Live

- Trump's proposed tariffs threaten North American jobs, says Mexican employers' association

- AP minister Savita pays tribute to Mahatma Jyotibapule on Death Anniversary

- Japan: Two die in fire at lawmaker's residence

- Navy braces up to deal with Cyclone Fengal brewing in Bay of Bengal

- Cake mixing celebrations held at KIMS College of Hotel Management

- Vijayawada CP inaugurates AP Police Sports and Games Meet

- Allu Arjun’s Special Tribute to Devi Sri Prasad at Pushpa 2 Event!

- Gold rates in Delhi today slashes, check the rates on 28 November, 2024

- Keep a tab on drug menace, says Collector Sarada

- Empowering women through drone training

Just In

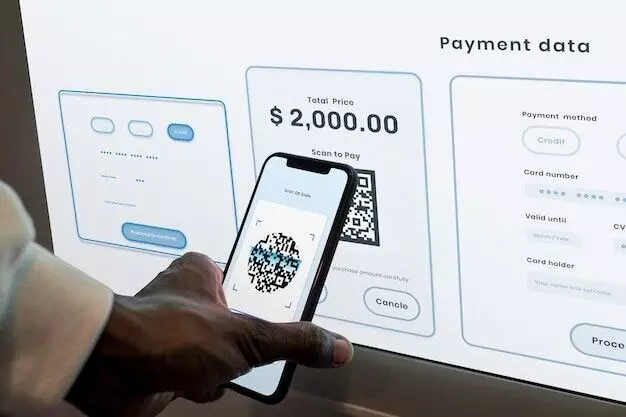

Trends in Fintech and Digital Payment Solutions in India

Explore the latest trends in fintech and digital payment solutions in India, highlighting innovations, consumer behavior, and market dynamics transforming finance

India has emerged as a global powerhouse in financial technology (fintech) and digital payment solutions. Over the past decade, the fintech sector in India has grown at an unprecedented rate, driven by factors such as increased smartphone penetration, affordable internet access, and government initiatives aimed at fostering a digital economy. From mobile wallets to Unified Payments Interface (UPI) transactions, the financial landscape in India is undergoing a transformation, making transactions more accessible and secure for millions of people.

In this blog, we will explore some of the most significant trends in fintech and digital payments that are shaping India's future, including the growth of UPI, the rise of digital lending platforms, the emergence of neobanks, and how these advancements are bringing financial inclusion to the masses.

1. The Explosive Growth of UPI

One of the most remarkable developments in India's fintech sector is the Unified Payments Interface (UPI). Launched in 2016 by the National Payments Corporation of India (NPCI), UPI has revolutionized digital payments in the country. UPI enables seamless and real-time money transfers between bank accounts using a mobile phone, eliminating the need for entering complex details like account numbers or IFSC codes.

UPI’s growth has been nothing short of phenomenal. As of 2023, UPI transactions have crossed 10 billion transactions per month, making it one of the most widely used digital payment systems in the world. Its success can be attributed to several factors:

• Interoperability: UPI allows money to be transferred between accounts of different banks and across multiple apps. Users can use any UPI-enabled app, like Google Pay or PhonePe, to send and receive money.

• Ease of Use: With just a mobile number or virtual payment address, users can easily make payments, making it user-friendly for both tech-savvy individuals and those who are new to digital transactions.

• Zero or Minimal Transaction Fees: UPI transactions are free or come with negligible costs, making them more attractive compared to traditional banking methods or even other digital payment systems.

UPI has also evolved beyond just peer-to-peer payments. Today, it is used for bill payments, online shopping, and even small business transactions. The future looks promising as UPI continues to innovate, with upcoming features like UPI 123PAY that aims to enable payments through feature phones, further expanding its reach in rural India.

2. Rise of Digital Lending Platforms

Digital lending platforms are another fintech trend gaining traction in India. Traditionally, obtaining loans from banks involved a lengthy process filled with paperwork, credit checks, and long approval times. However, fintech companies have changed the lending landscape by offering instant, hassle-free loans to both individuals and businesses through digital platforms.

These platforms leverage advanced algorithms, data analytics, and artificial intelligence to assess creditworthiness, offering loans to a wider range of people, including those who may not have a formal credit history. Some of the leading digital lending platforms in India include:

• EarlySalary: A personal loan app that offers quick, short-term loans for salaried individuals.

• Lendingkart: Focuses on providing working capital loans to small and medium enterprises (SMEs).

• KreditBee: A digital lending platform offering personal loans to individuals with minimal documentation.

