Live

- 2024 on track to be hottest year on record

- PM Modi’s visit to Solapur: Women applaud ‘Double-Engine’ government’s initiatives

- Nagarkurnool MLA Dr. Kuchukulla Rajesh Reddy Campaigning in Maharashtra Elections

- Wife Kills Husband with Her Lover: Details of Veldanda Murder Case Revealed by SP Gaikwad

- Strict Action on Violations of Food Rights: Telangana Food Commission Chairman Goli Srinivas Reddy

- Smooth Conduct of Group-3 Exams with Strict Security Measures: Collector Badavath Santosh

- Delhi HC orders cancellation of LOC issued against Ashneer Grover, wife

- Shami’s absence a major blow for India in BGT, says Paul Adams

- Will organize protests at borders if attack on minority Hindus in Bangladesh not stopped: Bengal LoP

- Dutch Ambassador Marisa Gerard Meets Telangana CM A. Revanth Reddy in Delhi

Just In

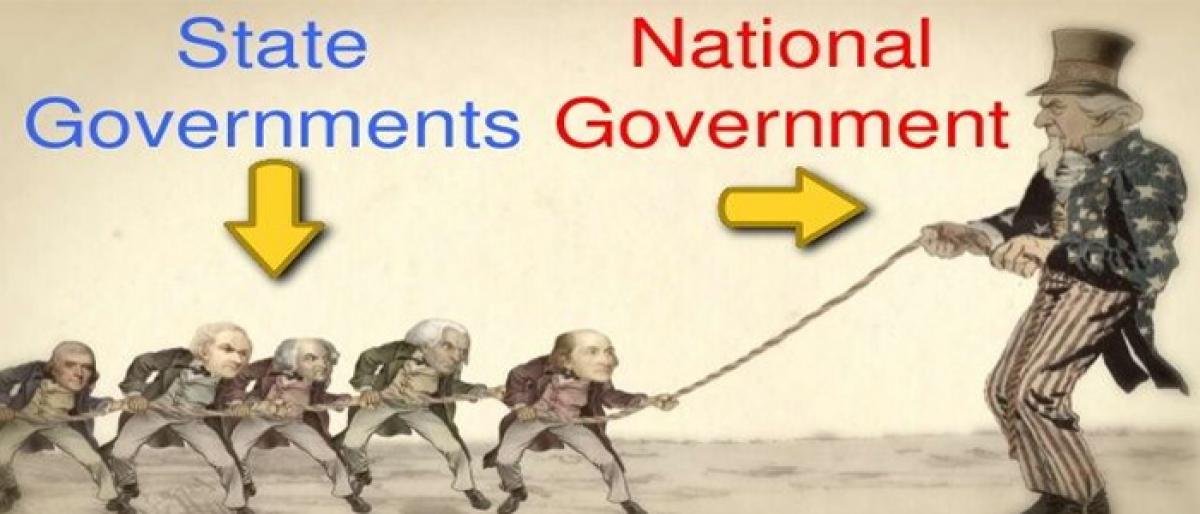

At this critical juncture of the world’s and India’s history, what are the areas in which the federal relations in the Indian Constitutional Scheme got imbalanced, that it calls for a review and ‘course correction’ if the States along with the nation have to move forward on the developmental path of national reconstruction.

At this critical juncture of the world’s and India’s history, what are the areas in which the federal relations in the Indian Constitutional Scheme got imbalanced, that it calls for a review and ‘course correction’ if the States along with the nation have to move forward on the developmental path of national reconstruction.

This exercise can be undertaken only when a ‘federal code’ is evolved and put in place to measure the federal trends in the body-politic, with regard to ‘centralisation and decentralisation of power’ between the Centre and the States.

LISTS

The first area of friction is in the lists or subjects enumerated in the VIIth Schedule to the Constitution. This calls for a thorough review, as to how these areas have been operated in terms of ‘centralization or decentralization of power.’ The crucial questions that fall for consideration are:

(i) Whether the powers exercised by the Union government, with regard to the entries in the Union List, are invoked in accordance with the ‘Rules of Conduct of Business of Union Government’?

(ii) What is the sphere of autonomy enjoyed by the State governments with regard to the entries in the Concurrent List (List-III), which is yet another question to be examined? It would be interesting to note how the exercise of residuary legislation has only resulted in a federal-deficit?

