as being available in local dialect. It should cover the entire functionality of all types of agricultural credit, covering short,

medium- and long-term loans in a wide spectrum of parameterized options of loan products, origination and sanction systems-covering processes that span across different tiers of the credit system and cover different reporting system requirements right up to the rural levels.

On positioning such solution, online access to ground level information is expected to enhance inputs for policy formulation and facilitate timely monitoring of the progress of various schemes.

The State of Odisha, in which the Cooperative Banks have a share of around 65 percent in agricultural credit, has taken the lead in adoption of technology in all the three tiers of the cooperative credit structure. Such technology led transformation of this important segment of our rural eco-system across the country is expected to go a long way to help in mitigating the problems of our farmers.

It is because of this that the GOI in the Union Budget for 2017-18 has made its policy and financial commitment towards computerisation of all viable PACS in the country over a span of three years.

It expected that technology adoption on the lines adopted by Odisha will find favour for replication across the country. This would further the cause of financial inclusion of the excluded and marginalised segments of the rural population in a big way. (The writer is Chief Product Officer, VSoft Technologies)

By Ms Rama Rao

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com