Digital lending is expected to grow significantly in the coming years as more people turn to fintech companies for their financing needs. According to reports, the Indian digital lending market is projected to reach $350 billion by 2025, driven by the growing demand for quick, affordable loans.

3. The Emergence of Neobanks

Neobanks, or digital-only banks, are another exciting development in India's fintech space. Unlike traditional banks, neobanks operate entirely online without physical branches. These fintech companies offer a range of banking services such as savings accounts, loans, insurance, and more, but with the convenience of digital access.

Neobanks are particularly attractive to tech-savvy millennials and small businesses looking for easy-to-use banking services without the hassle of visiting a branch or dealing with cumbersome paperwork. Some of the popular neobanks in India include:

• Jupiter: Offers zero-balance savings accounts, rewards on everyday transactions, and smart money management tools.

• Niyo: Provides digital banking solutions aimed at salaried individuals and businesses, including forex services and employee benefits.

• Open: Caters to SMEs and startups by offering business banking services like automated invoicing, expense management, and tax compliance.

Neobanks are set to disrupt traditional banking by offering faster, more personalized services. They are increasingly gaining customer trust by focusing on customer experience and leveraging technology to provide innovative solutions.

4. Expanding Financial Inclusion

One of the most important impacts of fintech in India is its contribution to financial inclusion. In a country where a large portion of the population remains unbanked or underbanked, fintech has become a powerful tool to bridge the gap. Digital wallets, micro-lending platforms, and UPI have enabled even those in remote areas to access financial services.

Government initiatives like Pradhan Mantri Jan Dhan Yojana (PMJDY) have also played a crucial role in increasing financial inclusion. Under this scheme, millions of Indians have opened bank accounts, and with the help of fintech solutions, they now have access to financial services like savings, insurance, and credit.

Fintech companies are also helping small businesses and street vendors by offering easy-to-use payment solutions. QR code payments, for example, have become common in markets and roadside stalls, enabling even the smallest of merchants to accept digital payments. The rise of buy now, pay later (BNPL) services is further expanding access to credit for consumers who may not have a credit card or traditional loan options.

5. The Role of Blockchain

India's fintech sector is also witnessing the growing influence of blockchain technology. While the regulatory environment around this technology remains uncertain, blockchain is being explored for various applications in finance, such as secure cross-border payments, identity verification, and decentralized finance (DeFi) platforms. Blockchain can bring transparency, speed, and security to financial transactions, and Indian fintech companies are actively experimenting with it. For example, Bajaj Finserv has developed blockchain solutions for asset management and cross-border remittances. As the technology matures, it has the potential to revolutionize not just payments but the entire financial services ecosystem. However, the adoption of blockchain technology remains a contentious issue in India due to regulatory concerns. While the government has proposed a bill that seeks to ban certain digital assets, it is also exploring the possibility of launching its own Central Bank Digital Currency (CBDC). The outcome of these discussions will play a significant role in shaping the future of digital payments in India.

6. The Rise of Contactless Payments and BNPL

The COVID-19 pandemic accelerated the adoption of contactless payments in India. People were wary of handling cash and touching point-of-sale (POS) devices, leading to a surge in digital transactions via contactless methods like Near Field Communication (NFC) and QR code payments.

Moreover, the Buy Now, Pay Later (BNPL) model is gaining immense popularity, especially among younger consumers. BNPL allows users to make purchases and pay for them in installments without requiring a credit card. Platforms like Simpl and LazyPay offer BNPL options for online shopping, further driving digital payment adoption.

7. Online Lotteries and Digital Payments

In addition to the above trends, sectors like online lotteries have also benefited from the rise of digital payment solutions in India. Users can now purchase international lottery tickets online, securely and conveniently, using platforms such as UPI and mobile wallets. This shift from traditional to digital methods has made it possible for people across the country to participate in lotteries and other online games without any geographical limitations.

8. Regulatory Environment and Future Outlook

The regulatory environment for fintech in India is evolving, with the government and regulatory bodies like the Reserve Bank of India (RBI) taking steps to ensure that innovations in fintech are safe, secure, and inclusive. The Data Protection Bill and guidelines on digital lending and cryptocurrency will play a crucial role in shaping the future of fintech. Online lotteries, including popular games like Mega Millions, are expected to grow in popularity as digital payment solutions continue to enhance accessibility for users across India.

In conclusion, fintech and digital payment solutions are transforming India’s financial landscape at an incredible pace. From UPI’s widespread adoption to the rise of neobanks, digital lending, and blockchain, these innovations are making financial services more accessible, secure, and efficient. As the sector continues to grow, we can expect to see even more exciting developments that will further enhance the digital economy and bring financial inclusion to every corner of the

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com