(iii) The entries in State List (List-II) over a period of time have lost all the power to be determined by the States alone, as the ‘sovereign power’ in that sphere has, by subterfuge methods, been adopted by the Centre, in the form of Regulatory Authorities, which have deprived the States of their exclusive domain powers. Examples are galore with authorities like the Electricity Regulatory Authority, Tariff Authority for Ports etc.

Regulatory authorities

That, bring us to the Regulatory Mechanisms and Tribunals, which have only contributed to the centralisation of power with the Union Government, even in relation to subjects covered in the State & Concurrent Lists.

From the State List, if one were to take, for example, the subject of Agriculture and Animal Husbandry, it finds mention at Items 14 & 15 of the State List (List-II) or Schedule VII of Constitution of India). This subject has 72 sub-areas, which would include agricultural banking, agricultural co-operatives, pricing of agricultural commodities, seeds, fertilisers etc. In all these areas the Centre has a major say and the States are reduced to nominal mouthpieces of the Centre, even in matter of policy formulation, not to speak of planning.

And in exercise of Article 253 of the Constitution of India, which gives the Union government, the treaty-making powers for entering into multilateral agreements with international bodies like the WTO, the Central government has further encroached into the States powers, all in the name of its international obligations.

This is not to speak of the areas such as health, sanitation or education where once again the Centre has made inroads into the States powers. Applying the ‘Federal Code,’ one can measure the extent of ‘centralisation & decentralisation’ on a scale of 10, from the time of enactment of the Indian Constitution in 1950 till date (i.e., 70 years later). Such an exercise is a must to be able to assess the extent of growth of ‘true federalism’ or ‘federal deficit.’

Similarly, there are several other scientific bodies, which exercise their power over the States and thus reduce them to just being vassals of the Union, thus misbalancing the delicate Centre-State calculus.

Fiscal federalism

The GST Council is yet another agency, which is disturbing the Centre-State balance in the fiscal sector. There are many instances when the said council’s decisions have not gone to the Union Cabinet and Parliament as the GST Council has acted as a super-regulatory authority. This needs to be reviewed by experts in the realm of fiscal relations between the Centre and the States, not to mention that fiscal relation is one of the four pillars of Centre-States Relations, as envisaged in the Constitution of India along with legislative, administrative and emergency powers.

Finance commissions

The Terms of Reference (ToR) of the 15th Finance Commissions is yet another instance of constricting the State’s shares in the finances by diluting the recommendations of the 14th Finance Commission, which had devolved finances in certain sectors to the States. Then, we have the Finance Bill incorporating many other subjects not directly linked to the Money Bill, so as to avoid legislative enactments or going to Parliament for the passage of the same.

The Central Bank

It is to be remembered that the Reserve Bank of India (RBI) has been stripped of its powers and made over to the Union Finance Ministry, which is not in keeping with the Constitutional Scheme nor the statute governing the RBI, to maintain the fiscal balance in the best interests of the Centre-State relations.

The Niti Aayog

We then come to the Super Central Planning Body, the NITI Aayog, which is supposed to have replaced the Planning Commission and calls itself a ‘think tank,’ has been issuing directives to several State governments on policy matters, thus thwarting the delicate Centre-State relationship. It is only the Central government that has the executive authority to issue such directives and not a policy-making Body such as the NITI Aayog.

This article, to avoid prolixity, is not covering the other areas of friction or encroachments in any detail, such as language, culture, transportation, especially water ways, environment, employment, welfare schemes, flows of Foreign Direct Investment (FDI) and infrastructure. There has been even usurpation of States’ powers even in the realm of criminal investigation with the CBI’s ever-increasing role in the States.

It is salutary to remember that the ‘Federal Rights’ of the States as enshrined and promised in the Constitution are not derived by the ‘grace of the Union Government.’ These are constitutionally guaranteed rights of the State, which can’t be marginalised. There has to be a perfect balance between the centripetal & centrifuged forces as recommended by the Justice R S Sarkaria Commission before the Centre and the States. The sovereign power in India rests co-equally with the Centre and States, in their respective spheres, earmarked in the VIIth Schedule to the Constitution in the form of Lists.

It is high time the States in India are considered ‘confederacies’ rather than ‘dependencies’ and the nation move forward from being just a ‘conglomeration of territories’ to a Union of States in the true federal sense.

By: P Niroop

(Writer is an Advocate, Supreme Court of India, and former Additional Advocate-General of Meghalaya)

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com