Live

- Meloni speaks with 'friend' Elon Musk after congratulating Trump on election win

- Israel signs 5.2-billion USD deal to purchase 25 F-15 fighter jets

- Pioneering machine learning and GIS in agri-food systems

- Aha OTT Launches Writers Talent Hunt to Empower New Voices in Telugu Cinema

- Chhath festivities turn sour for two families in Bihar

- Preparations afoot for evening Arghya in Patna

- Vanara Celluloid announces debut project ‘Tribanadhari Barbarik’

- IPL player auction: James Anderson hopes IPL would help him in his coaching career

- ‘Jithender Reddy’ team expresses confidence on film’s content

- TN farmers plan major stir against Land Consolidation Act, 2023

Just In

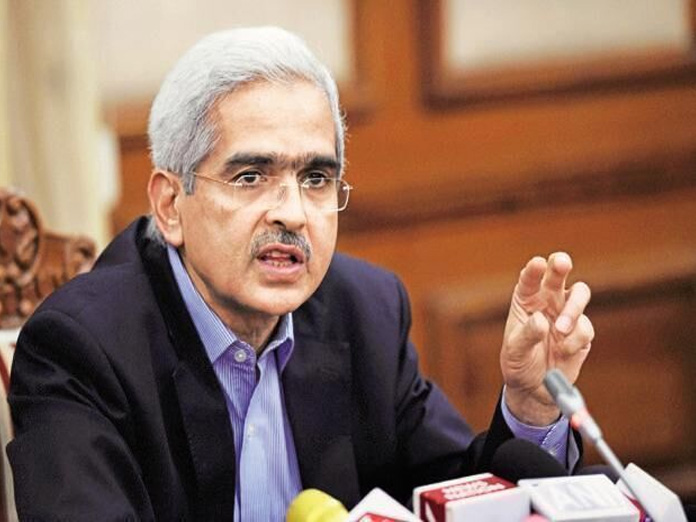

In the first interest rate cut in 18 months, the RBI on Thursday shed its hawkish stance to reduce policy rates in the maiden policy meeting under new Governor Shaktikanta Das, a move that may make home and other loans cheaper

Mumbai: In the first interest rate cut in 18 months, the RBI on Thursday shed its hawkish stance to reduce policy rates in the maiden policy meeting under new Governor Shaktikanta Das, a move that may make home and other loans cheaper.

Coming just months ahead of the general elections, the move will help boost lending and support the government's efforts to boost a slowing economy after it last week unveiled an expansionary budget which included a Rs 75,000 crore cash dole to small farmers and income tax rebate to the middle class.

The Reserve Bank of India's six-member monetary policy committee (MPC) cut the repo rate by 25 basis points to 6.25 per cent as inflation continues to remain benign. While four out of the six members, including Das, voted for a reduction in interest rate, all the six members unanimously favoured switch in stance to 'neutral' from 'calibrated tightening' adopted in October.

Emboldened by a slowdown in inflation which fell to 18-month low of 2.19 per cent in December and is expected to be in the range of 3.2-3.4 per cent in April-September to 3.2-3.4 per cent - lower than previous RBI prediction of 3.8-4.2 per cent range, Das-led MPC weighed more concern about economic growth risks, paving the way for more rate cuts.

Besides repo rate, reverse repo was reduced to 6 per cent from 6.25 per cent. Repo rate is the rate at which commercial banks borrow money from the RBI; while reverse repo rate is the rate at which RBI collects money from banks. Das, who unlike his predecessor Urjit Patel is seen more amenable to government demands for boosting credit growth, said it was "vital to act decisively and in a timely manner to address the objective of growth once price stability as defined (in RBI's inflation-targeting mandate) is achieved." A former bureaucrat, Das was appointed RBI Governor in December as Patel quit amid a debate over central bank's autonomy.

"The shift in stance from calibrated tightening to neutral provides flexibility to address, and the room to address, sustained the growth of India's economy over the coming months as long as inflation remains benign," he said. "RBI's decision to reduce the repo rate by 25 basis point from 6.5 per cent to 6.25 per cent and change of stance to 'Neutral' will give a boost to the economy, lead to affordable credit for small businesses, homebuyers etc and further boost employment opportunities," Finance Minister Piyush Goyal said in a tweet.

RBI last hiked interest rates in August 2018 by 0.25 per cent. It came on back of a similar increase in June. These hikes were the first since January 28, 2014, when rates were hiked by a similar proportion to 8 per cent. In the subsequent years, RBI cut the interest rate on six occasions. In its last revision, on August 2, 2017, rates were cut by 25 basis points to 6 per cent. "Investment activity is recovering, but supported mainly by public spending on infrastructure," the MPC said in a statement. "The need is to strengthen private investment activity and buttress private consumption."

The RBI kept GDP growth forecast unchanged at 7.4 per cent for the next fiscal year starting April 1, 2019. "Headline inflation is projected to remain soft in the near term reflecting the current low level of inflation and the benign food inflation outlook," the MPC statement said.

Meanwhile, bankers see more rate cuts in the offing. With the change in the monetary policy stance to ‘neutral’ from ‘calibrated tightening’, RBI may deliver more positive surprises on the rate front, they say. "The policy rightfully signals that rates may further soften further going forward, with the headline inflation numbers consistently undershooting the RBI inflation mandate and inflation expectations materially down," said State Bank of India Chairman Rajnish Kumar said.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com